Posted 6:54 a.m.

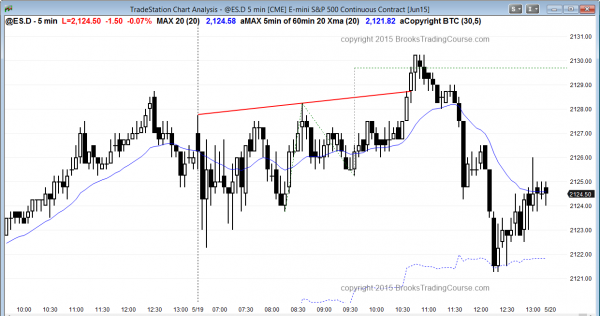

Yesterday had a spike and channel bull trend, which is usually evolves into a trading range. Today sold off to below the bottom of the channel and reversed up sharply in a big doji bar. This is trading range price action, and it may be forecasting a lot of trading range price action in the Emini today. Unless there is a strong breakout with follow-through in either direction, traders will more inclined to take quick profits and enter with limit orders, buying near the bottom of the range and below bars, and selling near the top of the range and above bars.

Is the market Always In Long after the big reversal up on the 3rd bar? It is not convincing, but it probably is.

This is difficult daytrading for beginners learning how to trade the markets, and they will have to patiently wait for either a strong breakout up or down, or for 2nd entries at the top or bottom of the range.

My thoughts before the open: Intraday trading strategies for a buy climax

The Emini in the Globex session is up slightly, but it is at the top of a wedge candlestick pattern that began with the pullback on May 12, and this pullback was from the strong bull reversal (spike, breakout) of May 7). Traders learning how to trade the markets should realize that bears have been profitably selling new highs for several years in the Emini, so that it is unlikely that the current bull breakout will go very far before without reversals. Also, the Emini is in a 21 bar tight channel on the 60 minute chart, which is a buy climax.

The day trading tip for today is expect at least a couple of hours of sideways to down trading in the Emini. However, when there is a buy climax, the Emini often has some follow-through buying for the first hour or two before the correction begins. The price action trading strategy is to look for trades in both directions.

Since the bull channel on the 60 minute chart is tight, whatever reversal today that we see will more likely result in a trading range on the 60 minute chart than a strong bear reversal. However, a bear leg in a trading range on the 60 minute chart can be a bear trend on the 5 minute chart. Can yesterday’s rally and the 60 minute 3 day rally continue all day? Yes, but the probability is that there will be at least a couple of hours of sideways to down trading for at least one bear swing trade.

Best Forex trading strategies for online daytrading today

Traders learning how to trade Forex markets for a living can see that the dollar is continuing to correct from being oversold and the EURO is continuing to correct from being overbought. The EURUSD had a sell vacuum overnight to near the bottom of the 60 minute wedge, and has been going sideways for several hours. The bear breakout below the bull trend line was big enough so that the first reversal attempt will probably be sold, for at least another small leg down.

Less likely, it will reverse up from a double bottom with the May 10 low. In either case, it is near the May 5 bottom of the wedge top and it will probably bounce soon and then clearly be in a trading range. Although this is a bear rally on the daily chart, it has been strong enough so that it will probably go more sideways and maybe up before trying to resume the daily bear trend.

The dollar is even stronger against the pound. The USDJPY is in a tight trading range on the daily chart, even though it rallied overnight. Until there is a breakout, there is no breakout.

The best Forex strategy for online Forex trading today is to look for continued strength in the dollar, which means to sell rallies in the EURUSD and AUDUSD, buy pullbacks in the USDJPY. Since the overnight moves were big, the US session might soon enter a trading range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a small trading range for the first four hours. After failing to hold a bull breakout, it reversed down to the 60 minute moving average. It bounced there and closed in the middle of the day’s range.

The Emini is at the all-time high, and today closed below the midpoint of the day’s range. This means that the candlestick pattern on the daily chart is a bear reversal bar and a sell signal bar for a failed breakout above the prior all-time high. With the rally as strong as it has been over the past couple of weeks, the bears probably will need a 2nd entry sell signal. This means that there probably will be buyers below today’s low and the best the bears will get is a small tight trading range on the 60 minute chart.

Because the monthly chart is so extremely overbought, one of these sell signals will be the start of a big bear trend on the daily chart. Since most reversals fail, today, too, will probably lead to a failed reversal, and there will probably be buyers below today’s low. If traders see a strong bear breakout tomorrow, they will swing trade. However, it is more likely that tomorrow, like today, will be mostly a trading range day.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.