Market Overview: Nifty 50 Futures

Nifty 50 Bull Micro Channel on the weekly chart. After an extended period of bull bars, the Nifty 50 has formed a bear. This week, the market formed a weak bear bar that has no chance of leading to a reversal. Second leg up is likely ahead of any significant weekly reversal attempt, as the measured move target resulting from the breakout gap pattern acts as a magnet for the price. Bears made a strong attempt at reversing on the daily chart, but they were unable to produce strong follow-through bars. Additionally, the market has reached the tight bull channel bull breakout’s measured move target, which has also prompted some selling close to the measured move level.

Nifty 50 futures

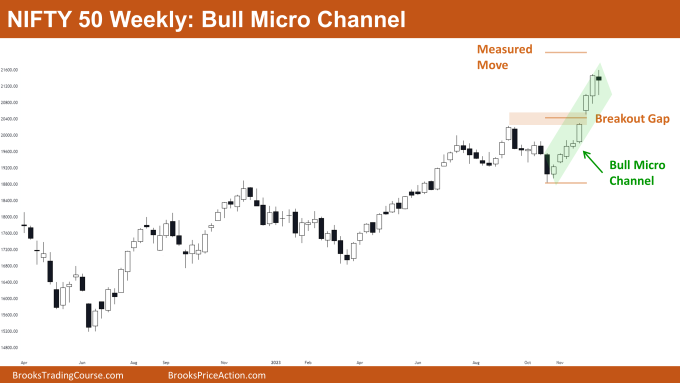

The Weekly Nifty 50 chart

- General Discussion

- The market is currently trading within a strong bull micro channel, so short sellers should refrain from entering the market.

- The market is getting closer to the breakout gap pattern’s measured move target, allowing bulls to take a long position.

- Bulls with long positions should hold onto them until there is a significant attempt by the market to reverse course.

- Deeper into the price action

- The market has created a bull breakout gap, which is indicative of strong bulls and typically results in a measured move target that is calculated using the height of the breakout leg (as seen in the above image).

- The market is currently in a strong bull leg, which suggests that there is a good chance that the second leg will rise. Traders can enter this trade at the next open or at the bear bar’s low by placing a limit order.

- Patterns

- A bull micro channel is a kind of bull channel where bars’ lows never fall below the lows of the bars before them.

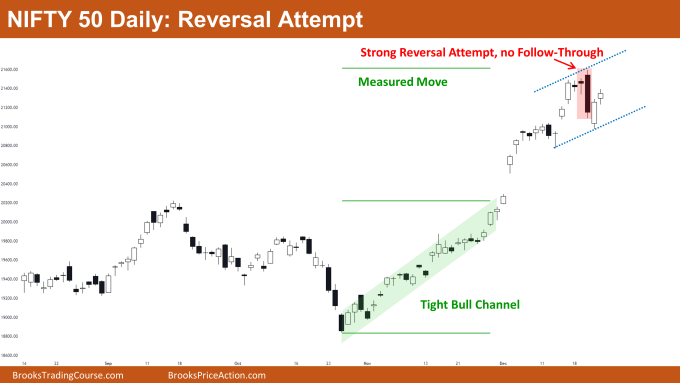

The Daily Nifty 50 chart

- General Discussion

- The market is in a strong bull trend, and despite their best efforts, the bears were unable to turn the market around. Since there aren’t many bears in the market right now, traders should hold off on selling.

- Bulls ought to keep holding long positions until. Bulls can enter gain on high-2 or enter on the next open trade if they have sold their long positions as the market has reached the tight bull channel’s measured move target.

- Deeper into price action

- Following the aggressive bear reversal attempt, the market is still forming a higher low, which raises the possibility of a bull channel rather than a trading range.

- There is a greater likelihood of a narrow trading range if bears are able to form a strong bear bar once more.

- Patterns

- A bull channel, also referred to as the spike & channel up pattern, is likely to form in the market as a result of a bull spike, as indicated by the blue dotted line.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.