Market Overview: S&P 500 Emini Futures

The weekly chart formed an Emini outside doji after making a new high. If a pullback begins, the bulls want it to be sideways and shallow, filled with bull bars, doji(s) and overlapping candlesticks. The bears want a reversal from a higher high major trend reversal and a large wedge pattern (Feb 2, July 27, and Mar 8).

S&P500 Emini futures

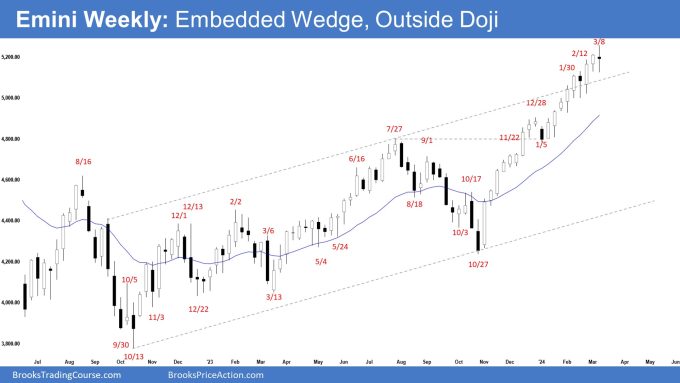

The Weekly S&P 500 Emini chart

- This week’s Emini candlestick was an outside bear doji with long tails above and below the candlestick.

- Last week, we said that the market continues to be Always In Long and odds slightly favor the market to trade at least a little higher.

- This week made a new high but reversed to close below last week’s high.

- The bulls have a tight bull channel. That means strong bulls.

- They want a strong breakout into all-time high territory, hoping that it will lead to many months of sideways to up trading after a pullback.

- They will need to continue to create sustained follow-through buying above the prior all-time high.

- We may also see some profit-taking activity once the market starts to stall.

- If a pullback begins, the bulls want it to be sideways and shallow, filled with bull bars, doji(s) and overlapping candlesticks.

- The bears hope that the strong rally is simply a buy-vacuum test of the prior all-time high.

- They want a reversal from a higher high major trend reversal and a large wedge pattern (Feb 2, July 27, and Mar 8). They want a failed breakout above the all-time high and the trend channel line.

- They also see a parabolic wedge in the third leg up since October (Dec 28, Jan 30, and Mar 8) and an embedded wedge (Jan 30, Feb 12, and Mar 8).

- They hope to get a TBTL (Ten Bars, Two Legs) pullback of at least 5-to-10%. They want at least a test of the 20-week EMA.

- The problem with the bear’s case is that the rally is very strong. They will need to create a few strong bear bars to indicate that they are at least temporarily back in control.

- Since this week’s candlestick is an outside bear doji, it is not a strong signal bar for next week.

- The candlestick after an outside bar sometimes is an inside bar, forming an ioi (inside-outside-inside) breakout mode pattern.

- Otherwise, it could have a lot of overlapping range with the outside bar.

- The market continues to be Always In Long.

- However, the rally has lasted a long time and is slightly climactic. Traders are looking for signs of profit taking but there are none still.

- Until the bears can create strong bear bars, traders will not be willing to sell aggressively.

- Sometimes, a euphoric market (as it is now) can continue higher into a blow-off top (parabolic climax).

- Side note: There are signs of a blow-off top in the stocks of the leaders of the rally such as Nvidia and Meta.

- Traders will see if the bulls continue to create more follow-through buying or will the bears start to create some decent bear bars soon.

- Once the market starts to stall and traders are convinced that the profit-taking phase has begun, the selling can be strong and last at least a few weeks.

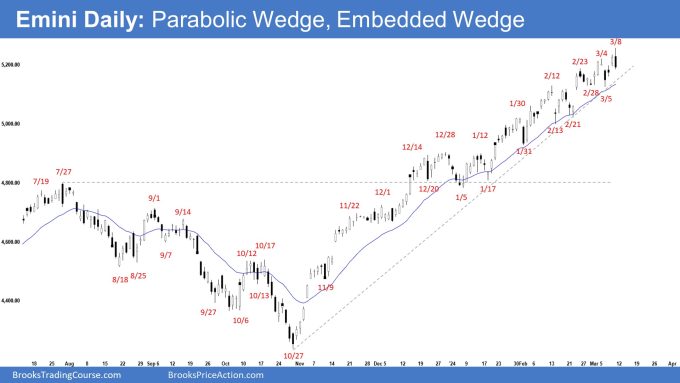

The Daily S&P 500 Emini chart

- The market broke into new all-time high territory on Monday and Friday. However, Friday reversed into an outside bear reversal bar closing near its low.

- Previously, we said that odds slightly favor the market to still be Always In Long. While there are no signs of strong selling pressure yet, traders should be prepared for a minor pullback which can begin within a few weeks.

- The bulls got a tight bull channel breaking above the prior all-time high (Jan 2022).

- They hope that the current rally will form a spike and channel which will last for many months after a deeper pullback.

- They got another leg up completing the wedge with the first two legs being the January 30 and February 12 highs.

- The third leg up (since Feb 21 low) consists of 3 pushes (Feb 2, March 4, and March 8) therefore an embedded wedge. The risk of a profit-taking event is elevated.

- If there is a deeper pullback, the bulls want at least a small sideways to up leg to retest the current trend extreme high (now March 8).

- The bears hope that the strong rally is simply a buy vacuum retest of the prior all-time high.

- They want a reversal down from a higher high major trend reversal, a large wedge pattern (Feb 2, July 27, and Mar 8) and a parabolic wedge (Dec 28, Feb 12, and Mar 8).

- They also see an embedded wedge in the current leg up (Feb 2, March 4, and March 8).

- The bears will need to create consecutive bear bars closing near their lows and trading far below the 20-day EMA and the bear trend line to indicate that they are at least temporarily back in control.

- Since Friday was a reversal bar closing near its low, it is a sell signal bar for Monday.

- If the bears can create sustained follow-through selling trading below the 20-day EMA, it may lead to the start of the pullback phase.

- For now, the market is still Always In Long. However, the rally has lasted a long time and is slightly climactic.

- While there are no signs of strong selling pressure yet, traders should be prepared for a minor pullback which can begin at any moment.

- Traders will see if the bulls can continue to create sustained follow-through buying above the all-time high.

- Or will the market begin the profit-taking phase soon?

Trading room

Al Brooks and other presenters talk about the detailed Emini price action real-time each day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.