Posted 7:04 a.m.

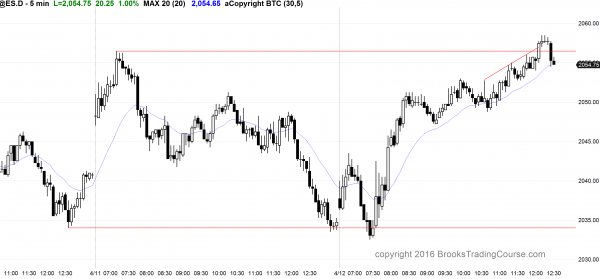

The Emini rallied on the open, but the 1st 3 bull bars had tails, and limit order bear scalpers made money. Also, the Emini stalled at the 60 minute EMA, which was support yesterday and therefore possibly resistance today. This makes the rally more likely a bull leg in a trading range.

Although the Emini is Always In Long, the reversal down can be deep because of a possible trading range. This is not how strong bull trends typically begin. If today is a bull trend, the trend will probably be a weaker trend, like a broad bull channel or a trending trading range day. This is a trading range open and it increases the chances for a lot of trading range price action today.

While a bear trend is possible, it is not likely. Although the bears want an early reversal down, like yesterday, the best the bears probably will get is a trading range. The bulls have not yet done enough to create a bull trend, but the Emini could rally to test yesterday’s lower highs above 2048.

After 3 bear bars on the daily chart, the odds favor a bull bar today. This is especially true since the Emini is in a 3 week trading range. The odds are that today will close above its open, and day traders should remember this late in the day. If the Emini is above the open and sells off, it probably will be bought. If it is below, it will also probably be bought.

Pre-Open Market Analysis

S&P 500 Emini: Learn how to trade a failed Head and Shoulders

Although the Emini had 3 consecutive bear bars on the daily chart, it is holding above the moving average after a 20 Gap Bar buy signal (it was above the moving average for more than 20 days so all of those bulls who were eager to pay more than an average price finally can buy at an average price).

What is more important right now is the 60 minute Head and Shoulders Top (HST). A HST is a trading range in a bull trend. About 40% of the time, it leads to a trend reversal. There was a bear breakout last week, but it was followed by a strong reversal back up. The reversal was big enough to make it likely that the bulls will break above the right shoulder. That is where the bears have their stops. Once the Emini gets above the right shoulder, the topping pattern has ended and the Emini then looks for something else.

The neck line of the HST is also around the December 31 close. As long as the Emini stays above 2026.25, it is up on the year. The Emini has tested this many times over the past 3 weeks. The bulls have been unable to break strongly above it. The bears have been unable to turn down strongly below it. The Emini is trapped between it and the all-time high, and it will break above or below in the next few weeks. The odds slightly favor the bears, especially since the Emini is at the top of a 2 year trading range. Eighty percent of trading range breakout attempts fail.

The Emini is deciding whether the failed top will result in more of a trading range of a breakout above. A trading range in a bull trend is a bull flag. The bulls want a bull breakout and a test of the other two lower highs in the October – December trading range. If it gets above them, the all-time high is only about 6 points higher, and the bulls will probably break above that as well.

The odds for the bulls are still less than 50-50 because the Emini had been forming lower highs for 200 bars and the monthly chart had an extreme buy climax. The odds of a double top with one of the 3 highs in that 3 month trading range are greater than those of a bull breakout.

The Emini is up 6 points in the Globex session. It has been sideways for 3 weeks. Every strong move up and down has reversed. Yesterday ended with a sell climax. There is a 50% chance of follow-through selling in the 1st hour or two today. There is only a 25% chance of a relentless bear trend, which would result in a breakout below the trading range. There is a 75% chance of at least 2 hours of sideways to up trading, which will start by the end of the 2nd hour. If there is no follow-through selling on the open, it will start on the open.

I always pay attention to the 1st 5 – 10 bars. I want to know if both bull and bear scalpers can make money. If they can, it increases the chances of a trading range day, which means that whatever the initial swing is, up or down, it will be followed by an opposite swing within 2 – 3 hours.

Again, because the 60 minute HST breakout reversed back up strongly, the odds favor a move above the April 6 lower high of 2060.50 at some point in the next couple of weeks. However, whether or not that happens, the odds also favor a 100 point tall trading range over the next month or two, and the Emini is probably close to the top. The upside is probably limited. If there is a strong breakout to a new all-time high, then the bulls could get a sustained rally, but that is about a 40% bet at the moment.

Forex: Best trading strategies

The daily chart of the EURUSD has had 8 consecutive doji bars in a tight trading range. However, last night reversed down from a 3rd push up in that range, and therefore triggered a wedge top reversal. There was a bear breakout over the last hour, but the EURUSD 60 minute chart is still in a bull channel. The bears need a breakout below the April 6 low. That was the most recent strong bull reversal, and many traders will change their minds below that major higher low. If the EURUSD 60 minute chart is no longer making higher lows, it is no longer in a bull trend. It is then either in a trading range or a bear trend. A strong breakout below would increase the chances of a swing down on the daily chart. The targets for the bears are the higher lows in the bull trend. The 1st one is the March 24 higher low around 1.1140.

The bulls need a strong breakout above this 8 day trading range. However, the EURUSD had tried any times on the 60 minute chart and it keeps finding sellers above the prior high. Usually when a market repeatedly tries to do something and fails, it then tries the opposite. Three strong bull breakout attempts that fail is usually enough, and that is why I am calling the pattern a wedge top, even though it does not have a wedge shape. Most wedges do not look like wedges, but computers trade them like wedges. They are all variations of the same process.

I said that the 60 minute chart had a bear breakout over the last hour. This will be just another probe down in the bull channel unless there is strong follow-through. Markets have inertia. They tend to continue to do what they have been doing. Until there is a bear breakout below the April 6 higher low, there is no breakout and the odds favor more sideways trading. However, because there was a wedge top reversal in Europe, day traders are prepared to change their style of trading from scalping to swing trading.

The selloff is simply not quite good enough for the bears to swing trade yet. The bulls will continue to look to buy selloffs until there is a much stronger bear breakout. The bears will continue to take quick profits. Day traders will continue to mostly scalp for 10 – 20 pips.

The context is good for the bears, but they need a strong, relentless breakout to make traders believe that the EURUSD will begin a 200+ pip move down to the April 6 low.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini formed a spike and channel bull trend day that was also an outside up day.

I had to leave 45 minutes early today. Today was an outside up day. I have been saying that the 60 minute Head and Shoulders top would probably fail. The bulls showed strength today by reversing up strongly from below yesterday’s low and then rallying to above its high, creating an outside up day. At the time I am writing, the Emini has not yet gone above the right shoulder of the Head and Shoulders top, but it probably will today or tomorrow. The odds also are that it will go above last week’s high and test at least one of the other 2 highs in the October – December trading range.

It does not have to go higher and the top of the developing 3 week trading range might remain intact (last week’s high). However, the Emini is in a 2 year trading range and there are several lower highs above. In a trading range, a reversal down usually does not come after only going above one of the resistance levels. The odds are that the Emini will go above at least one more.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.