Market Overview: Nifty 50 Futures

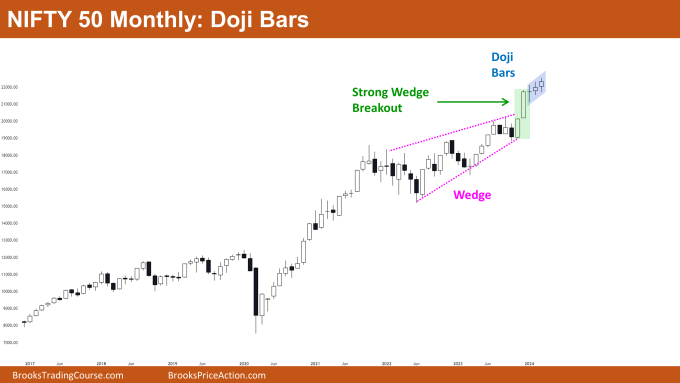

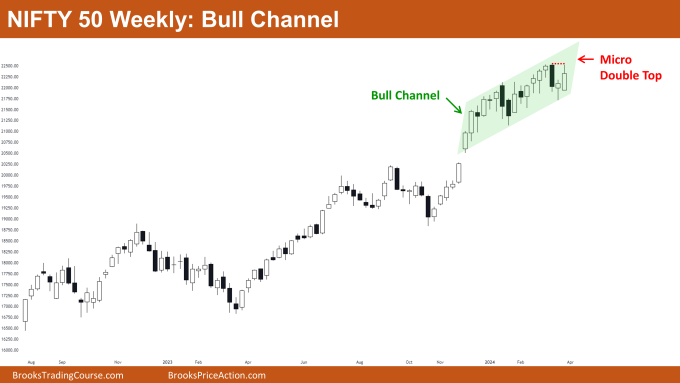

Nifty 50 Doji Bars on the monthly chart. The market has formed the third consecutive small doji bar this month. Despite the bull breakout of the wedge top, bulls are struggling to maintain strong follow-through upward momentum. This could potentially signal weakness to bears, prompting them to initiate short positions. On the daily chart, Nifty 50 is currently trading within a bull channel and has recently formed a micro double top. Additionally, the weekly chart indicates the market beginning to exhibit trading range price action. If bulls fail to generate a robust bull bar in the upcoming week, Nifty 50 may transition into a trading range or experience a minor reversal.

Nifty 50 futures

The Monthly Nifty 50 chart

- General Discussion

- Nifty 50 on the monthly chart indicates a robust bull trend, minimizing the likelihood of a significant trend reversal.

- With such a strong trend, it’s advisable for bears to refrain from selling for a swing position. At best, they may encounter a trading range but not a major trend reversal.

- Despite a potential pullback due to decreasing upside momentum, bulls can still make strategic entries by placing limit orders at the low of bars.

- In cases where a bull bar is notably strong and closing near its high, bulls can also consider entering at the high of the bar using stop orders.

- Deeper into Price Action

- The forceful bull breakout of the wedge top presents a low probability event, akin to a surprise occurrence.

- In instances like these, where the market experiences such events, the likelihood of a second leg up before a major trend reversal is significant.

- This suggests that even with an entry point at the peak of the trend, bulls can manage to exit the trade at breakeven if they handle their trades prudently.

- Patterns

- Should bears manage to form robust bear bars with a close near the low in the upcoming month, the probability of a small trading range will rise.

- The bull breakout of the wedge top is regarded as a surprise event due to the rarity of bull breakouts from such formations, with only a 25% chance of occurrence.

The Weekly Nifty 50 chart

- General Discussion

- Nifty 50 is trading within a bull channel. The tightness of this channel makes it difficult for bears to profit.

- Bears are cautioned against taking short positions unless there’s a clear and strong bear breakout from the bull channel.

- The market is exhibiting an expanding trading range in its price action on the weekly chart. This suggests that bulls should also refrain from entering long positions until strong bull bars reappear, closing near their highs.

- Deeper into Price Action

- It’s notable that within the bull channel, more than 80% of bars have long tails, indicating an impending trading range.

- With the market trading close to the significant round number of 22000, traders should anticipate trading range price action on the weekly chart in the coming weeks.

- Patterns

- Nifty 50 is showing signs of forming a micro double top pattern. Given the strength of the bull trend, this micro double top isn’t likely to trigger a major trend reversal.

- The most bears can expect from this micro double top is a small trading range.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.