Market Overview: NASDAQ 100 Emini Futures

NASDAQ Emini futures April monthly bull follow-through candlestick is a small bull doji bar closing at its high just above the March high. The bulls got the minimum follow-through after the big outside up bull bar in March. This is the second consecutive bull close above the monthly exponential moving average (EMA).

On the weekly chart, the market closed as an outside up bull bar, although the bar went far below the prior week low than above prior week high.

NASDAQ 100 Emini futures

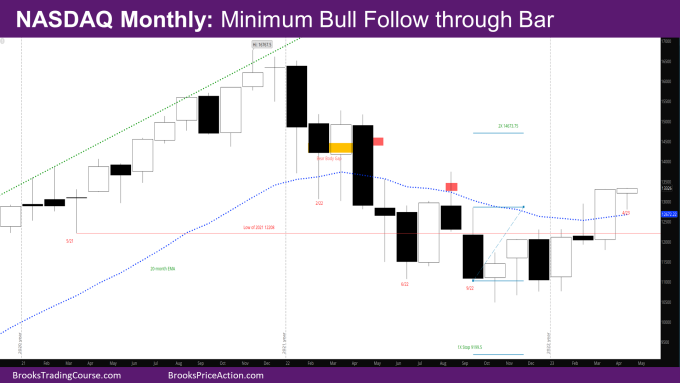

The Monthly NASDAQ chart

- The April month bar is a small bull bar relative to March.

- The bulls needed a strong follow-through bar to try and convert the market to be Always in Long (AIL).

- Outside bars need follow-through, otherwise they can become a trading range.

- The market is now near the top of the trading range from June 2022. It is near the mid-point of the upper tail of August 2022.

- Last month’s report had mentioned that the market could do the opposite of what happened in May-September.

- This would mean bears will try to sell in April to prevent having a follow-through bar for the bulls, and then bulls could create another buy-signal bar at the monthly EMA.

- While the bears could not create a bear bar, the bulls also did not get a strong follow-through bar.

- Bulls will try again next month to create a strong follow-through bar.

- Since the market has just transitioned above the EMA, it is likely it will go sideways for a few months than straight-up.

- The next target for the bulls is the high of the August 2022 sell-signal bar, followed by the high of the April 2022 sell climax bar.

- Since the market has been in a trading range on the monthly chart, it usually goes above one resistance, but not above the next one.

- So, it’s likely the market will go above the August high, but not the April high, before a leg down in the trading range.

- Bears could start selling here to attempt a double top with August (shown with red shade).

- They will scale in higher around the close of the February 2022 month and the upper half of April 2022 to keep the bear body gap open.

- The bear body gap (shown with yellow shade) was created when April and May 2022 broke below the bear body of February 2022, and there has not been a close since that overlaps with the body of February 2022.

- The bull targets mentioned in last month’s report and shown on the chart are still valid.

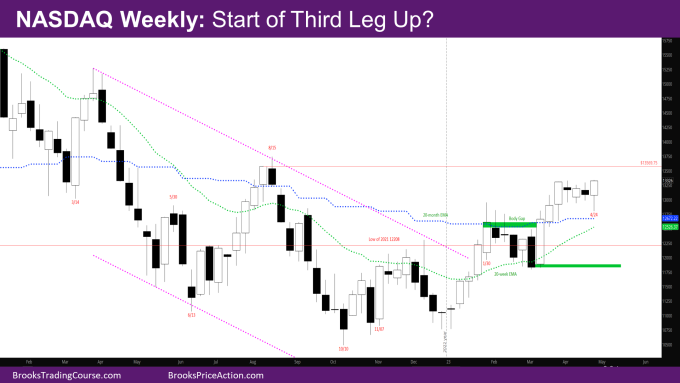

The Weekly NASDAQ chart

- This week’s candlestick is a bull outside bar closing near the high of the trading range going on in April.

- The market triggered the bad sell-signal bar of last week. It looks like buyers came in around the mid-point of the 3/27 bull bar tail.

- The market is in a tight trading range for past 3 weeks – Traders are buying near the low of prior week and selling near the high.

- The question now is, will traders sell the high of this week? Bulls will need a follow-through bar to convince traders the 3rd leg up has begun.

- One problem for the bulls is that they don’t have consecutive bull bars anymore.

- In other words, after the strong move up in March, the 4 weeks have been alternating bull and bear bars.

- If bulls need this leg up to continue strongly, they need consecutive bull bars. Otherwise, it becomes a leg in trading range.

- The next bull target is the close of Week of 8/8 at 13569.75 – the last bull bar of the micro channel up in August. That was a reasonable buy the close bar, and there are trapped bulls up there.

- The market is close enough to this target that it should reach it.

- There is also a body gap created by the week of 1/30 – There has not been a bear close after the market broke above the close of 1/30 that overlaps with the body of 1/30.

- If the market continues to go sideways for a few weeks, bears will try to get a leg down like they did at the end of the first leg up in early February.

- The first target for bears will be to close the body gap by going below close of 1/30 – 12613.25

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.