Market Overview: NASDAQ 100 Emini Futures

NASDAQ Emini futures October monthly bull reversal bar from below the June low, with a tail at the top and bottom.

Since this month is a bull bar, it signifies a failed breakout below last month’s low. At the same time, the market went far below last month’s low that there should be sellers above.

NASDAQ 100 Emini futures

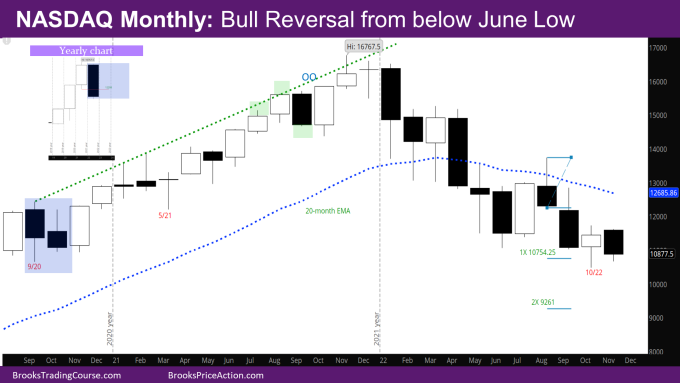

The Monthly NASDAQ chart

- This month’s candlestick is a bull reversal bar with a tail at the top and bottom.

- Even with the tail on top, the October month is the best-looking bull reversal bar this year. The market should go above it to see where the sellers come in – likely near the monthly exponential moving average (EMA)

- The market may have to make a micro double bottom this month before buyers come in.

- Last month’s report had laid out the case for both the sideways vs down move for the next few months. All those points are still valid, although the case for more down would have become stronger if October month had closed as a bear bar far below the September low.

- Possible bear targets –

- The August monthly bar was a credible Low 1 Sell Signal bar. Assuming a 40% chance of success, a 2X target based on size of the August bar would be at 9261. The market has already made the 1X target.

- The August monthly bar as a double top (DT) bear flag with May high, with the neckline around July low, and a measured move (MM) down would be between 9000-9200.

- If October had been a strong bear bar, the likelihood of the above would have been closer to 60%. If November is a bear bar, the probability will go up again.

- Possible bull targets –

- As mentioned in last month’s report, the year is still a big bear bar. The bulls would like to put a big tail at the bottom of the year. Minimally they would like to close above the low of last year at 12208.

- Monthly EMA around 12685.

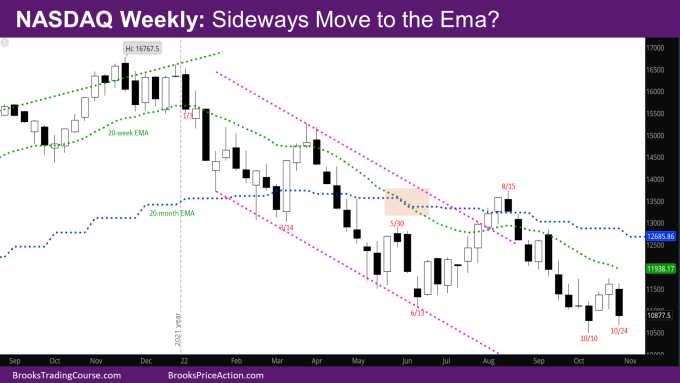

The Weekly NASDAQ chart

- This week’s candlestick is a big bear bar reversing all the bull action of the past two weeks.

- The last couple week reports have made a case for the market going sideways to the weekly EMA – and that the bulls need a good bull reversal bar around the bar from the week of 10/10. This is still valid.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.