Posted 7:15 a.m.

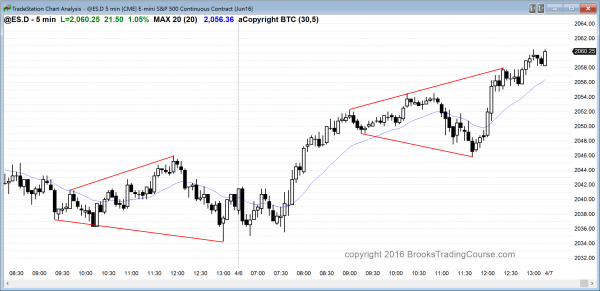

Yesterday ended with an expanding triangle bottom at the bottom of a 4 day trading range. Today had an early higher low major trend reversal, but the 4 bull bars were not big and had tails. This is more trading range price action. Bulls and bears made money with limit order scalps, which is also trading range price action. Traders are waiting for a strong breakout up or down before they will swing trade. This early trading range price action increases the chances a lot of trading range price action for the rest of the day. There is an early double top and double bottom. This is a breakout mode open, and there will probably be a measured move up or down. The breakout has a 50% chance of leading to a swing, and a 50% chance of reversing and then having an opposite swing. Until there is a strong breakout, traders will continue to scalp.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade quiet price action

The Emini triggered a sell signal on the daily chart yesterday by trading below the low of the bear ioi sell signal bar of the day before. The bull channel from the February low was tight so the sell signal is for a minor reversal. This means that a trading range is more likely than a bear trend.

The daily chart is also at the top of a 2 year trading range. This is another reason why at least a minor reversal likely. The Emini will probably be in a trading range for a month or so. The 4 prior trading ranges within the 2 year trading range lasted a month or more and were about 100 points high. That means that this one will probably be similar because the best guide of what is to come is what has already happened.

The Emini is up about 1 point in the Globex session and near the bottom of a 6 day trading range. It is too early to know if the small breakout above the December 29 lower high will be the top of the developing trading range, of if the high will be a little higher. However, bears are beginning to make money by selling above prior highs on the daily chart, and they will sell a breakout above Monday’s high. The bulls see the loss of momentum over the past 3 weeks. Rather than buying a breakout above Monday’s high, they will probably sell to take profits. With both bulls and bears selling new highs, the upside will be limited over the next few weeks.

It is obviously possible for the Emini to break out to a new all-time high without first entering a trading range. However, the behavior over the past 3 weeks is not typical of a strong bull trend that is about to begin a new leg up. When traders begin to sell new highs in an overbought bull trend, a trading range is more likely.

With a trading range beginning to form and the Emini having a small range day yesterday in a 6 day trading range, more trading range price action is likely today. The bulls want a double bottom with Monday’s low. The bears want a breakout and a measured move down. Until there is a strong breakout up or down on the 5 minute chart, traders will assume that yesterday’s trading range price action will continue. They will look for swings lasting 2 – 3 hours, and then reversals.

Forex: Best trading strategies

The EURUSD has a nested wedge top on the daily chart and it has been sideways for 4 days. Because thus trading range is holding above the March 17 strong bull breakout, there is a possibility of a measuring gap and a measured move up.

March 17 was an attempt at a top. Instead, the bulls got a breakout. When the pullback from a breakout above a top stays above that top, there is a 60% chance that there will be at least one more leg up. However, if the bulls get that leg up, then there is a 60% chance that the daily chart will form a Low 4 top pattern. This is a pattern where there are two legs up to a possible top (March 10 and 17), and then a bull breakout that is followed by another 2nd leg top.

The October lower high around 1.1500 is also a magnet, and it is just above this 4 day trading range. Whether or not the EURUSD tests that lower high, the rally from the December low looks more like a leg in a trading range, which it is, than the start of a bull trend. There have been many big bull bars, but the follow-through has been bad. When a rally is made of a series of buy climaxes that all have bad follow-through buying, instead of relentless buying, the odds favor a trading range.

The odds favor one more push up on the daily chart, and then a TBTL Ten Bar Two Leg correction on the daily chart. The EURUSD has been sideways for 4 days. Although it sold off overnight, the selloff was weak and had many reversals, It has rallied over the past 2 hours, but there has been bad follow-through buying after 3 brief big bull bars on the 5 minute chart.

This is trading range price action, and is happening in the middle of a 4 day range. Unless the EURUSD has a strong breakout up or down traders will continue to scalp, as they have been. Day Traders know that one more leg up is likely and they have been buying pullbacks down to around the January 17 high. However, they need a strong breakout on the 5 minute chart before they will be willing to swing trade their longs. The odds are that the breakout will come within the next few days, but it has not begun yet.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini rallied up from yesterday’s expanding triangle bottom and closed the gap on the daily chart. It was in a trading range for the final 4 hours, and ended with an expanding triangle top.

The 60 minute chart reversed up from a breakout below a wedge top. The odds are that it will have a 2nd leg down and that the rally that began today will create a lower high major trend reversal. The reversal up today was strong enough so that there will probably be one more push up tomorrow before the 60 minute chart begins its 2nd leg down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.