Market Overview: NASDAQ 100 Emini Futures

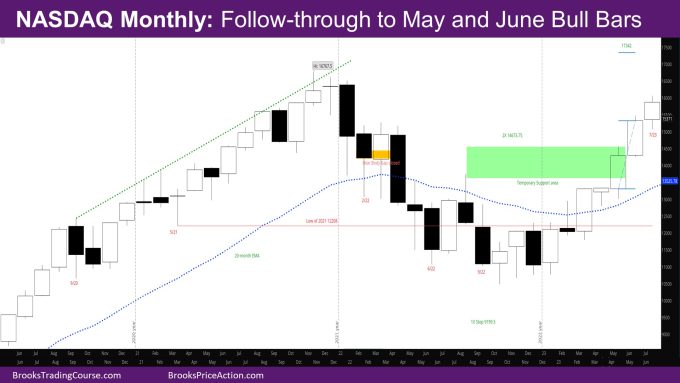

The NASDAQ Emini futures July monthly candlestick is a small bull trend bar with small tails. This month represents follow-through to May and June bull bars.

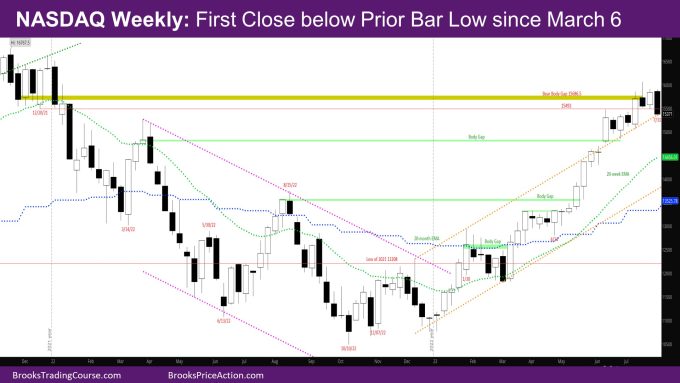

The week closed as an outside down bear bar. This is the first weekly close below the prior bar since early March. Now the question is – will there be a follow-through bear bar next week?

NASDAQ 100 Emini futures

The Monthly NASDAQ chart

- The July month bar is a non-climactic bull bar with small tails.

- It shows more follow-through to the strong bull bars of May and June.

- As mentioned in last month’s report, if the market pulls back, it will likely find buyers between the May close and August 2022 high.

- 2023 so far is an inside bar. The question is – Will there be sellers above the 2022 high?

- The next targets for the bulls are –

- The all-time high close of Dec 2021 – 16338.75

- The all-time high in November 2021 at 16767.5

- The Measured Move (MM) based on high of August 2022 and low of October 2022 – at 16996.75 which would be a new all-time high.

- The MM based on the bodies of May and June 2023 – at 17342

- Bears would like a leg down to the August 2022 high, and the monthly EMA.

The Weekly NASDAQ chart

- This week is an outside-down (OD) bear bar – a bear bar whose low is below last week’s low and high above last week’s high.

- As has been mentioned in recent reports, the first target for the bears was to have a close below the prior bar. This is something they have been unable to do since early March.

- The bears accomplished that this week.

- Now the bears need follow-through next week. If they can get follow-through selling, their next target will be to close the body gap with March 2022.

- The market is testing the breakout point of June. It is also testing the top of the channel again as shown on the chart.

- The next target for the bulls is –

- The high close of 2021 – 16338.75

- The all-time high in November 2021 at 16767.5

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.