Probable Fed interest rate hike correction after buy climax

Updated 6:52 a.m.

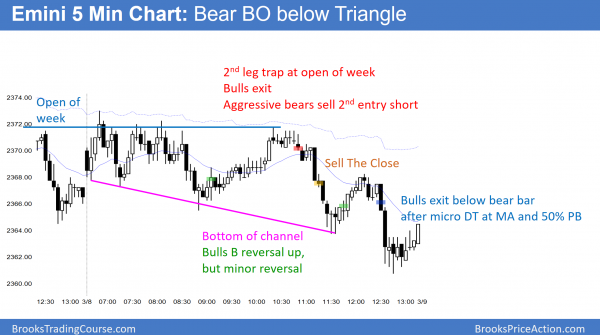

The Emini opened in the middle of yesterday’s range and reversed up from a pullback to the moving average. This Opening Reversal was strong enough to make the low a likely low of the day. Yet, the bulls need a strong breakout above the 60 minute moving average is today will be a strong bull trend day.

At the moment, the Emini is Always In Long. The bears want an Opening Reversal down from the 60 minute moving average. In addition, the week will probably close below the open of the week, which the Emini is currently testing. Yet, after a 5 day selloff, the odds favor a break above yesterday’s high, which is above the 60 minute moving average.

The odds are that the broad bear channel will transition into a trading range today. Hence, the Emini will probably be in a trading range or a weak bull trend. The reason why a strong bull trend is unlikely is that the Emini will probably have a bear bar on the weekly chart. Therefore, the odds are it will not get far above the open of the week.

While the bear channel can continue, that is less likely.

Pre-Open market analysis

The Emini was in a triangle yesterday. Because the weekly chart has had 9 consecutive bull bars, which is rare, this week will probably be a bear bar. Therefore, the open of the week is important. As a result, the Emini turned down from it several times yesterday.

The Emini has pulled back 5 bars on the daily chart. Since it is in a strong bull trend, this is unusual. It has created a Big Up, Big Down pattern over the past 2 weeks. The odds therefore favor a bounce today or tomorrow. Furthermore, with next week’s FOMC meeting and probable Fed interest rate hike, the stock market will probably be mostly sideways into the announcement.

While there is a 60% chance of a test down to last year’s close and Dow 20,000 within the next couple of months, the selloff probably will not begin until after the FOMC meeting. It might start on the announcement, or there might be one more new all-time high 1st.

Overnight Emini Globex trading

The Emini is up 2 points in the Globex market. The bears have created a 5 day pullback from last week’s buy climax on the daily chart. That is a lot of bars, and therefore the odds favor a bounce today or tomorrow. In addition, it is back in the late February tight trading range, which is support.

While the bears want this pullback to grow into an Endless Pullback and then have a bear break below the bull flag, the odds still favor a trading range into next week’s FOMC report and probable Fed interest rate hike. The past 3 days have drifted down, but were mostly trading range days. The Emini will therefore probably continue to have mostly trading range days until Wednesday’s FOMC announcement.

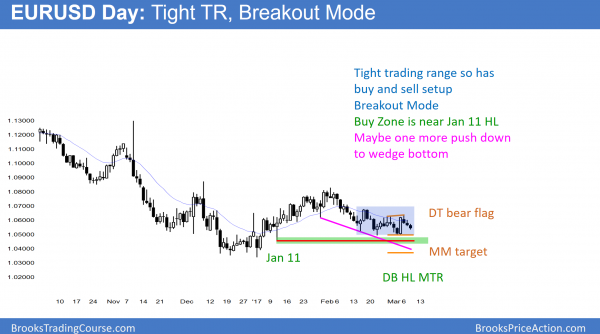

EURUSD Forex market trading strategies

The EURUSD daily Forex chart has been in a tight trading range for 4 weeks. It therefore has both a reasonable buy and sell setup. Hence, it is in Breakout Mode.

The EURUSD Forex market has been in a 150 pip range for 4 weeks. All trading ranges always contain both a reasonable buy and sell setup. The probability is only 50% that the 1st breakout will be successful. Furthermore, once there is a successful breakout, the probability is 50% that it will be up and 50% that it will be down. Once a market gets close to support or resistance in a trading range, it usually cannot escape the magnetic pull until it gets very close.

While the bulls see a higher low major trend reversal, there is no good buy signal bar yet. In addition, many will not buy until they believe that support has been adequately tested. Since the test so far is not convincing, many bulls are waiting for the market to fall a little further. Yet, if it strongly breaks to the upside, traders will buy. This is because the market would be telling them that the test was good enough.

If the EURUSD chart falls for a measured move down from its small double top bear flag, it will fall below the January 11 major higher low. Bulls would see a strong reversal up from there as a reliable bottom. The bears want a strong break below that low and then an eventual test down to par.

Overnight EURUSD Forex trading

The 240 minute EURUSD Forex chart continued its 3 day pullback from last week’s strong rally. While the odds still favor a higher low and a test of the top of the 4 week range, there is no sign of a breakout. The EURUSD Forex market was in a 40 pip range overnight with several reversals. This trading range price action will probably continue until next week’s FOMC meeting and likely Fed interest rate hike.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The 5 day broad bear channel continued today. The bulls failed again to get above the open of the week.

After 9 consecutive bull trend bars on the weekly chart, the odds of a 10th are small. Hence, the open of the week has been resistance for 2 days. Traders are betting that Friday will close below the open of the week. That would therefore end the string.

The 5 day bear channel is an endless pullback. The bears are therefore hoping a bear breakout below the bull flag or a gap down tomorrow. Either would convert the bull flag into a bear trend, and increase the odds that the selloff to the December close has begun.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.