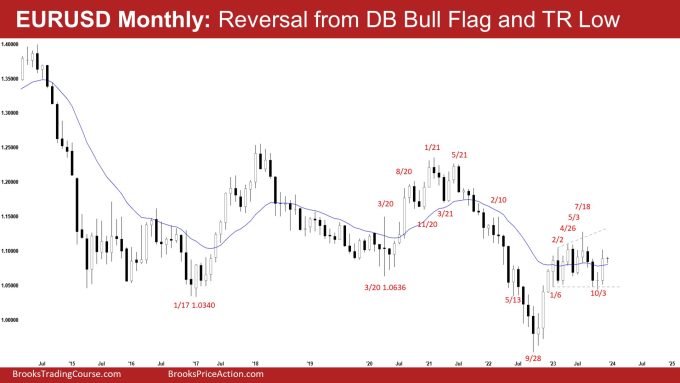

Market Overview: EURUSD Forex

The market formed a EURUSD bull flag (double bottom bull flag – Jan 6 and Oct 3) on the Monthly chart. The bulls need to create follow-through buying in December to increase the odds of retesting the July high. The bears hope that the current move is simply a deep pullback and want a reversal from a lower high major trend reversal.

EURUSD Forex market

The Monthly EURUSD Forex chart

- The November monthly EURUSD candlestick was a bull bar closing in the upper half with a prominent tail above.

- Last month, we said that the odds slightly favor the trading range to continue. Traders will see if the bulls can create a strong bull bar in November. If they do, it will increase the odds of the bull leg beginning.

- The market traded higher closing above the 20-week EMA and the trading range remains intact.

- The bears got a reversal down testing the trading range low (Jan low).

- While October broke below the trading range low, the bears were not able to get sustained follow-through selling.

- They hope that the current move is simply a deep pullback and want a reversal from a lower high major trend reversal.

- The bulls want a reversal from a double bottom bull flag (Jan 6 and Oct 3).

- They got a strong entry bar in November by closing above October high and the 20-week EMA.

- They need to create a follow-through bull bar in December to increase the odds of a retest of the July high.

- They hope to get a large second leg up lasting many months with the first leg being the September 2022 to July 2023 rally.

- Since October is a big bull bar, it is a buy signal bar for December. It is not a strong sell signal bar.

- For now, odds slightly favor the market to still be in the sideways to up phase.

- Traders will see if the bulls can create follow-through buying in December. If they do, it will increase the odds of a retest of the July high.

- If December closes as a bear bar below the 20-week EMA instead, that will increase the odds of a (tight) trading range or sideways to down moving forward.

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was an outside bear bar with tails above and below, closing below the middle of its range.

- Last week, we said that odds continue to slightly favor the market to still be in the sideways to up phase and a small second leg sideways to up after a small pullback.

- This week traded higher earlier in the week, followed by a reversal below last week’s low but closing above it.

- The bulls got a reversal after a test of the trading range low (Jan low).

- They want a retest of the July high followed by a continuation higher in the form of a large second leg up (with the first leg being the September 2022 to July 2023 rally).

- If the market trades slightly lower, the bulls want a reversal up from a higher low major trend reversal and the 20-week EMA to act as support.

- Previously, the bears got a tight bear channel testing the trading range low (Jan 6).

- They see the current move simply as a deep pullback and want a second leg down to retest the October low.

- They want a reversal from a wedge bear flag (Oct 12, Nov 3, and Nov 29) and a lower high major trend reversal.

- The problem with the bear’s case is that they have not been able to create follow-through selling (since the Oct low).

- Will they be able to create a follow-through bear bar next week?

- Since this week’s candlestick is a bear bar closing slightly below the middle of its range, it is a sell signal bar for next week albeit weaker (a prominent tail below).

- Traders will see if the bears can create follow-through selling or if will they fail to do so again.

- Odds slightly favor any pullback to be minor and at least a small second leg sideways to up after a pullback.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.