Market Overview: NASDAQ 100 Emini Futures

This week’s candlestick is a Nasdaq strong weekly bull bar closing on its high above last week’s high. This is the first bull bar after seven bear bars.

As mentioned in last week’s report, the month is trying to create a bull body. Minimally bulls want to close the month above the midpoint. Most likely, the month will be a doji bar, which will lead to sideways to down in the next few months.

NASDAQ 100 Emini futures

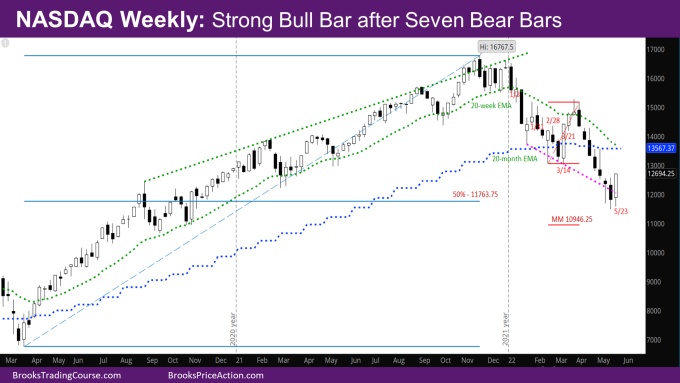

The Weekly NASDAQ chart

- This week’s candlestick is a Nasdaq strong weekly bull bar closing on its high above last week’s high.

- While a big bull bar is a show of strength, it will also attract sellers. The bulls also do not have a good signal bar. Most likely this will be a minor reversal.

- Bull upside targets that are interesting for the last day of the month/next few weeks –

- midpoint of May monthly bar around 12523 – bulls would like the close above the midpoint. Bulls are already above this, and just need to keep it that way on the last day of the month.

- the daily exponential moving average (EMA) at 12433 – bulls already got above the daily EMA. The Friday bull bar also closed far above the EMA which is good.

- the open of the month at 12841 – 60% likely. At this point, the market should at least reach this number, and the close of May will be around the open.

- the monthly EMA at 13567 – this should be reached in the month of June.

- The next target for the bears would be the measured move (MM) down of the double bottom (DB) on monthly chart at 10946.25, or the open of the November 2020 month at 11139.5.

- November 2020 is when the spike on monthly chart started after the sideways months of September and October. At this point, these are still valid targets for the next few months.

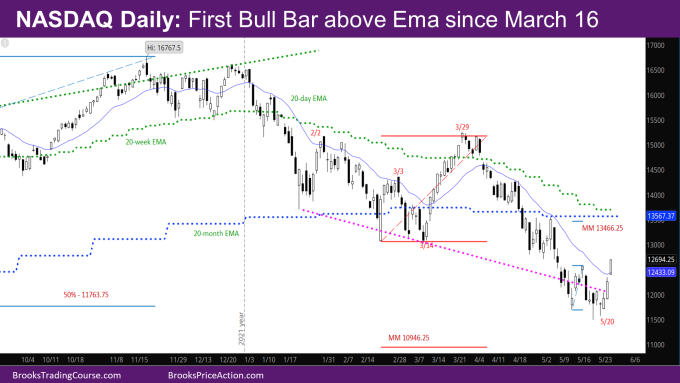

The Daily NASDAQ chart

- Friday’s NASDAQ candlestick is a shaved bull bar, with the low at the daily EMA and the close far above the daily EMA. This is good for the bulls. They will need a follow-through bar on Tuesday to convince the bulls to buy more.

- The week put a low in on Tuesday and then rallied strongly for the last three days of the week.

- One problem for the bulls again is lack of a good signal bar – the signal bar is a bear bar, which supports the theory that this is a minor reversal, and the market will come back and test them.

- As mentioned before, it is still to be seen where the sellers come in above the daily EMA. This Friday was the first close above the daily EMA since March 16th, so this is only a minor reversal.

- If the bulls get follow-through buying, the market may try to make a MM of the DB with a neckline at 5/17, the target of which would be 13466.25.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.