Emini island top needs bear breakout before 5% stock market correction

Updated 6:47 a.m.

The Emini gapped up and created another island bottom. Wednesday’s attempt failed. Since 2nd attempts have a slightly higher probability, traders will be more willing to swing trade if a bull trend begins.

The 1st bar was a bear bar, and the 2nd bar was small with a tail. This hesitation increases the chances of a trading range for the 1st hour or two. The 2nd attempt at an island bottom in 2 days increases the chances of a trend day today. If there is a trend, it could be up or down. The bulls need to keep any pullback from falling below yesterday’s high.

The bears want the island bottom to fail. They therefore want a reversal down below yesterday’s high. If they are successful, that would be a 2nd failed bull breakout in 3 days. It would therefore increase the chances of a break below the daily moving average. Furthermore, it would increase the chances that the 5% pullback has begun.

At the moment, the Emini is Always In Short. Yet, the bulls hope that this selloff is simply a test of yesterday’s high. They therefore expect it to fail and to lead to a bull trend. The bears want a break below yesterday’s high. If they succeed, today could be a bear trend day. The market is currently deciding between these 2 choices. The follow-through selling has been bad. This increases the chances of a trading range for an hour or two before a trend attempt begins.

Pre-Open Market Analysis

Yesterday was a trading range day with many abrupt reversals. The daily chart is in a bull trend, but still on its sell signal from the 3 day island top. Yet, the Emini has been sideways for 4 days. It is therefore still deciding if the 100 point pullback has begun or if the bull trend is still intact.

Weekly support and resistance

Because today is a Friday, traders will pay attention to weekly support and resistance. So far, this week is a small bear doji bar. Furthermore, last week was an outside bar. Hence, there is a weekly ioi breakout mode setup. This means that if next week trades below this week’s low, it would trigger a sell signal. Hence, the bears want this week to close near its low, which is about 10 points below.

Since an ioi is a breakout mode pattern, the bulls see it as a bull flag. Yet, they will be more inclined to buy above this week’s high if it has a bull body and closes near the high. This week’s open is 2281.00. Therefore, the bulls will try to close the week above that. That would create a bull body and a higher probability buy signal bar.

Overnight Emini Globex trading

The Emini is up 8 points in the Globex market. It therefore might gap up and make another attempt at an island bottom today. Tuesday’s attempt failed in the 1st hour. Since the daily chart is in a bull trend and holding above its moving average, the probability still favors higher prices. Yet, the Emini never tested the August high, so the upside is probably not big until after a 5% correction.

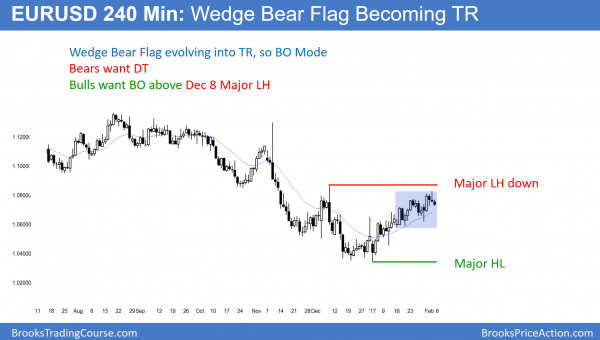

EURUSD Forex Market Trading Strategies

The daily EURUSD Forex chart has rallied for 5 weeks. Yet, the rally has many bear bars and minor reversals. It therefore is more likely a bear flag than a bull trend. Since it has been losing momentum over the past 2 weeks, it is rounding over into a trading range. It is therefore entering breakout mode.

The weak rally on the daily chart is beginning to round over. Hence, it is evolving into a trading range. It therefore is entering Breakout Mode. The bulls need a strong breakout above the December 8 major lower high. The bears want a double top with that high.

Because the chart is in a broad bear channel, the probability is slightly higher for the bears. Yet, broad channels have lots of trading range price action. Therefore the bears are not much stronger than the bulls. Hence, the probability of a continued bear trend is not much greater than it is for a bull breakout.

All financial markets are related. The U.S. bond market is oversold and might bounce for a few months. The U.S. stock market is overbought and it might correct down for a few months. Therefore the EURUSD bear trend on the daily chart might revert back to a trading range for a few months. Each of these markets is currently making that decision.

Overnight EURUSD Forex trading

While the EURUSD traded in a small range overnight, it just had a 70 pip move up and down in the past 15 minutes after the US Unemployment report. This increases the chances of a swing trade today. While the move was in both directions, the stronger move was up. Therefore, there is a greater chance of a small swing up. Yet, the 240 minute chart has been sideways for 3 weeks, so the odds are against a big trend day.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini gapped up, creating a 4 day island bottom. After a weak rally, it entered a tight trading range. The market will wait for Monday for trend resumption up or trend reversal down.

The bulls created a 4 day island bottom. Yet, they were unable to break above last week’s island top. While the odds still favor higher prices, many bears will hold short with a stop above the island top.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.