April is seasonally strong but still in early bear channel

Updated 6:45 a.m.

The day began at yesterday’s close at the 60 minute moving average. In addition, it was a limit order open. The bears want yesterday’s selloff into the close to be the start of a pullback to Wednesday’s bottom of the bull channel. The bulls want the selloff to be a pullback in the 3 day bull channel.

The odds are that the 3 day rally is a bull leg in a trading range. Yet, traders do not know if Friday was the top of the range. Hence, the market is unclear. In addition, it is in the middle of a 2 month trading range. The odds favor trading range price action this week, and today is starting like a trading range day.

While a strong trend day is possible, more likely there will be a swing up and a swing down. Traders are deciding which will be 1st. If there is a strong breakout up or down, today could be a weak trend day, but most of the day will probably continue last week’s trading range.

Pre-Open market analysis

The Emini reversed up strongly last week after a strong bear reversal. Yet, the rally failed to break above the March 15 major lower high. Hence, while breaking out of a bull flag, it is also in a bear channel. Therefore the bulls need to break strongly above that lower high. Without that, the odds still slightly favor a move down to the weekly moving average and the close of last year.

Friday was a bear inside bar on the daily chart after 4 days up. Therefore, there are probably buyers below. Yet, because it had a bear body, it is a weak buy signal bar. The odds are that the 2 month trading range will continue and most days will be trading range days.

Overnight Emini Globex trading

The Emini is unchanged in the Globex session. Because it rallied to 4 days last week, the bulls are exhausted. In addition, the Emini is now in the middle of its 2 month trading range. The odds are that it will hesitate here for a day or two. The bears still have an early bear channel while the bulls have a bull flag. The probability over the next couple of months is close to the 50% for each. But, because the weekly chart was so overbought and at major resistance, the odds slightly favor the bears over the next 2 months.

EURUSD Forex market trading strategies

While the 240 minute EURUSD Forex chart sold off strongly last week, the bear trend followed a strong rally. The 1st reversal down is usually minor, which means a bounce and a trading range is likely this week. Yet, the selloff was strong enough to make an attempt at a lower high major trend reversal likely after a 2 – 5 day rally.

The EURUSD sold off into a support zone. It had fallen below the bottom of the wedge rally that began on March 16 and is now testing the top of the February trading range. Because this 4 day selloff is the 1st leg down in a 4 week bull trend, it is more likely a leg in a trading range than in a bear trend.

Bull trends usually transition into trading ranges before becoming bear trends. Hence, this will will probably have a rally to confuse traders. They will then wonder if the selloff was simply a sell vacuum test of support rather than the start of a bear trend. In addition, the rally might be stronger than what seems likely. Hence, it might retrace 50% of last week’s selloff. Therefore it probably will extend at least 100 pips. At that point, traders will wonder if the selloff was simply another higher low on the daily chart. The bears will hope that the rally becomes the 1st lower high in a new bear trend.

Overnight EURUSD Forex trading

The selling has been evolving into a 50 pip tall trading range since early Friday. Traders expect a bounce and are therefore wondering if this is the bottom. While it is possible that the selloff will continue without a bounce, the odds are against it. The EURUSD is still in a 5 month trading range and most attempts to break into a trend fail. Therefore, until there is a clear breakout beyond the range, the odds are that the bears will be disappointed this week.

This is therefore just the opposite of what took place for the bulls last week. Traders will be looking for a 100 pip bounce this week. Bulls will therefore begin to buy for scalps and a swing trade. In addition, bears will probably begin to switch from swing trading to scalping until the EURUSD rallies about 100 pips. There is resistance at around a 50% pullback. Furthermore, the March 16 – 26 trading range is a magnet.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

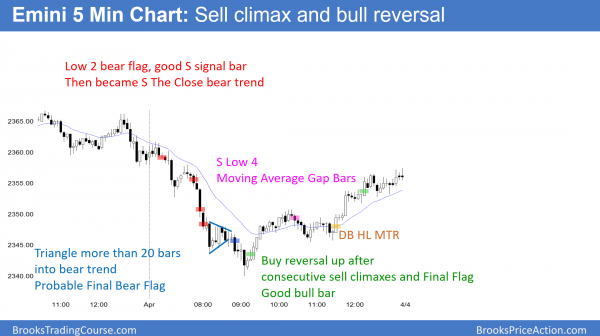

The Emini reversed up from consecutive sell climaxes and a final bear flag. It then pulled back and rallied from a higher low major trend reversal.

The Emini sold off in consecutive sell climaxes for 2 hours. It then reversed up from a Final Bear Flag. It continued up from a higher low major trend reversal to test the 60 minute and daily moving averages. In addition, it tested near the open on the day. Consequently, the bull reversal turned the day into a doji day.

Since it is in the middle of a 2 month trading range, the odds are that most days will continue to be trading range days. Furthermore, there is no evidence that the 2 month range is about to break out successfully.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.