Market Overview: EURUSD Forex

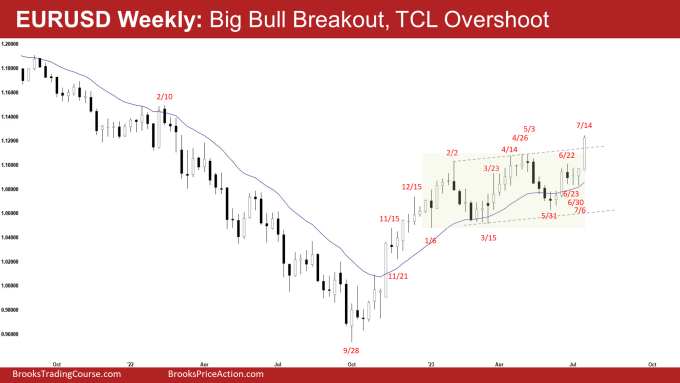

The weekly chart was a EURUSD Bull Breakout above the April high. The bulls want a new leg up lasting many weeks like the one which started in November 2022. The bears want a failed breakout above the April high and a reversal from a trend channel line overshoot.

EURUSD Forex market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a big bull bar closing near its high.

- Last week, we said if the current pullback remains weak (with overlapping bars, doji(s) and bull bars) as it is now, the odds will favor a retest of the April high in the coming weeks.

- This week broke and closed above the April high.

- The bulls want another strong leg up, completing the wedge pattern with the first two legs being February 2 and April 26. The third is currently underway.

- Next, they want a strong leg up lasting many weeks like the one which started in November 2022.

- The targets for the bulls are the Jan/Feb 2022 highs and a measured move up using the height of the prior 6 month’s trading range which will take them to around the October 2021 high.

- They will need to create a follow-through bull bar to confirm the breakout above the April high.

- The bears hope to get a reversal from a failed breakout above April, a wedge top (Feb 2, Apr 26, and Jul 14) and a trend channel line overshoot.

- The problem with the bear’s case is that they have not been able to create strong bear bars with follow-through selling since the May low.

- They need to create consecutive bear bars closing near their lows to show that they are back in control.

- Since this week’s candlestick was a big bull bar closing near its high, it is a buy signal bar.

- For now, odds slightly favor the EURUSD to trade at least a little higher even if there is a small pullback.

- Traders will see if the bulls can create follow-through buying or will the market trade slightly higher but close with a long tail above or with a bear body.

- If the bulls continue to get strong consecutive bull bars, the odds of a spike and channel up will increase.

The Daily EURUSD chart

- The EURUSD spiked higher for the week.

- Last week, we said that the odds slightly favor the EURUSD to trade at least a little higher and traders will see if the buyers can create strong follow-through buying or will the market trade slightly higher but stall around June 22 high area.

- This week broke above the April high.

- The bulls got a strong breakout from a wedge bull flag (Jun 23, Jun 30, and Jul 6) and a larger second leg sideways to up completing the wedge pattern with the first two legs being February 2 and April 26.

- They want the breakout above April to be the start of a new leg lasting many weeks, like the one which started in November 2022. They want a channel up after a small pullback.

- The next targets for the bulls are the Jan/Feb 2022 highs and a measured move using the height of the January-June trading range which take them to around October 2021 high.

- The move up is strong enough for traders to expect at least a small second leg sideways to up after a pullback.

- The bears hope to get a failed breakout above the April high. They want a reversal down from a trend channel line overshoot and a wedge top (Feb 2, Apr 26, and Jul 14).

- Because of the strong move-up, the bears will need at least a micro double top or a strong bear reversal bar before they would sell more aggressively.

- The current move-up is in a 7-bar bull microchannel with big consecutive bull bars closing near their highs. That means strong bulls.

- The first pullback would likely be minor, and odds slightly favor at least a small second leg sideways to up.

- Traders will see if the bulls can form a bull channel after a small pullback, or will the market form a micro double top of some sort?

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.