Market Overview: NASDAQ 100 Emini Futures

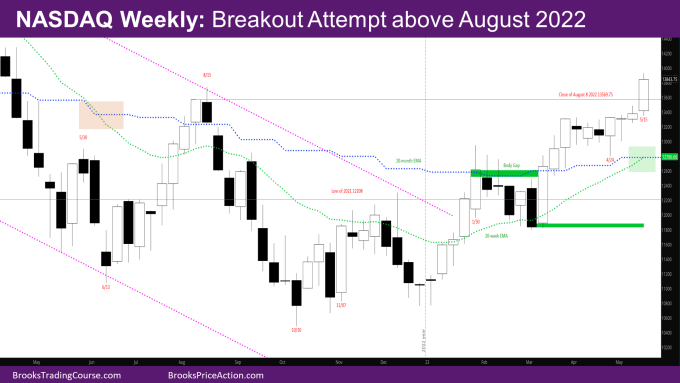

NASDAQ 100 breakout attempt above August 2022 high, and the trading range of past 8 weeks.

The question is: Is this a new breakout or a climax bar? Bulls will need a follow-through bar next week to increase the odds this is a breakout.

So far the monthly bar is a bull trend bar. Bulls need to close the month above the August 2022 month high. Bears want the opposite.

NASDAQ 100 Emini futures

The Weekly NASDAQ chart

- This week is a big bull trend bar closing far above prior week high.

- The market met the bull target of the close of week of 8/8 at 13569.75 – the last bull bar of the micro channel up in August. It closed the week well beyond it.

- The next bull target is the close of 3/28/2022 at 14831.

- Bulls need follow-through bar next week to confirm the new breakout.

- Bears have not done much yet.

- There have been no consecutive bear bars since December of 2022.

- There has not been a close below a prior bar since early March.

- The first bear target is the bottom of week of 4/24 – 12800.

- There is also a body gap created by the week of 1/30 – There has not been a bear close after the market broke above the close of 1/30 that overlaps with the body of 1/30.

- The next target for bears will be to close the body gap by going below close of 1/30 – 12613.25

- The weekly exponential moving average (EMA) is touching the monthly EMA from below for the first time since it crossed below in June 2022 (shown by the green shaded region on the chart)

The Daily NASDAQ chart

- Friday is a small bear bar.

- The market is in a bull micro channel and accelerating up parabolically this week.

- The move up may be a buy vacuum test of the August high, which was the next major swing target.

- Wednesday was a big bull bar and Thursday was an even big bull bar.

- This is not sustainable, and the market should go sideways soon.

- Every day this week except Friday was a bull bar.

- When there is a bigger pullback, some of the possible targets and areas of support are shown in the chart.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.