Posted 6:56 a.m.

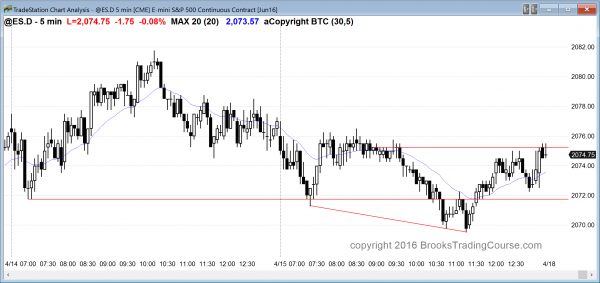

Yesterday is a sell signal bar on the daily chart, but it is a doji after 2 good bull bars. The odds are that there will be buyers below yesterday’s low. The bears want a bear trend, but the bulls scalpers have already made money twice today and the bear bars are not big. This selloff is probably a bear leg in a trading range, which means that there will probably be a bull leg. It might not begin until after a test below yesterday’s low.

The bulls are hoping that the early selloff today will be like those of Wednesday and yesterday. They want an early low of the day. If they get it, the rally will probably stay below yesterday’s high and form a lower high major trend reversal. The wedge channel is likely to have 2 legs down, and the rally would mark the end of the 1st leg down.

This early trading range price action and limit order trading increase the chances of a trading range day. There will probably be both a swing up and down, like yesterday. Without a strong breakout up or down, day traders will mostly scalp and the range will probably be from below yesterday’s high to around yesterday’s low.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade doji candlestick patterns

The Emini has about a 50% chance of breaking out to a new all-time high. It has been hesitating at the top of the October to December trading range. Although it is moving up, it has been mostly sideways for a month. If Wednesday’s breakout fails, then that trading range will be the Final Bull Flag. If there is a reversal down after this weekend’s OPEC meeting, the selloff will probably be a minor reversal and lead to a trading range, which would probably be similar to the other 4 trading ranges that have formed in the big trading range of the past 2 years.

The Emini is testing the all-time high, and it has done so repeatedly over the past year. The rally since February has been strong. When a market repeatedly comes back to resistance, it tends to wear the resistance down. The bears begin to question their premise and become resistant to selling. This increases the chances of a breakout. The weekend OPEC meeting might be the excuse for a breakout or a reversal down. The Emini could have a big gap either way on Monday.

The rally of the past 2 days was weak. Yesterday finally broke below the bull channel. The odds favor a 2nd leg down on the 5 minute chart.

The bull channel on the 60 minute chart is tight, and yesterday had many dojis. This means that a reversal down will probably be minor and result only in a trading range. Yesterday began a tight trading range on the 60 minute chart. Given that more sideways to down trading is likely today because of the 5 minute chart and there is a market moving OPEC meeting this weekend, today will also probably be mostly sideways. Even though most days over the past month have been trading range days, they have had swings up and down. That will therefore probably be true today as well.

Online day traders should always be prepared for surprising big breakouts in either direction, even that is unlikely today. If we get one, it could lead to a big trend day, so traders need to be prepared for a big swing up or down. More likely, there will be a weak rally and a weak selloff, and the Emini will probably go sideways initially before we know if the 1st leg will be up or down.

Forex: Best trading strategies

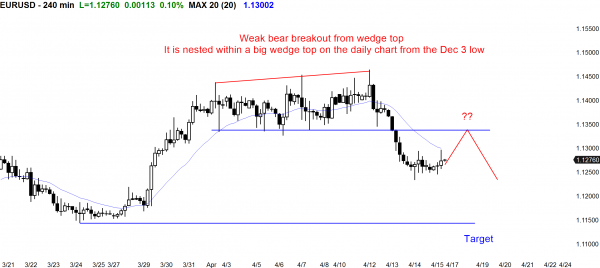

Although the selloff 2 days ago in the EURUSD was not especially strong on the 60 and 240 minute charts, it was strong enough so that at least a small 2nd leg sideways or down is likely. This means that day traders will look to sell the 1st rally. There is a market moving OPEC meeting on Sunday, and yesterday and last night were sideways.

Today will probably be sideways as well. The 60 minute bears see the 2 day trading range as a 2 day double top bear flag. All trading ranges also have bullish patterns. The bulls see the overnight low as a higher low major trend reversal. However, there is no momentum either way and traders are scalping until there is a strong breakout either way. The bulls are hoping for at least a test of the 2 week tight trading range above, around 1.1340, even though the odds are that there would then be a 2nd leg down. The bears want a test of the March 24 higher low, even though there probably would be a bounce.

The rally from the March 10 low had 3 pushes and created a Spike and Channel bull trend. Those are usually followed by trading ranges. The 3 legged bull channel from the March 16 low often gets tested and becomes the low of the trading range. Because the channel up lasted more than a month, the trading range that appears to be unfolding could last a month as well. Wednesday’s bear breakout could be the start of the bear leg.

The bulls are still hoping that Wednesday’s bear breakout will turn out to be bear trap and just a brief test of the daily moving average. They want the bear breakout to fail and reverse up quickly. They want it to be simply another higher low in a bull channel that began on December 3. There is a 40% chance that they will be right. There is a 60% chance that the EURUSD will be mostly sideways for the next month after its wedge top on the 240 minute and daily charts.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini drifted down to the 60 minute moving average, and reversed up from a wedge bottom.

The price action was quiet today. The Emini had a strong rally up to the top of a 2 year trading range, but has been mostly sideways for several weeks. The November and December highs are just above and they probably will be tested next week. There is always the possibility of a big surprise up or down, like from this weekend’s OPEC meeting, but the odds right now favor at least a little more up.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.