Emini sell climax and failed bear breakout

Updated 6:44 a.m.

The Emini opened with a big gap down in the middle of yesterday’s range. Because of the confusion, from yesterday, today will probably be a trading range day. Since yesterday was a big day and the Emini is in its middle, today will probably be an inside day. As a result, the 1st swing up or down will probably be a leg in a trading range. Therefore, traders will look for an opposite swing after the 1st 2 – 4 hours.

Most of the days of the past 3 weeks have had prominent tails and small bodies. Today will probably be the same. This means that the day will probably close near the open.

While it is possible that today could be a strong trend day, it will more likely be a trading range day.

Pre-Open Market Analysis

While I have been saying that the bears would get a bear breakout below the 2 month trading range and that bulls would buy the selloff, the strength of yesterday’s big bull reversal was a low probability event. Friday’s selloff was strong enough to make a 2nd leg sideways to down likely. Yet, yesterday reversed most of the bearishness of Friday. A Big Down, Big Up pattern creates Big Confusion. Hence, it usually leads to a trading range.

The bulls are hoping to close the gap above Friday’s high. As a result of that bull strength, they then would want a breakout to a new all-time high. Yet, the odds still slightly favor a 2nd leg sideways to down. The bears were disappointed by yesterday’s lack of follow-through selling. The bulls will probably be disappointed by a lack of follow-through buying this week. The Emini is probably trying to get neutral before next week’s FOMC report.

Buy climax so trading range likely

Because yesterday was a buy climax, there is only a 50% chance of follow-through buying in the 1st 2 hours today. There is also only a 25% chance of a strong bull trend day. Furthermore, there is a 75% chance of at least a couple hours of sideways to down trading, beginning by the end of the 2nd hour.

Emini Globex session

I said in the chat room at the end of yesterday and I wrote in last night’s blog that the bulls would probably be disappointed by bad follow-through buying this week. The Emini is down 17 points in the Globex session. While the reversal up has about a 30% chance of continuing up strongly this week, it has about about a 50% chance of staying mostly sideways going into next week’s FOMC meeting.

Because the daily range was big over the past 2 days, a trading range day today might also have a big range. As a result, day traders probably will be able to swing trade up and down today. This is in addition to their scalp trading.

Forex: Best trading strategies

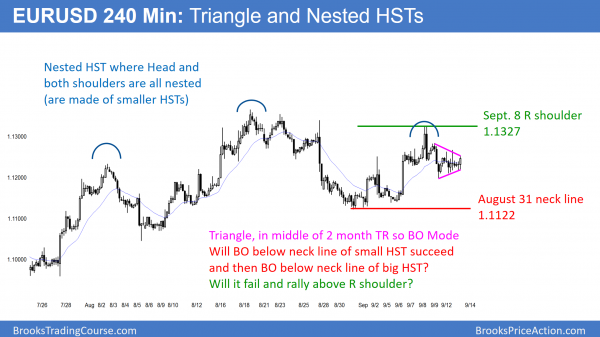

The 240 minute EURUSD chart has a big Head and Shoulders Top. Furthermore, the head and both shoulders are made of smaller Head and Shoulders Tops. While the bears got their breakout below the neck line of the small Head and Shoulders top, the EURUSD Forex market has been sideways for 3 days. Hence, traders are deciding if the breakout will succeed and then fall below the neck line of the bigger Head and Shoulders top. If they instead decide that it will fail, the EURUSD Forex market will rally above the right shoulder. In either case, traders expect a Measured Move after the breakout up or down.

Because the daily EURUSD Forex chart is at the apex of a yearlong triangle, it is in breakout mode. Furthermore, the 240 minute chart is in a smaller triangle. The probability of a bull breakout is the same as for a bear breakout. There are nested Head and Shoulder tops and bottoms on the daily and 240 minute charts. Because the range is getting very tight, the odds are that it will probably soon breakout of its yearlong range. It might be waiting for the Fed to raise interest rates either next week or in December.

The 5 minute chart is reversing every few hours. Hence, day traders are mostly scalping as they wait for the next breakout.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

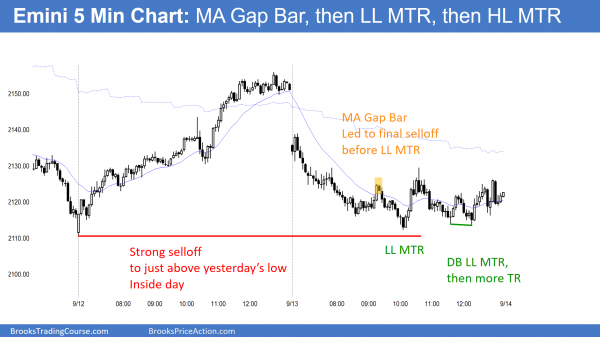

The Emini opened in the middle of yesterday’s range, and then sold off to test yesterday’s low. It reversed up from a lower low major trend reversal just above yesterday’s low, and then from a double bottom higher low major trend reversal. It then went sideways and was an inside day.

As I said on the open, today would probably be disappointing for the bulls, and today would probably be an inside day. The Emini will probably remain confused and therefore sideways going into next week’s FOMC announcement.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.