March FOMC Fed rate hike tomorrow is stock market catalyst

Updated 6:58 a.m.

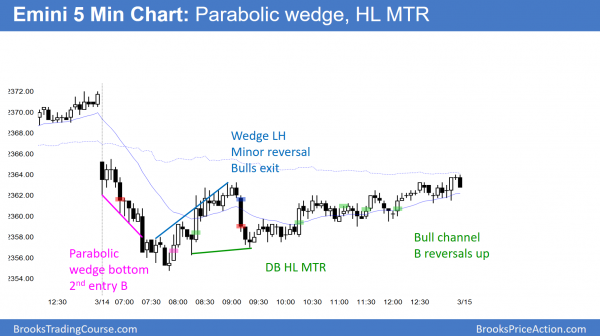

The Emini opened with a small gap down, but reversed up on the 2nd bar. Yet, the reversal did not immediately close the gap. Hence, the bears were disappointed by a small gap down and bad follow-through. In addition, the bulls were disappointed by the weak reversal up. This is a trading range open and it increases the chances of another trading range day.

Friday’s low was a pullback from Thursday’s strong reversal up. The Emini is testing that low today. Yet, the odds are that the trading range price action will continue. Therefore, there will probably be buyers below that low. A reversal up from below that low would create a 3 day lower low double bottom. The bears need a strong breakout below that low if today is going to be a bear trend day.

The bulls are looking for an Opening Reversal up from around Friday’s low. Yet, even if they get it, the quiet open and 7 day trading range make a trading range day more likely than a bull trend day.

At the moment, the Emini is Always In Short. Yet, the bears need stronger bars and a big break below Friday’s low. More likely, this selloff will end within an hour or two and become a bear leg in a trading range day.

Pre-Open market analysis

Yesterday was a tight trading range day. In addition, tomorrow’s March FOMC meeting is a major catalyst. Furthermore, the Emini has been quiet for several days. Hence, it is neutral before the report. Therefore, the odds are that it will continue in a tight range today. Yet, the Fed rate hike tomorrow and the statement will probably result in a big move. Because of the uncertainty, it is equally likely to be up, down, or both.

Any day can become a trend day, and therefore traders should swing trade if today is a strong trend. But, it will more likely be a trading range day.

Island top?

Island tops and bottoms are relatively common. An island can be a single bar or 20 or more bars. The Emini gapped up on March 1, but then reversed down strongly from resistance. If the Emini gaps down today or any day soon, it will create an island top. The gap down is rarely at the same price as the gap up. If this forms an island top, it would therefore be an example of that. Furthermore, if today gaps down, but does not gap below Friday’s low, the gap will look minor. Yet, it would still be a gap and a possible start of a correction.

In addition, the weekly chart is far above its average price and therefore in a buy climax. Furthermore, the stock market has not tested the close of last year or Dow 20,000, which is likely after the January breakout. Hence, the odds favor a pullback to the 2016 close.

March FOMC meeting and Fed interest rate hike

Can a trend begin today and continue after tomorrow’s FOMC meeting? Yes, but most traders will not hold a position at the time of the announcement. This is because they know the size of the move will probably overwhelm any move today. Hence, they do not want the risk of a big, fast loss.

As a result, the odds are against trend traders holding their positions through the announcement. Therefore, whatever trend there is before the announcement will probably lead to profit taking before the announcement. Hence, the small trend would probably reverse before tomorrow’s Fed interest rate hike.

Overnight Emini Globex trading

The Emini is down 7 points in the Globex session. If the day session opens here, there would be a small gap down. Furthermore, there would be an island top with the March 1 gap up.

Yet, tomorrow’s March FOMC meeting is unusually important. This is because it might be the start of a new Fed interest rate policy that could last for years. In addition, it might undo the policy that supported the 8 year rally. Hence, a gap down today is unimportant unless it leads to follow-through selling after tomorrow’s 11 a.m. Fed interest rate hike.

While the Globex market sold off overnight, the odds still favor a trading range day today. This is because the Emini is searching for a neutral price before tomorrow’s FOMC meeting. It is in the middle of the 7 day tight range that began on March 2, and hence it is in breakout mode. Therefore, the odds favor another trading range today.

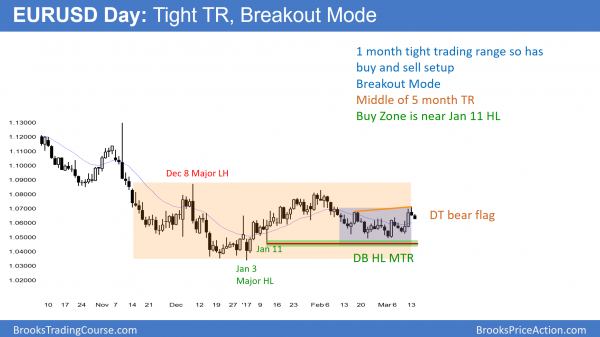

EURUSD Forex market trading strategies

The EURUSD daily Forex chart turned down yesterday from a failed breakout above a month long trading range. But, it has had many 2 – 4 day legs within the range, and this is probably another. Yet, tomorrow’s March FOMC meeting will probably lead to a big trend day up or down.

The EURUSD daily Forex chart is in a month long trading range that is at the bottom of a 1 year trading range. It is therefore in Breakout Mode. Since tomorrow’s March FOMC meeting will probably change Fed interest policy for the next many years, it is a major catalyst. Hence, tomorrow will probably be a trend day. Furthermore, the move could be the start of a trend up or down. In addition, that trend could last for a month or more.

The bears want a break below the 5 month range. Since that would also be a breakout to a new 15 year low, they would then try to reach par over the next several months.

On the other hand, the bulls want a strong reversal up from the bottom of the yearling trading range. In addition, they hope the reversal would be the start of a double bottom that eventually would break above the year long range.

Since tomorrow is an important catalyst, today will probably be mostly sideways. Yet, sometimes a trend from a catalyst begins the day before the catalyst. Hence, there is a small chance of a big trend today.

Overnight EURUSD Forex trading

The EURUSD fell 80 pips since yesterday’s high. Yet, the bulls see the selloff as simply a pullback to the February 27 – March 6 small double top. They want the selloff to reverse up from a breakout test of that support.

The bears see the reversal as a higher high double top with the February 16 high. Because both the bulls and bears have a reasonable pattern, they are balanced. Furthermore, the probability is the same for both. Hence, the daily chart is in breakout mode.

Last week’s rally on the 240 minute chart was strong. In addition the 2 day selloff was strong as well. This is therefore a Big Up, Big Down, Big Confusion pattern on the 240 minute chart. Since a confused market usually goes sideways, today will probably be a trading range day.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini sold off from below yesterday’s low, but reversed up from a parabolic wedge bottom. It then reversed up from a double bottom higher low major trend reversal.

Today gapped down and therefore created an island top with the March 1 gap up. While the Emini touched yesterday’s low, it did not get above. Hence, the gap is still open. Yet, anything that happens before tomorrow’s FOMC meeting is minor. This is because tomorrow could change how traders see the market for the next few years. As a result, there could be a big move up or down. Since the weekly chart is so overbought, the odds are against a sustained rally from here without a pullback first.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.