Market Overview: Nifty 50 Futures

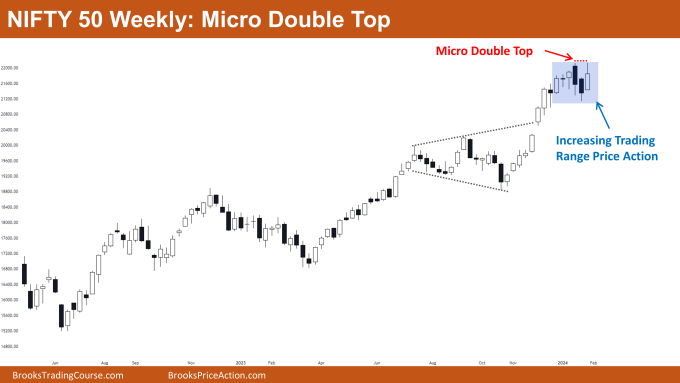

Nifty 50 Inside Bar on the monthly chart. On the monthly chart, Nifty 50 closed weakly bullish with a very small body. Despite this, the market remains in the breakout phase since the bull breakout of the wedge top pattern. However, due to the lack of strong follow-through, there’s a high likelihood of a pullback in the upcoming month. On the weekly chart, Nifty 50 also closed weakly bullish with a long tail at the top, forming a micro double top pattern. Increased trading range price action is observed on both the monthly and weekly charts.

Nifty 50 futures

The Monthly Nifty 50 chart

- General Discussion

- The market continues in a strong bull trend, advising bears to refrain from selling until strong bear bars appear on the monthly chart.

- Bulls currently in long positions should hold, considering the best outcome for bears now is a trading range.

- Exit long positions if bears manage to form strong consecutive bear bars or a single strong bear bar.

- In case of a weak upcoming pullback with weak bear bars, bulls can enter a long position on a high-1 bar.

- Deeper into the Price Action

- Although Nifty 50 broke out bullishly with strong consecutive bull bars, the lack of significant follow-through raises the risk of breakout failure if bears produce a strong bear bar.

- Trading now below the significant big round number 22000, which acts as strong resistance for the price.

- Patterns

- Generally, the success rate of a bull breakout from a wedge top pattern is around 25%.

- This likelihood diminishes further if strong follow-through bars fail to materialize post-breakout.

- The formation of an inside bar, indicative of trading range price action, suggests a potential pullback soon.

- Given the strength of the bull trend, the best outcome for bears is a trading range, not a reversal.

The Weekly Nifty 50 chart

- General Discussion

- Nifty 50 has entered a small trading range on the weekly chart, prompting bears to await a strong reversal attempt before selling.

- Bulls can maintain long positions until bears execute a strong bear breakout of the trading range.

- Deeper into Price Action

- In the past three weeks, bears attempted reversals, but weak bear bars hindered their efforts.

- The recent formation of a micro double top pattern signifies another attempt by bears to trigger a reversal.

- Should bears fail to generate strong bear bars this time, traders should consider buying on a high-2 entry bar and anticipate the continuation of the bull trend.

- Patterns

- With Nifty 50 reaching the significant big round number 22000, traders should anticipate trading range price action in the coming weeks.

- The formation of a micro double top pattern suggests a subsequent measured move up/down

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.