Posted 7:37 a.m.

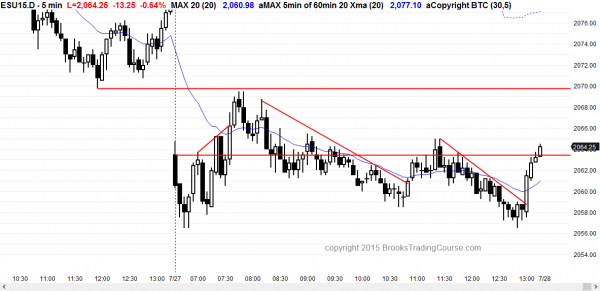

Thursday and Friday formed early double top bear flags that broke below the low of the day and were followed by bear trend days. Today also formed an early double top bear flag, but the 60 minute chart is so oversold that bears have to reduce position sizes by buying back some of their shorts. Unlike Thursday and Friday, today’s 2nd high went above the first, which is a sign that the bulls are stronger today.

The 60 minute chart had a bull breakout above a micro channel on Friday. This is usually followed by one more new low and then a reversal up lasting several bars. Today had the new low and the bulls are hoping that we have seen the low of the day. The bears want the early rally to be a wedge bear flag, but the odds favor the bulls, and the best the bears probably can get over the next couple of hours is a trading range. The bulls have a chance at a bull trend day.

At the moment, the Emini is Always In Long, but the bulls need follow-through to make it a bull trend day instead of a bull leg in a trading range day. They will try to get above yesterday’s low and close the gap, and then rally to yesterday’s close.

My thoughts before the open: Candlestick pattern is an island top

The Emini has had a strong 4 day selloff from a new all-time high. The bulls are hoping that it is just a pullback and that it will reverse up from a lower high. The bears are hoping that this is the beginning of a 10 – 20% correction down to the monthly moving average and possibly the October low.

Since the 60 minute chart is so oversold, the odds favor a bounce for a day or two, even if this is the beginning of a bear trend on the daily chart. However, bull swing traders need either a strong bottom or a strong reversal up with follow-through.

The bears have a problem. Even if the Emini is converting from a trading range into a bear trend on the daily chart, it is very oversold on the 5 and 60 minute charts. This increases the chance of a 1 – 2 day rally. Bears who are swinging shorts on the daily chart still need their stop above the top of the bear leg, which is above the all-time high 60 points above. This is too much risk. The odds favor profit taking by the bears today, which means that there could be a rally. Rallies in bear trends are often extremely strong, so the day trading tip is to be ready for a bull trend. If one forms, do not be in denial. Look to swing trade from the long side.

At the moment, the Emini will probably gap down on the open. This will create a 2 week island top on the weekly chart, and it is a possible start of a swing down. However, the Emini weekly chart is still in a 6 month trading range, and strong moves up and down do not mean much unless there is strong follow-through, which has yet to happen.

The bulls will try to close the gap down. The bears want the gap down to become a breakout gap and the start of a swing down on the weekly chart. Remember, smart bears know that there is an 80% chance of at least a 10% correction between now and the end of the year, and it can start at any time.

The bears need to do more to convince traders that they have taken control. One thing that they can do is to create another strong bear trend day, or several more consecutive bear trend days. When the market is oversold and the probability favors profit taking and a rally, and the market continues to sell off, the market is usually telling traders that the price action has changed from that of a trading range to that of a bear trend. Day traders will be ready for this today. Even though it is still a low probability, they will swing trade shorts if today is another strong bear trend day.

What does it mean if today has a bull trend that closes the gap below Friday’s low? It will increase the chance that the weekly tight trading range will continue a little longer.

The monthly chart closes on Friday and the bulls want to prevent the candlestick pattern from becoming a big bear trend bar closing on it low. If it does, the if August falls below the July low, it would trigger a 2nd entry sell signal on the monthly chart and increase the chances that the move down to the monthly moving average has begun.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini reversed up on the open, but was unable to close the gap below last week’s low. It ended up having trading range price action all day and closed near the open.

Friday is important because it determines how the monthly chart will look. The Emini daily chart is oversold and is likely to rally tomorrow in an attempt to make the monthly candlestick pattern more neutral.

Thursday and Friday will be very important because they will determine whether the bulls or bears won the month. With the monthly chart as extremely overbought as it is, if the bears win, the monthly sell signal would have a slightly higher probability of success that it otherwise would in a 7 bar tight trading range.

Best Forex trading strategies

The Euro was strong and the dollar was weak overnight. The EURUSD had a sharp rally, but this is the 3rd push up on the 240 minute chart and it is in a parabolic curve up. The bulls are hoping that this is a breakout above a wedge bear flag and that it will form a measuring gap. The bear are hoping the bull breakout will fail. They see this as is a buy climax, and a lower high in a broad bear channel.

The bull are hoping that the 5 hour pullback on the 5 minute chart is simply a bull flag. The bears are hoping that any rally will form a lower high major trend reversal, which would trigger a wedge lower high on the 240 minute chart.

The reversal down on the 5 minute chart was not especially strong so the odds of a test up are greater than a bear breakout. Because the buy climax had several legs up on the 5 minute chart and the 240 minute chart, the bears have a chance of a reversal. However, traders who trade Forex markets for a living will be prepared for a swing trade up if the gap above last Thursday’s high (the top of the 240 minute wedge bull flag) stays open.

The EURJPY and EURGBP also are pulling back after a 3rd strong leg up on the 240 minute chart, and the price action is similar. The bears want a wedge top and reversal down, and the bulls want a measuring gap and a 2nd leg up after any pullback.

They 240 minute chart of the USDJPY is turning down from a test of the top of the June trading range. However, the rally of the past couple of weeks was strong enough so that bulls will looks to buy at support. Supports is at the bottom of the June trading range, around 122.00, which is also around a 50% pullback of the strong rally of the last 2 weeks. There is a gap at 122.87, which is only 20 pips below the current price. The overnight bear trend is strong enough to make it likely that the USDJPY will reach the gap today.

The Forex price action on the 5 minute chart is bearish and there is no sign of a bottom yet, but because it is climactic, the bulls can get a 2 legged rally lasting more than an hour at any time. The first reversal attempt will probably only be minor, which means that the best the bulls can reasonably hope to see over the next couple of hours is a trading range. Since the USDJPY is at the bottom of its channel, a 1 – 2 hour rally or trading range is likely soon. Bulls will be more interested in Forex scalping until there is a clear bottom.

The USDCAD is overbought on the 240 minute chart, but there is no clear top yet. The July 15 bull breakout still might become an exhaustion gap. The bears will look to see if the overnight rally will form a lower high major trend reversal. Since the Euro is stronger than the dollar, traders looking to sell the Canadian dollar should look more at buying the EURCAD than buying the USDCAD.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.