Posted 6:58 a.m.

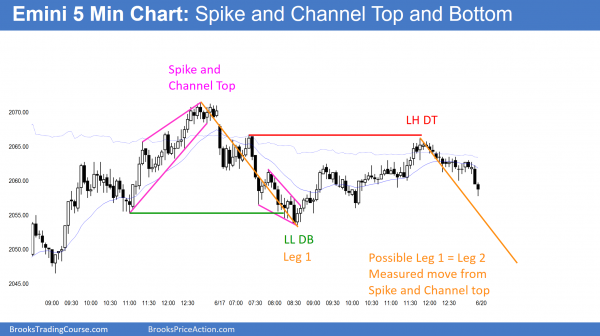

The Emini broke below yesterday’s bear channel and the 60 minute moving average on the open. Yesterday’s Spike and Channel bull trend is likely to transition into a trading range early today. The Emini formed a tight trading range in the middle of the final bull channel of yesterday. It is deciding between going above yesterday’s high and below the higher lows in yesterday’s channel.

This is trading range price action. Limit order bulls and bears are making money. Stop order traders are losing. This increases the chances of a lot of trading range price action today. If today becomes a trading range day, it will have at least one swing down and one up. The Emini is deciding which will come first. Whichever it is, traders will look for an opposite swing after 2 – 3 hours.

Until there is a strong breakout up or down, traders will continue to scalp. The odds of a trend day at this point are about 25%. However, there is at least a 75% chance of at least one swing up or down. Early confusion and disappointment means a trading range day is likely.

Pre-Open Market Analysis

S&P 500 Emini: Future trading strategies after a buy climax

While the Emini had a strong reversal yesterday, the 5 minute chart had a series of buy climaxes. Therefore there is a 75% chance of a 2 hour sideways to down move today starting by the end of the 2nd hour. There is only a 25% chance of a strong bull trend day. In addition, there is a 50% chance of follow-through buying in the 1st 2 hours.

Yesterday’s candlestick pattern on the daily chart was a bull trend reversal. In addition, it formed a micro double bottom with Tuesday’s low. Therefore there is enough buying pressure so that it is likely that today will trade above yesterday’s high. As a result, it would trigger a buy signal on the daily chart.

Since the weekly chart had an 11 week bull micro channel, a trading range is likely. As a result, the upside on the daily chart is probably limited to a few days.

Because tomorrow is Friday, day traders need to be aware of weekly support and resistance. The most important magnet is the 2079 open of the week. Most of all,the bulls want a close above the current 2089.25 high of the week. This is especially relevant because it would undo this week’s selling. The weekly candlestick pattern would be a strong bull reversal bar. Consequently, the selloff of the past 2 weeks would then be simply a pullback from the all-time high.

The big picture has not changed. That weekly micro channel was climactic. A trading range is likely. The bottom of the range is probably the May low. While there might be a new high, it will probably be limited. As a result of the weekly buy climax, the Emini should still test the May low.

The Emini was in a tight trading range overnight and it down 2 points at the moment.

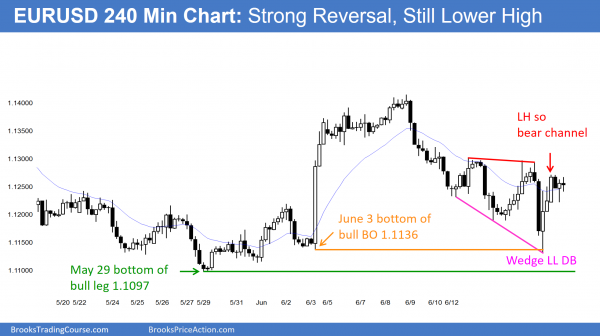

Forex: Best trading strategies

Yesterday broke slightly below the June 3 bull breakout low, and reversed up. This is therefore a lower low double bottom (LL DB). It held above the bottom of the bull leg. It is also a reversal from a 3rd push down and therefore a wedge bottom.

The EURUSD 240 minute chart had a strong reversal up after a small breakout below the June 3 low. The selloff held above the May 30 low, which was the bottom of the bull leg. This means that the EURUSD Forex chart fell below the bottom of the buy climax, but not the bottom of the trend. Therefore, this is trading range price action. When a market falls below one support level, but not another just below, a trading range is likely.

As I mentioned yesterday, the selloff was in 3 pushes. That is a wedge bottom candlestick pattern. Day traders will therefore expect 2 legs up. The first leg up formed yesterday. It was strong enough so that there will be buyers below, and therefore then a 2nd leg up.

The EURUSD Forex chart is up 26 pips at the moment. It was in a 50 pip range in the European session. As strong as yesterday’s reversal up was, the high was still below the high earlier in the day. The 60 minute chart is still in a bear channel and therefore yesterday might simply be a bull leg in the bear trend.

However, the momentum up was strong and the odds favor at least a small 2nd leg up. It is possible that the one hour rally at the start of last night’s Asian session was the 2nd leg up and the end of the rally. It is more likely that it was not. Hence, there still will probably be buyers on the first pullback. The best the bears can probably get today is a leg in a trading range. As a result, today will probably be a trading range day and a continuation of he overnight session.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

There was a big Spike and Channel top yesterday. The Emini had a Spike and Channel bear trend, which might be only the 1st leg down from the top. There was a broad bull channel after today’s low. The Spike and Channel top might have a 2nd leg down on Monday.

Yesterday was a wedge bull channel and a buy climax. It had nested spike and channel candlestick patterns. There was a 75% chance of a bear breakout. After selling off to a wedge bottom that tested yesterday’s higher low, the Emini rallied to a wedge top. It failed to get above the 60 minute moving average. It also closed in the middle of the week’s range and the middle of the 4 month trading range. It is therefore neutral going into next week’s Brexit vote. The odds still favor a test of the May low before a test of the June high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.