Posted 7:13 a.m.

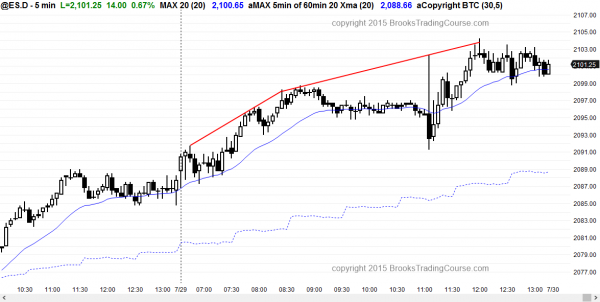

Yesterday ended with a tight trading range, and today opened with sideways bars, prominent tails, and reversals. This increases the chances of trading range price action today before the 11 a.m. report. It is still Always In Long, but in breakout mode.

The Emini reversed down from a 50% pullback of the selloff from the all-time high, but the reversal was weak. It entered a tight trading range and is in breakout mode. Support is at the 60 minute moving average below, and resistance is at the measured move up from yesterday’s 9:20 a.m. gap bar, and the target is at the July 15 60 minute low or 2095.

Day traders are either scalping with limit orders or waiting for a strong breakout with follow-through in either direction. They are willing to take a swing trade with a stop entry if they get to buy above a strong bull bar near the bottom or sell below a strong bear bar near the top. Otherwise, they will wait for the breakout in either direction.

If there is a swing trade, it will probably be limited by the magnetic pull of the tight trading range that began yesterday and by the closeness of the support below and resistance above.

My thoughts before the open: Price action patterns after a report

The Emini has had exceptional moves in July. It traded below the June low, above the June high, back below the June low, and it is now in the middle of the 7 month tight trading range.

There are 2 big events left in July. The FOMC report comes out at 11 a.m. today, and Friday is the final day of the month. Both are important because they determine the appearance of the monthly candlestick pattern. A close in the middle of the month is neutral and would represent no change to the 7 month tight trading range. A close near the high of the month would create a strong bull candlestick pattern at the top of the range in a strong bull market. It would increase the chances of another bull breakout and all-time high. A close at the bottom of the month would create a sell signal bar in a very overbought market that has an 80% chance of at least a 10% correction within the remaining 5 months of the year.

Yesterday was a strong bull trend day. That means that two things are likely today. There is an increased chance of a rally within the 1st 2 hours, and a 75% chance of at least a 2 hours sideways to down move. FOMC days often go quiet so there that further increases the odds of a trading range before the report.

Online day traders will trade the first few hours like any other day, with the exception that they might be some early follow-through buying and a 2 hours pullback. Once the report comes out, day traders should not enter on the 1st 2 bars since there is a 50% chance that the initial move, no matter how strong it is, will reverse.

If there is a strong breakout with follow-through on the 2nd or 3rd bar after the report, the day trading tip is to look for a swing trade in the direction of the breakout. If the 2nd or 3rd bar has a reasonable reversal, day traders will look for a reversal swing trade.

About half of the moves after reports over the past several months have had a lot of trading range trading, and only half have resulted in strong trends for the rest of the day.

Day traders need to be very careful. Because the bars are usually big, the stops are far and there is less time to make decisions. Traders need to trade small. If a trader cannot trade small enough to be able to use an appropriate stop, he should not trade. However, he can still paper trade and get some experience.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini rallied after a small trading range above the moving average. The price action was erratic after the FOMC report, but the day closed near its high.

I said that there were 2 important events this week. Today’s FOMC report was the first, and the reaction was mostly confused. The next important event is Friday’s close. This month’s candlestick pattern can end up as bullish, bearish, or neutral, and Friday’s close will determine the result.

The rally of the past 2 days was back to the midpoint of last week’s selloff. The bears see this as a lower high major trend reversal on the 60 minute chart. The bulls see this as a strong reversal up. Since there have been multiple big reversals up and down and the Emini is now in the middle, there is no advantage for the bulls or bears. Both have reward equal to the risk (the top and bottom of the trading range), and a 50% chance of success.

Traders need more information and Friday’s close might help. Is it likely to help much? No, because the monthly chart is still in a tight trading range, and probabilities only go up after a strong breakout, which has not yet happened. Until then, bulls will continue to buy low and take profits in the middle, and bears will sell high and also take profits in the middle.

Best Forex trading strategies

Those trading Forex markets for a living will probably be scalping Forex crosses today, expecting limited moves going into the 11 a.m. FOMC announcement. Overnight trading was mostly sideways, but there was some weakness in the British Pound. However, the EURGBP had 2 legs down on the 60 minute chart after its wedge top and is now at support, and the GBPUSD is in a 3rd push up and forming a wedge top at the top of the July trading range. Both will probably be mostly sideways today.

This means that there probably will not be good Forex trading for beginners until after the report. Until then, most traders will be Forex scalping for 10 – 20 pips in any Forex cross.

Once the report comes up, there will probably be big moves in every market. Since the first move has a 50% chance of reversing, the best Forex trading strategy is to wait for the 2nd or 3rd 5 minute bar after the report before taking a trade.

If there is a strong breakout with good follow-through, there is often a good swing trade. If instead there is a strong reversal, day traders will look to swing trade in the opposite direction.

Since the bars will probably be big, the stops will be far. Also, big bars mean a fast moving market, which means there is less time to make decisions. For both of these reasons, traders need to trade very small positions.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room, and a 2 day free trial is available.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.