Stock market 5 percent correction regardless of earnings reports

Updated 6:46 a.m.

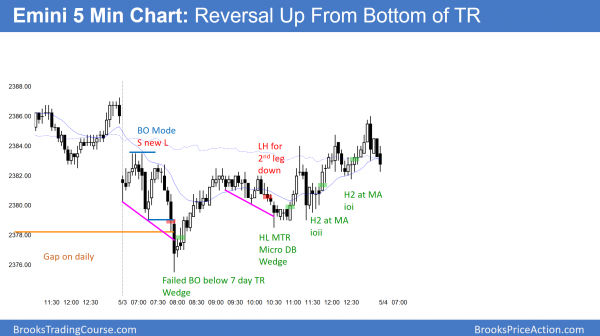

The Emini opened at yesterday’s low and the first 2 bars were small dojis. The bears were unable to create a big gap down, and the bulls were unable to create a strong reversal up. Hence, both feel that the price of the past 6 days is about right.

While a trend day can come at any time, a quiet open in a 7 day trading range reduces the chances. Since the Emini opened around yesterday’s low and near the bottom of the 6 day range, the odds favor a swing up. This is because traders like to buy when the market is low in a range. Bears sell the rallies near the top of the range (buy low, sell high, scalp)

The upside is not great because traders are more inclined to scalp. This therefore tends to prevent trends. Two to 3 hours swings are more likely. The market is deciding on the direction of the initial swing. Because the open is low in the range, the probability slightly favors a swing up. Yet, the Emini could trade below the range for a couple of hours before the bulls begin to buy.

If there is a series of big, strong trend bars up or down, the day could become a trend day. This is unlikely at the moment.

Pre-Open market analysis

The Emini has been sideways for 6 days. Yet, April was a buy signal bar in a strong bull trend on the monthly chart. Furthermore, the resistance of the all-time high is just a little higher. Consequently, the odds are that the Emini will go a little higher within a couple of weeks.

But, since the weekly chart has an unusually extreme buy climax, there is a 70% chance of a pullback to the weekly moving average. In addition, that selloff will probably begin within the next few weeks. Finally, that selloff can begin at any time, even without the Emini 1st testing above the April high.

Overnight Emini Globex trading

The Emini is down 3 points in the Globex session. Whenever a tight trading range lasts 6 bars like this in a bull trend, there is always a micro double top and a micro double bottom bull flag. Consequently, the bears now have the minimum needed to create a credible reversal down. While the odds still favor a little more up before the 5% correction begins, if it begins without one more brief leg up, traders will be more willing to believe that the bears will succeed.

When a market is in a tight trading range, the odds are that it will continue indefinitely. As a result, today is most likely going to be another day within the range. Furthermore, there is a greater chance that today will be another trading range day. Yet, because the weekly chart is so extremely overbought, a strong trend down can begin anytime. In addition, because the chart is in a buy climax, there might be a brief, strong final rally at any time.

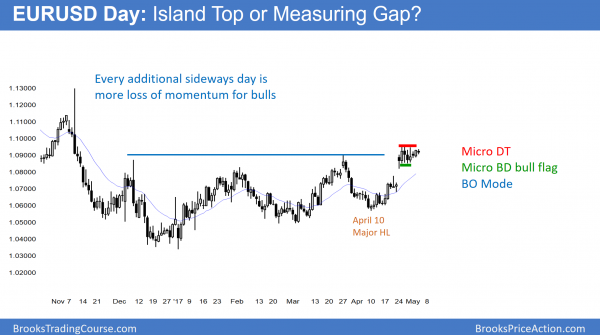

EURUSD Forex market trading strategies

Today is the 8th day in a tight trading range after a weak breakout above a 6 month trading range.

The daily EURUSD Forex chart has been in a tight trading range for 8 days. As a result, the momentum up from 2 weeks ago is getting distant. Consequently, it is losing influence. Therefore, the chart is becoming more neutral. Yet, the most recent clarity is the strong rally that began on April 10. Hence, the odds are that the bulls are still slightly more likely to get another leg up.

However, the daily chart is in a 6 month trading range within a 2 year trading range. Therefore, the odds are that the bulls will soon be disappointed by a reversal and a leg down.

Overnight EURUSD Forex trading

The EURUSD Forex market has been in a 20 pip range for the past 6 hours. This is so small that it is difficult for day traders to make money, even scalping. Until the range expands, there will be very few opportunities for day traders, and those will be for 10 pip scalps. Yet, 8 days is a long time to be in a tight trading range. Consequently, traders should be watching for a breakout up or down,

or a breakout and a reversal.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini was in a trading range day today. Since it closed near its high after reversing up from below the 7 day range,

it was a reversal day.

The daily chart has been in a tight trading range for 7 days. Since it is after a strong bull breakout, the odds are the bulls will get trend resumption. Today formed a weak High 2 bull flag buy signal bar for tomorrow.

Yet, even if the bulls get a strong breakout to a new all-time high, the rally will probably fail within a few weeks. This is because of the extreme weekly buy climax. The odds are that the Emini will trade to below the weekly moving average before going much higher. In addition, the reversal down will probably begin within a few week.s

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.