Trump’s Mideast trip will not prevent 100 point correction

Updated 6:54 a.m.

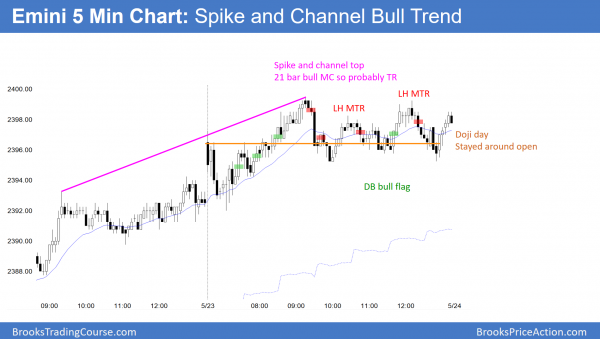

Today opened above yesterday’s high. Furthermore, the week will likely begin to test down today or tomorrow. In addition yesterday had a small range. Finally, the magnet of the 60 minute moving average is around yesterday’s low. These factors increase the chance of an outside down day today.

Because yesterday ended with a 4 hour limit order market, traders are hesitant to enter with stops today. Stop entries lost money for the bulls and bears on today’s open. Yet, the odds are that there will be a swing up or down. However, the Emini might have to go sideways for an hour or two 1st.

When there is a lot of trading range trading and the Emini is high, the odds favor a swing down. But, because of all of the trading range trading, traders will need signs of strength before they will sell low or buy high, betting on a swing.

At the moment, the Emini is Always In Short. The bulls hope for an opening reversal up from the moving average. However, the Emini is near the resistance of last week’s high and the early bars have bear bodies. Therefore, the odds are against a big bull day.

The bears want a strong bear trend day, but the early selling has been weak. Therefore, if there is a bear trend day, it will probably be weak. Hence, the selloff will probably bounce around yesterday’s low.

Pre-Open market analysis

The Emini will probably form an inside bar on the weekly chart this week. It therefore will probably have a lot of trading range trading, and most days will probably be mostly trading range days. Furthermore, since it is now near the top of last week, it will probably begin to trade down for a couple of days starting today or tomorrow.

Yesterday was a breakout mode day and had a bull breakout. Yet, it spent the next 2 hours in a tight range. The bulls want a new all-time. Since this week will probably be an inside week and last week was the all-time high, the odds are against a new all-time high this week.

Furthermore, last week was a big bear doji on the weekly chart. It is therefore a weak buy signal bar. Hence, if this week trades above last week’s high, the breakout will probably be small.

Because this is what is likely, traders always have to be prepared for a Black Swan. That means a low probability event. The most likely Black Swan would be a strong bull trend that breaks far above last week’s high.

Weekly buy climax

Since the Emini has now been above its weekly moving average for 28 weeks, and that has not happened during this 8 year bull trend, this extreme buying will likely end soon. Hence, there is still a 60% chance of a 100 point selloff before a 100 point rally. The odds are that a breakout to a new high will probably not go far unless there is 1st a pullback to the weekly moving average.

Overnight Emini Globex trading

The Emini is up 3 points in the Globex session. Since the odds are that this week will fail in its test of last week’s high, the Emini will probably begin to trade down today or tomorrow. The test will probably not go above last week’s high, but it might go a little above. The odds are against a strong bull breakout above the 3 month trading range. This is especially true since last week was a big bear doji bar, and therefore a weak buy signal bar.

Since this week will probably be an inside week and it is now near last week’s high, it will probably begin to trade down for a couple days. The selloff should begin today or tomorrow. Since it is far above last week’s low, any selloff will probably be minor. For example, it might test last week’s close around 2380.

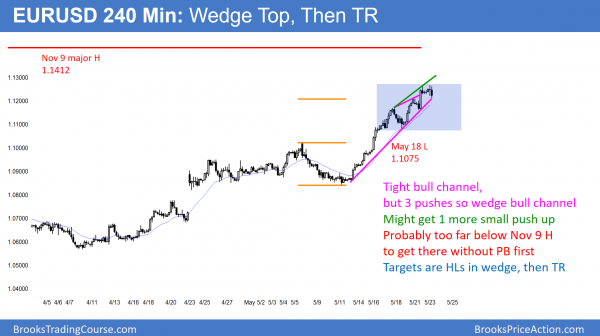

EURUSD Forex market trading strategies

The EURUSD 240 minute chart has rallied strongly for 9 days in a tight bull channel. Since it is now forming a wedge top, it will probably enter pullback and form a trading range.

The 7 week rally has been strong, especially over the past 9 days. Yet, the strong 9 day bull breakout has been getting pullbacks on the 240 minute chart. Since it now has 3 pushes up, the channel is a wedge top. Hence, the odds are that a pullback will soon grow into a trading range. While it might have one more push up 1st, the wedge is probably too far below the November 9 major high to get there before forming a trading range.

When a breakout slows into a channel, and then into a trading range, it has to pullback for enough bars and pips to generate confusion. The bears usually have to create a credible top. This process will probably take at least a couple of weeks on the 240 minute chart. The odds will still favor trend resumption up to the November 9 high. Yet, they be less than now, and closer to 50%.

Targets for the bears when a channel becomes a trading range are the higher lows in the wedge. Therefore, the pullback might be 150 pips deep.

Overnight EURUSD Forex trading

When a market is pulling back into a trading range, the lower time frame charts also become more two-sided. Since the 240 minute chart will likely pull back about 150 pips over the next 2 weeks, day traders will begin to make money selling in addition to buying. Furthermore, day traders will begin to scalp more.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini formed a doji day today, oscillating around the open of the day.

Today was another trading range day. It is testing last week’s high. Since last week was a big doji and this week opened in its middle, the odds are that the 2 day rally is testing last week’s high. Furthermore, the Emini will probably test down for the next couple of days. Less likely, it will break strongly above last week’s high.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.