Posted 7:00 a.m.

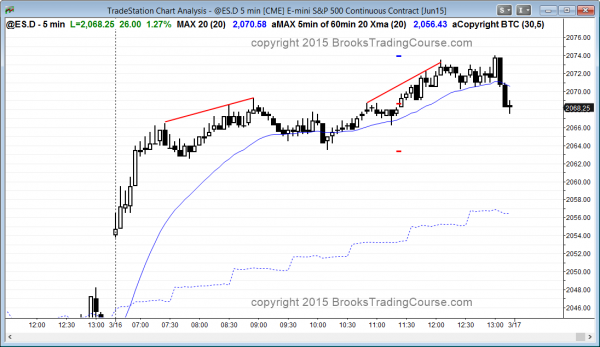

The Emini yesterday ended always in long and gapped up today and rallied above the neckline of the 3 day double bottom. The bulls want to get above the lower high at 2075.00 because that was the most recent lower high in the bear channel. If the bulls succeed, then the 60 minute bear trend will have converted to a trading range or a bull trend.

The Emini is always in long and in a trend from the open bull trend. The rally is climactic and there will probably be a pullback for an hour or so. Once the market gets closer to the moving average, traders will decide whether to continue the trend up to 2075 or back down below the neckline of the 3 day double bottom.

The bears are hoping for a parabolic wedge top and an early high of the day, but there is no sign of this yet. However, this is a reasonable possibility and traders need to be prepared. Unless the bears are able to create a credible reversal, bulls will swing trade. The Emini will probably pull back soon. The bears hope that it will be the start of a parabolic wedge top and the bulls want a bull flag.

My thoughts before the open: ABC pullback after the wedge trend reversal

The 60 minute chart formed a wedge bottom last week, and traders learning how to trade the market know that the odds favored a 2nd leg up after the initial rally on Thursday. Today will probably gap up and be part or all of that 2nd leg up (an ABC bear flag). The bulls want a 60 minute double bottom and the bears want a big low 2 sell setup. Both are looking for a measured move. Until there is a successful breakout, legs up and down are simply moves within the 4 day trading range.

Last week’s selloff ended at around a 50% pullback from the February rally. The bottom of the pullback was about the same distance from the top and bottom of the February rally, and the probability of going up 70 points from the bottom of the pullback before going 70 points down to the bottom of the rally was about the same.

The Emini is in a 5 day tight trading range just below the moving average. It might extend until Wednesday’s FOMC announcement. If so, it would be in breakout mode. A successful bear breakout would then try for a test of the 1966.25 bottom of the rally, and a successful bull breakout would try for a new high above 2110.25.

Because of the news event in 2 days and the current tight trading range at a 50% pullback, the Emini might go mostly sideways into Wednesday’s report. However, the tight trading range is big enough for swings up and down, despite the likelihood of mostly sideways trading for the next 2 1/2 days.

Summary of today’s price action and what to expect tomorrow

The Emini rallied to just below the 60 minute lower high and failed at the end of the day.

The Emini was in a trend from the open bull trend and then in a broad bull channel. It failed at the last lower high in the 60 minute bear channel. Until it breaks above that lower high, the bears still have a bear channel. The Emini might instead stay sideways into Wednesday’s FOMC report. The bears see today’s rally as the 2nd leg up after the 60 minute wedge bottom.

See the weekly update for a discussion of the weekly chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.