Market Overview: NASDAQ 100 Emini Futures

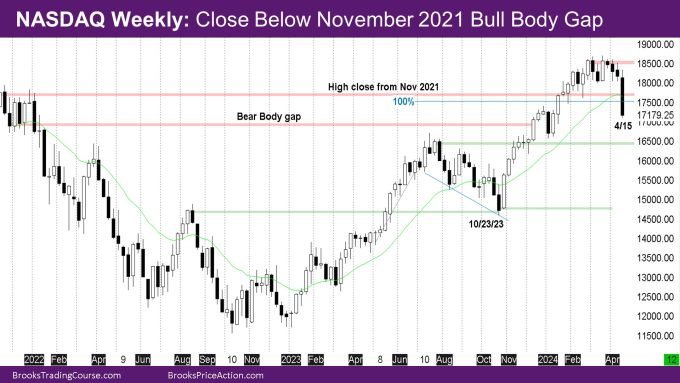

The NASDAQ Emini futures week is a big bear bar closing on its low far below the exponential moving average (EMA). The market also had a close below November 2021 bull body gap.

On the daily chart, the market had a bear micro-channel with bear trend bars on 4 of the 5 days. The market has closed the bull gap from the November 2021 high with several bear trend closes below it.

So far, the month is a big bear trend bar reversing the bull bodies of the prior 3 months. Since the monthly chart is in a bull micro-channel, there should be buyers below prior bull trend bars like February. With a little over a week left in the month, the problem for the bears is that the monthly bar is already the size of an average month (over past 10 bars or so), so likely some part of the rest of the month will be sideways.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- The week is a big bear trend bar closing far below the EMA.

- As has been mentioned before, the November 2021 close was a magnet and traders wanted to see how the market would test it.

- The bull scenario was that the market tested the EMA and the November 2021 gap as a bear leg in a trading range and closed above it, essentially keeping the bull trend intact.

- The bear scenario was that the market broke through and closed far below the EMA and the November 2021 gap, concluding that the market is in a trading range.

- Bears need a follow-through bar or two to confirm the close of the bull body gap, but so far it is looking like the latter is the case.

The Daily NASDAQ chart

- The market broke below the trading range that has been going on since March.

- Bulls wanted the test of November 2021 bull gap to be as a bear leg in a trading range.

- Instead, the market broke through the November 2021 bull gap with several closes below it.

- The market closed below a lot of bars during February-March to the left.

- Prior reports had mentioned the bear targets if the market breaks below the EMA – The first one was the November 2021 high close.

- The next one is the close of 1/4/2024 – which was a bear microchannel that was never sufficiently tested.

- The week had 4 bear trend bar days, 3 being large.

- Monday was a bear trend bar whose body matched Friday’s bear trend bar.

- This was also the first successive trend bar closes below EMA since October.

- Tuesday was a doji bar, likely a pause for a 2nd leg. Wednesday was a breakout below, with Thursday a good follow-through bar.

- Friday was another big bear bar.

- The bear breakout of Wednesday, Thursday and Friday should have a 2nd leg, possibly 2 legs.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.