Emini strong all time high breakout but buy climax

Updated 6:48 a.m.

The Emini opened with a doji bar between yesterday’s 2 trading ranges. It reversed down and then up. In addition, bull and bear scalpers made money in the 1st few bars. These factors increase the chances that today will stay mostly within yesterday’s range. Furthermore, they increase the chances that today will close around the open and create a doji day.

Trend traders need consecutive strong trend bars. Furthermore, they need a strong break beyond yesterday’s range. Until traders see that, they will bet that any more up or down will probably be a leg in a trading range day.

Pre-Open Market Analysis

While yesterday gapped up to a new all-time high, it was a quiet tight trading range day. Since the Emini is above a bull channel on the daily chart, the odds are that it will pull back this week. Furthermore, yesterday reached the top of a bigger channel. The odds are that the bulls will take profits soon. The 1st measured move target above is around 2340 and the next is 2375.

While the Emini might reach both targets before pulling back to the December 30 low, it will more likely pull back first. This is because the rally is in a tight channel and is therefore climactic. In addition, it is at the top of 2 channels on the daily chart. Furthermore, the gap above the August trading range is still open. Since gaps late in trends usually close before the Emini reaches its final target, the odds favor a pullback within the next month or so.

Since the rally is so strong, the bears will probably need at least a micro double top. Hence, traders will probably buy the 1st 1 – 2 day pullback this week.

Overnight Emini Globex trading

After yesterday’s buy climax, the Emini pulled back into a tight trading range. That small range continued overnight, and the Emini is about unchanged from yesterday’s close. The daily chart has rallied strongly to the top of a 7 month bull channel. In addition, the Emini is at a measured move projection from the December-January trading range.

While this rally might continue to the 2375 measured move target, the odds are that it will fail around the top of the bull channel and correct down to at least the December 30 low.

Since there is no top yet, the odds are that the bulls will buy the 1st pullback. The bears will probably need at least a micro double top before there is a 50 point or more pullback.

Because of the buy climax at resistance, the Emini will probably go sideways for the next few days. It will then decide whether to pull back or continue to the 2375 target. At the moment, the odds favor the pullback. Yet, the pullback will not come unless the bears create a top.

EURUSD Forex Market Trading Strategies

The 2 week selloff lacked consecutive strong bear bars and is therefore more likely a leg down in a trading range. Because it is stalling at a 50% pullback and at minor higher lows in the January rally, bulls will begin to buy. Yet, after the January wedge bear flag, the rally will probably fail after about 100 pips and lead to one more leg down. Hence, the trading range will probably last at least a few more weeks.

The EURUSD daily Forex chart is testing the higher lows in the January rally. In addition, it is around a 50% pullback. Hence, bulls will begin to buy. Because the January rally has a wedge shape, the odds favor 2 legs sideways to down. Therefore, the 2 week selloff is probably the 1st leg of a 2 legged correction. Hence, there will probably be about a 50% bounce, which is about 100 pips.

In addition, there will then probably be a 2nd leg down. The bears will see the bounce as a right shoulder of a head and shoulders top. The bulls will see the 2nd leg down as a double bottom with this week’s low.

As a result of opposite signals, there will be confusion. Since confusion is a hallmark of a trading range, the odds are that the chart will go sideways in about a 150 pip range for at least 2 weeks. Furthermore, it is now probably close to the bottom of the range.

Since it has been in a trading range since November, it might test all the way to the bottom of the range at the January low before it bounces. Yet, it is more likely to bounce around where it currently is.

Overnight EURUSD Forex trading

The EURUSD Forex market traded in a 30 pip range overnight. This is because it is at a support level. Traders are deciding if the 100 pip bounce will come from this area or from the bottom of the 4 month range. The January rally was strong enough so that the bounce will probably come from around here, which is about a 50% pullback. Hence, bulls will begin to look for setups for a swing trade up for about 100 pips. That would be about a 50% correction of the 2 week selloff.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

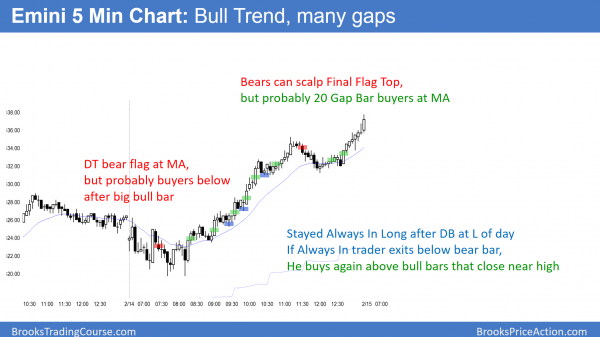

After many early reversals, today became a strong bull trend bar, forming many gaps.

Today was the 5th consecutive strong bull trend day. There is still room to the 2340 measured move target. While the momentum up has been strong, the bulls might not be able to reach the 2375 targer without a pullback. The bears will buy the 1st reversal down. Therefore the bulls will need at least a micro double top.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.