Posted 6:57 a.m.

I will here for only the first 2 hours today, but I will be home on Monday and will be here all day again.

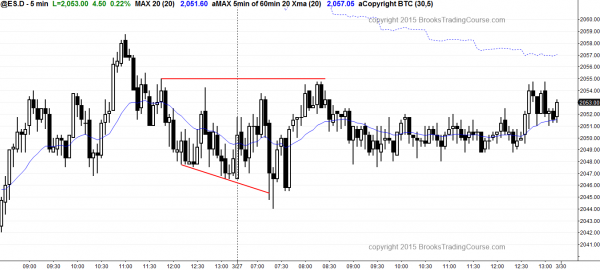

The Emini opened with a tight trading range within yesterday’s 5 hour trading range. It is in breakout mode. There have been many breakouts over the past 5 hours up and down and all have failed. The bulls need a higher low to convert the 3 hour bear channel into a trading range or a bull trend. The bulls want a 2nd leg up on the 60 minute chart. The bears want a leg 1 = leg 2 move down on the 15 minute chart after yesterday’s 15 minute gap bar. However, gap bars usually lead to the final bear leg before a major trend reversal. The bulls hope that the rally has begun. However, until there is a strong breakout up or down with strong follow-through, the limit order market will continue. Most traders should wait for that breakout, or for a clearer stop entry setup.

At the moment, the Emini is probably Always In long, but it is in a bear channel. The odds favor an attempt at a 2nd leg up on the 15 minute and 60 minute charts. Traders do not yet know if the pullback from the 1st leg up has ended.

My thoughts before the open: Double bottom and a double top

The daily chart in the Emini has a double bottom and a double top and it is therefore in breakout mode. Traders learning how to trade the markets must be aware that this is a balanced situation where there is a 50% chance of a profitable breakout in either direction, and a 50% chance of a failed breakout and a reversal. Breakout traders are looking for a breakout, but are prepared to reverse if it fails. If the downside breakout fails and reverses up, the reversal will be a large high 2 buy setup (an ABC bull flag) on the daily chart. If the upside breakout fails and reverses down, the reversal will be from a final bull flag.

The 60 minute chart was oversold and bounced yesterday. The 60 minute rally was in a 5 bar micro channel and is therefore likely to be the 1st of at least 2 legs sideways to up, even of the Emini first falls below yesterday’s low. If there is one more leg up, bears will short any reversal down, seeing it as a lower high major trend reversal. Bulls need a strong breakout above this developing bear flag to make traders believe they are again in control. Since the Emini is in a 60 minute bear flag, which is a small trading range, it is on a trading range on the 5 minute chart. However, the legs up and down can still be big enough for swing trading.

Today is Friday and therefore weekly support and resistance are important. This includes the week’s current low, and the lows of last week and the week before. The current low is again back at the weekly moving average. These are all magnets today.

The monthly candle closes on Tuesday, and the bulls and bears will try hard to control its appearance in the final 2 days of the month next week. The current month is a sell signal bar in an extremely overbought market that is likely to have a 20% correction this year. If April falls below this month’s low, that would trigger a monthly sell signal. Although the monthly ioi is a small trading range and therefore the breakout will probably result in more sideways trading, there is a 40% chance of a swing down on the monthly chart. This means that April could become a big bear trend bar on the monthly chart, and the start of a swing down below the October low and to the monthly moving average.

Summary of today’s price action and what to expect tomorrow

I left early today and this is the chart at the moment. It is Always In long, but in a trading range. Today is a Friday and it is holding around the low of last week (LLW). The Emini is in breakout mode.

I left early today. The bulls want a 2nd leg up on the 60 minute chart after the consecutive sell climaxes earlier this week. The bears want the 2 day rally to be a bear flag. The bull case has a higher probability, but the bear flag can break out in either direction, and the market might wait until next week for the breakout.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.