Day trading the October unemployment jobs report

Updated 6:55 a.m.

The Emini reversed down from above the neck line of the 4 day head and shoulders bottom on the open. Furthermore, it had good follow-through selling. While it is possible that this bear breakout will fail, the odds are against that. The reversal down was strong enough so that the best the bulls probably can get over the next few hours is a trading range. The bears need a strong breakout below yesterday’s low if today is going to be a strong bear trend day. More likely, it will be either a trading range day or a weak bear trend day, like a broad bear channel or a trending trading range day. Less likely, it will be a bull trend day.

The Emini is Always In Short, despite the bull reversal attempt of the past few minutes. The odds are the reversal will be minor, which means the 1st leg up will be sold. The bulls will probably need some kind of double bottom before they can get a bull trend, and that is unlikely. The bears will try to create an outside down day.

Pre-Open Market Analysis

The Emini has been in a tight trading range for 2 weeks. It is therefore in breakout mode. The unemployment report will be a catalyst today. Hence, the Emini might open with a gap up or down. Furthermore, the odds of a trend day are greater than over the past few days. As a result, traders will look to swing trade part of their position if there is a strong breakout up or down.

Nothing has changed on the weekly and monthly charts. There is a 70% chance that the gap above the July 15 trading range high will close before the Emini gets much above 2200. Yet, there is still a 60% chance that the Emini will both sell off to close the gap, and rally to a new high. Most noteworthy is how tight the range has been. The Emini is telling us that it is deciding which target will be the 1st.

Because there is a 60% chance that the Emini will get both targets, traders will look to buy a 100 point selloff to below the July 2015 high if that comes 1st. Furthermore, if the Emini rallies to a new high 1st, traders will look to sell a reversal down. This is because they believe that there would be a 70% chance of a drop below the July 2015 high.

Today’s unemployment report

The report just came out. While the Emini rallied 8 points, it quickly pulled to below the bottom of the rally and bounced up. Big Up, Big Down means Big Confusion. Since there is confusion, the 10 day trading range might continue today. Hence the report did not change anything. The Emini will trade below 2100 and up to 2200 over the next 2 months, and is still deciding which will come first.

Friday support and resistance

Because today is Friday, weekly support and resistance is important. Most noteworthy are the open of this week, and the highs and lows of this week and last week.

Forex: Best trading strategies

FXCAPTION

The EURUSD daily chart has been in nested trading ranges for 18 months. The range of the past month is very tight. Therefore the odds are that there will be a breakout up or down within the next couple of weeks. Because the height of the range is about 200 pips, the measured move targets are either 200 pips above the range and 200 pips below.

Today’s unemployment report

The unemployment report today is a potential catalyst that can lead to a breakout up or down. I am writing just before the report. If the breakout has consecutive big trend bars, the odds of a trend day go up. Because 50% of Breakout Mode breakouts reverse after 1 – 3 bars, traders have to be prepared to get out and look to trade in the opposite direction.

Just before the report, the 60 minute chart had been reversing up for 4 hours after breaking below the month long trading range. They rallied a little more on the report, but quickly reversed down. The 2 day bear channel is tight. Therefore the 1st reversal attempt will probabl be minor. Hence, the odds are that the bulls will need a trading range before they can create a reversal pattern. The bears want the reversal up to be a pullback in the channel and for the break below the September trading range to continue. The odds are that the EURUSD will go sideways today.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

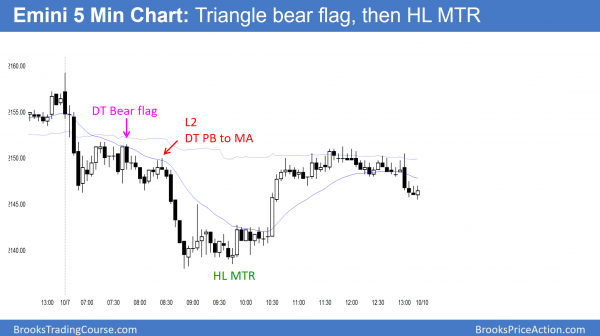

After selling off to near the bottom of the 10 day trading range, the Emini reversed up from a higher low major trend reversal.

The reversal up to the 60 minute moving average is just another leg in the 10 day trading range. Until there is a breakout, there is no breakout. Traders therefore bet that every strong move reverses within 3 days.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.