Posted 6:56 a.m. The Emini gapped above yesterday’s high and had a Trend From The Open Bull Trend for several bars. The rally was strong enough so that bulls will probably buy the 1st reversal down. It was also strong enough to make a bull trend day more likely than a bear trend day. Today […]

Intraday market update: May 24, 2016

Intraday market update: May 23, 2016

Weak price action in buy candlestick pattern

Posted 6:53 a.m. The Emini began with limit order trading around yesterday’s close and in the middle of yesterday’s trading range. The bulls were hoping that yesterday’s late rally was the start of a 2nd leg up. The bears wanted another lower high in the bear channel that began early yesterday, and they want to […]

Emini weekend update: May 21, 2016:

Learn how to trade failed candlestick patterns

Monthly S&P500 Emini futures candlestick chart: Weak sell signal The monthly S&P500 Emini futures candlestick chart had a weak sell signal last month after a very strong rally. So far, the sell entry bar is also weak. Regarding the monthly S&P500 Emini futures candlestick chart, I have been saying since the end of April that […]

Intraday market update: May 20, 2016

Learn how to trade a buy candlestick pattern

Posted 6:45 a.m. The Emini gapped up, but the gap was small, the tails were prominent, and the 1st bodies were not big. The gap still might become a measuring gap. However, this price action increases the chances for a trading range open where the Emini forms a double top and a double bottom over […]

Intraday market update: May 19, 2016

Learn how to trade monthly a sell signal

Posted 7:02 a.m. The Emini had an expanding triangle bottom and then a higher low major trend reversal at the end of yesterday. The bulls tried for an early reversal up from another higher low today, but the rally failed at the moving average. It then had an Opening Reversal down for a possible high […]

Intraday market update: May 18, 2016

Price action for day traders at support

Posted 7:10 a.m. The Emini began with a Small Bear Breakout of a Small Bear Breakout, which is a type of wedge bottom. The wedge began 11 a.m. yesterday. This is a breakout mode setup that can lead to a measured move up or down. The rally on the open had a couple of big […]

Intraday market update: May 17, 2016

Online day traders see topping and bottoming candlestick patterns

Posted 6:54 a.m. The Emini sold off on the open to below the 60 minute moving average down to a 50% pullback of yesterday’s rally. The channel down had about 15 bars and it was tight. This means that the 1st reversal up will probably be minor. A minor reversal is a leg in a […]

Intraday market update: May 16, 2016

Sell climax trading

Posted 6:54 a.m. Friday was a sell climax. Today had a 75% chance of at least a couple of hours of sideways to up trading beginning by the end of the 2nd hour. It might have begun at the end of Friday. The Emini began with a series of bull trend bars that rallied above […]

Emini weekend update: May 14, 2016:

Trade a trend reversal candlestick pattern

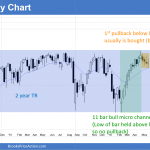

Monthly S&P500 Emini futures candlestick chart: Might trigger sell signal The monthly S&P500 Emini futures candlestick chart is moving down and it might fall below last month’s low. This would trigger a sell signal for a failed breakout above a 2 year trading range. The monthly S&P500 Emini futures candlestick chart still has not triggered […]

Intraday market update: May 13, 2016

Learn how to trade a triangle candlestick pattern

Posted 7:02 a.m. The Emini rallied on the open after a breakout test of yesterday’s 10:05 a.m. breakout point. The Emini will probably get a 2nd leg up today and reach a Leg 1 = Leg 2 target, but the bear channel at the end of yesterday was tight. This often means that the bulls […]