Market Overview: EURUSD Forex

The weekly chart traded sideways in the last 3- to 4-weeks, potentially forming a EURUSD final flag. The bulls need to create consecutive bull bars trading far above the bear trend line to increase the odds of a larger pullback. The bears want the pullback to remain sideways and weak which will increase the odds of a retest of the October 3 low.

EURUSD Forex market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was an inside bull bar closing near its high.

- Last week, we said that the odds slightly favor the market to trade at least a little lower. Until the bulls can show they are back in control by creating strong bull bars, odds continue to slightly favor the EURUSD to trade sideways to down.

- The market traded sideways to up for the week.

- The bulls hope that the strong move down from July is simply a sell vacuum within a trading range.

- They want a reversal up from a double bottom bull flag (with Mar 15) and a parabolic wedge (Aug 3, Aug 25, and Oct 3).

- The problem with the bull’s case is that the move down is very strong.

- They need to create follow-through buying trading far above the bear trend line to increase the odds of a pullback lasting many weeks.

- The bears got a tight bear channel testing the trading range low.

- That increases the odds of at least a small second leg sideways to down after a larger pullback (bounce).

- They want the pullback (bounce) to be weak (overlapping bars, doji(s), bear bars) and sideways, followed by another leg lower.

- They see the last 2- to 3-weeks simply as a small pullback and want the market to resume lower, breaking far below the March low with follow-through selling.

- The selloff from July 18 lasted a long time and was climactic. The market could be forming a pullback that lasts a couple of weeks.

- Traders will see the strength of the pullback. If the pullback is weak and has a lot of overlapping candlesticks, the odds of another leg lower increases.

- So far, the pullback is sideways and has overlapping bars (therefore weak).

- Since this week’s candlestick is an inside bull bar, the EURUSD is in breakout mode.

- The bulls want a breakout above, while the bears want a breakout below the inside bar.

- Because it is a bull bar closing near its high, the first breakout may be above the inside bar.

- The first breakout from an inside bar can fail 50% of the time. Also, the candlestick after an inside bar sometimes is another inside bar (forming an ii; inside-inside pattern) or has a lot of overlapping range.

- For now, while the sideways to up pullback can still last a while more, odds are the pullback is minor and we will get a retest of the prior leg extreme (Oct 3) after the pullback.

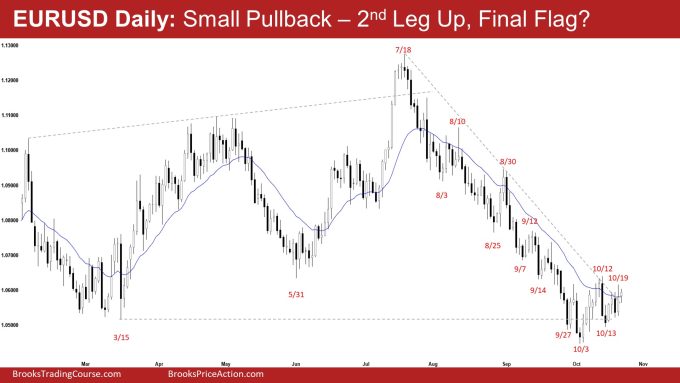

The Daily EURUSD chart

- The EURUSD traded sideways to up for the week. Friday was an inside bull doji.

- Last week, we said until the bulls can break far above the bear trend line, odds slightly favor the EURUSD to trade sideways to down still.

- The bulls hope that the strong move down is simply a sell vacuum test of the 45-week trading range low.

- They want a larger pullback (bounce) from a parabolic wedge (Aug 25, Sept 14, and Oct 3) and a large double bottom with the March low.

- They hope to get a reversal up from a higher low major trend reversal (Oct 13).

- They need to create consecutive bull bars closing near their highs, breaking far above the 20-day EMA and the bear trend line to increase the odds of the bull leg beginning.

- If the market trades lower, they hope that the small sideways trading range in the last 3 weeks will be the final flag of the move down.

- The bears got a tight bear channel down lasting 13 weeks.

- They want a strong breakout below the March low and a measured move down based on the height of the 45-week trading range.

- The move down since July 18 is in a tight bear channel. That increases the odds of at least a small second leg sideways to down after a larger pullback.

- If the market trades slightly higher, the bears want a reversal from a small double top bear flag with the October 12 high.

- This week formed the second leg sideways to up of the pullback, but it had a lot of overlapping candlesticks. The bulls are not yet as strong as they hoped to be.

- The odds continue to slightly favor the current pullback to be minor and favor a retest of the prior leg extreme (Oct 3 low) after the pullback.

- Until the bulls can break far above the bear trend line and the 20-day EMA, odds slightly favor the EURUSD to still be Always In Short.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.