Market Overview: NASDAQ 100 Emini Futures

The NASDAQ Emini futures week is a consecutive sell signal bar with its low above last week’s low. On the daily chart, this week looks like the 2nd and 3rd push of three pushes up from 8/18. The market tried breaking out above last week’s high and reversed.

The 2nd leg down for the move down from 7/31 is still in play.

NASDAQ 100 Emini futures

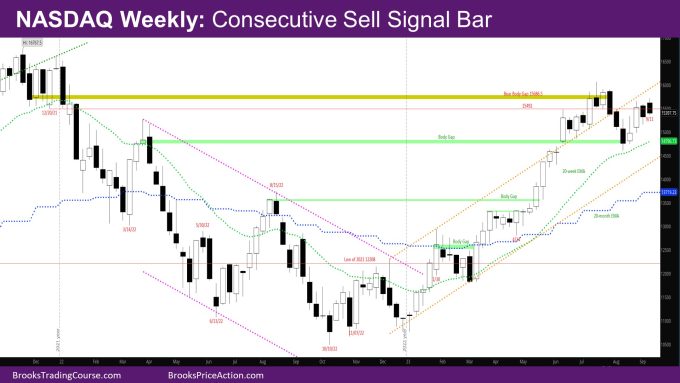

The Weekly NASDAQ chart

- The week is a good-looking bear reversal bar just above last week’s high.

- The week gapped up above last week’s high and tried breaking above it.

- However, by the end of the week, the bar had become a bear bar closing near its now.

- So, the question is – Is this a better sell signal bar than last week? While the bar is a stronger bar than last week and has small tails, it is higher in price than last week and has quite a bit of overlap with last week’s body.

- What that means is that it is not likely to result in a bear breakout, and more so a bar or two with tails below, and buyers below last week’s low.

- Buyers will likely come in below the low of week of 8/28 which was a strong bull bar.

- There is also the outstanding test of the exponential moving average (EMA)

- Bears wanted to close the body gap with March 2022, which they did couple of weeks ago, although with only a small overlap.

- If bulls can go up from here, the body gap close would be a considered a negative gap – a small overlap, but trend resumption up.

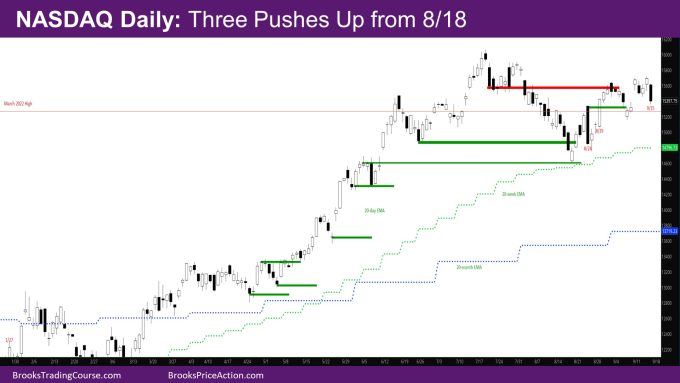

The Daily NASDAQ chart

- Friday is a big bear trend bar resting on the daily EMA.

- The daily chart looks like a wedge – 3 pushes up. The 2nd and 3rd pushes have bad sell signal bars so likely more sideways and nested wedges till there is a better sell signal bar.

- Monday had a big surprise gap up above last week’s high and far above the daily EMA.

- It was a chance for the bulls to trap the bears by breaking out above last week’s high.

- Tuesday gapped near Monday’s low and closed on its low. It also closed the breakout gap over last week close/high.

- Wednesday was a good bull reversal bar and Thursday a follow-through bar and the market was back near the high of the week.

- Friday gapped down again and sold off relentlessly to create the biggest bear bar since 8/24.

- Given big bars like this usually don’t have follow-through, Monday is likely a bull reversal bar around Friday’s low, or for Monday to gap up and be an inside bar.

- The week would have been a strong bull bar if the week had closed on Thursday. It is interesting that Friday reversed the entire bullishness of the week.

- 8/29 was a strong bull bar. There should be buyers below that bar if the market gets there.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.