Market Overview: NASDAQ 100 Emini Futures

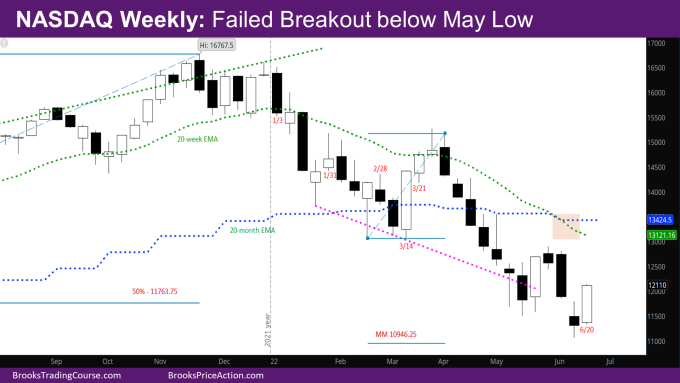

The NASDAQ Emini futures weekly candle is a strong bull bar closing near its high. It’s a Nasdaq 100 failed breakout below the May low.

Every day of the week was a bull bar, although they had tails indicating trading range price action. Friday was a strong bull day.

Next week is the last week of the month, and bulls want to put as big a tail below as possible on the monthly bar. Minimally, bulls want to close above the midpoint of the month around 11984. The open of the month at 12732.75 will be a magnet next week.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- This week’s bar is a strong bull bar. It is a failed breakout below the May low.

- As mentioned in last week’s report, the market had reached the bottom of the bull channel that started in November 2020. This would be a place for the bulls to come in. The bulls came in this week.

- This is still a minor bull reversal since the 2nd bear leg that ended in May is so steep, and the signal bar from last week is a bear bar – which means market will try to test it again. The bulls will need a second entry buy after forming a good bull signal bar in the coming weeks.

- After the open of the month at 12732.75, the next target for bulls is the top of the most recent sell climax – 12899.25.

- The bears would still like to make their target at the measured move (MM) down of the double bottom (DB) on monthly chart at 10946.25. This is right around the low of the November month mentioned above. This is still a viable target.

The Daily NASDAQ chart

- Friday’s NQ candlestick is a strong bull trend bar. The market is back up above the daily EMA – the low of Friday was just below the daily EMA, and the close was far above the EMA (good for the bulls).

- While Friday’s bar is a strong bull bar, it is big compared to bars earlier in the week, which looked more like trading range bars. This can attract profit takers again.

- The market is making a big down/big up in the last few weeks, which will likely lead to more sideways market in the next few weeks.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.