Emini bull flag after Turkey Coup: I will update around 6:55 a.m.

Today opened within Friday’s trading range. The 1st 3 bars had prominent tails. This is a continuation of Friday’s trading range price action, and it increases the chances of a lot of trading range price action today.

Friday was an outside down day in a bull trend. several days last week had small ranges. Today might have a small range and it might be an inside day. This would create an ioi breakout mode pattern on the daily chart. If today will be an inside day, it will test Friday’s low and reverse up, and it will test Friday’s high and revere down. Traders do not know yet which swing will occur 1st.

While there has been no bull bar in the 1st 4 bars, all 4 bars have big tails. The daily chart is probably in the early stages of a pullback. Friday had a lot of trading range price action. Therefore, today will probably have a lot of trading range price action. If it becomes a trend day, it probably will not be a strong trend day.

At the moment, the bulls are trying to create an opening reversal up from the moving average, like they did every day last week. However, because of the early trading range price action and the overbought daily chart, the best the bulls will probably get is a bull leg in a trading range day. This might be a breakout mode open, where the Emini stays sideways for an hour or two, and then breaks out.

If there is a strong breakout up or down, traders will trade the day like a trend day. However, a trading range day is more likely.

S&P trading range after Turkey Coup: Pre-Open Market Analysis

Nothing has changed from what I wrote last week. The Emini is far above where institutions have their stops. They have to reduce their position size to reduce the risk. As a result of them taking partial profits, there are few buyers. After such an extreme buy climax over the past 2 weeks, the Emini will probably be mostly sideways for a few days. It might go a little higher. Yet, bulls will use a new high to take profits and bears will begin to short for a 30 – 40 point pullback.

Bears need at least a micro double top

Friday was a one day pullback. While that is often all that the markets needs for the bulls to return, a buy climax usually needs more bars before the buyers come back. Consequently, the odds are that the Emini will enter a small trading range. It can always continue much higher without a pullback, but that would be unusual when the stops are now about 5% (100 points) lower.

While is it possible that Thursday will become the top of the next many years, the chance of that is tiny. The Emini usually needs a double top or a micro double top before it can reverse down. Therefore, the Emini at a minimum will need at least one more day up before it can pull back for more than a few days.

News out of Turkey

TV regularly reports that the news causes all moves in the market. As I said after the Brexit vote, Great Britain’s economy is tiny and insignificant. Turkey is even less significant. A 10% drop in Great Britain’s economy would be 0.3% of the world’s economy. A 0.3% drop in the Emini is 6 points. That is a 5 – 10 minute effect and unimportant.

The market is almost entirely controlled by tests of support and resistance. The news sometimes can affect the market for a few days, but traders quickly forget anything short of a huge story.

Globex Emini session

While the Emini is up about 6 points, it is in a tight trading range in the Globex session. There is a 60% chance that a 2 – 5 day bull flag has begun. A small trading range often has a slightly higher high as it forms. However, the odds are that traders will sell above Friday’s high. Bulls are afraid of a micro double top in an overbought market. Bears expect at least an attempt at a micro double top.

Friday was sideways for the 2nd half of the day after a strong selloff. The bulls want to get above the 2160.50 start of the sell climax and above Friday’s high. Unless a bull breakout is very strong, the odds still favor more sideways to down for at least a couple more days.

A pullback on the daily chart usually creates a lot of trading range price action on the 5 minute chart. However, there have been swings up and down over the past several days, despite the small ranges. That will probably be true again today.

Forex: Best trading strategies

The EURUSD Forex chart continues to have trading range price action.

While the EURUSD traded down strongly on Friday, it failed to break below the bottom of its month-long trading range. For the past month, I have said that the odds were that the June 24 huge bear breakout on the daily chart would lead to a trading range that could last a month or more. That trading range is still in effect.

I also said that it might have one more push down because the bear breakout was so strong. Yet, the odds are that the June 24 bear breakout will not be a measuring gap. The gap between the close of that bar and the June 16 low closed 2 weeks ago.

Market Inertia makes more trading range price action likely

Markets have inertia. As a result, they have a strong tendency to continue to do what they’ve been doing. Look to the left on the daily chart. The odds are that the next several days will also be within the trading range. Most days within a trading range have a lot of trading range price action intraday. Consequently, the odds are that the range today will be relatively small and that online Forex day traders will continue to mostly scalp.

Double Top Bear Flag

The bears now want the double top over the past 2 weeks to break below the July 8 neck line. If they succeed, a measured move down would be almost 200 pips. The selloff would then test the June 24 sell climax low.

If the bears break strongly below the double bottom neck line, they probably will also drive the EURUSD daily chart below the June 25 low. Yet, the odds still favor buyers below. This is true unless the bear trend accelerates strongly down with a series of strong bear bars closing near their lows.

European Forex session

The EURUSD Forex chart has been in a 30 pip trading range overnight. As a result, the trading range price action of the past month will probably continue today. Hence, Forex day traders expect to mostly scalp.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

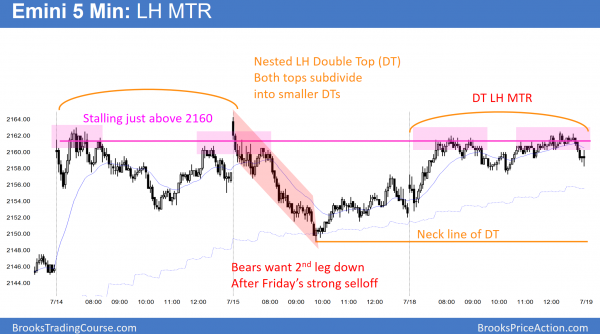

The Emini had an Opening Reversal up from the moving average and then spent most of the day in a trading range. The day was an inside day after Friday’s outside day. This is an ioi setup. The Emini formed a nested double top (DT). Both the left and right tops subdivide into smaller double tops. The right high is also a double top lower high major trend reversal (DT LH MTR).

As I mentioned above, today was probably going to be a trading range day, and it was. The daily chart now has an ioi, which is a breakout mode setup. Yet, with the Emini overbought, the bulls will probably not buy aggressively above today’s high. Furthermore, with the upward momentum as strong as it has been, the bears will probably not sell aggressively below today’s low.

The result will probably be at least another couple days of trading range trading, whether or not tomorrow goes above Friday’s high. Less likely, the pullback ended today and the bull trend will resume tomorrow. Even less likely, the Emini will enter a big bear trend tomorrow.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.