Emini all-time high, awaiting FOMC interest rate announcement

Updated 6:55 a.m.

The Emini opened near yesterday’s low, and with consecutive bear bars. This makes a bull trend day unlikely. In addition, after 3 bull days, each getting weaker, today will probably be a trading range day or a small bear day. Another bull day is unlikely after a a 3 day rally that is getting weaker. There is support around the lows of the past 2 days and the gap below Tuesday’s low. This is also around the 60 minute moving average.

The bulls want an opening reversal up from below yesterday’s low and then a rally to above yesterday’s high. Even if they get their outside up day, the odds are against today being a strong bull day. The bears want a strong break below support. Yet, after 3 decent bull days, this is unlikely. The odds favor a trading range day.

Since the Emini is near support, it will probably turn up within an hour or two. However, a 2 – 3 hour rally will probably be a bull leg in a trading range day. If it falls to the 60 minute moving average over the 1st hour, the selloff will probably be a bear leg in a trading range day. As is usually the case, when a trading range day is likely, the Emini often goes sideways for an hour or more as it decides on the direction of the 1st leg in the trading range.

Pre-Open market analysis

The Emini again was in a trading range yesterday, as it was for most of the past 3 days. It might continue sideways into next week’s FOMC announcement. Yet, the bears will scale into shorts at new all-time highs on the daily chart. This is because the 7 month rally has been in a broad channel. In addition, the bulls prefer to buy pullbacks than breakouts.

Overnight Emini Globex trading

The Emini is down 7 points in the Globex market. Three consecutive bull trend days is a lot in a bull channel. Therefore the odds are that today will not be a bull trend day. Furthermore, the rally has been getting weaker over the past 3 days. This makes a bull trend day unlikely today. Consequently, today will probably be either a bear day or a trading range day.

Yesterday’s setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart is turning down from a wedge top. Since it is near a higher low and the moving average, it is at support.

Yet, a wedge reversal typically has 2 legs down and therefore bears will sell the 1st rally.

The EURUSD daily Forex chart is turning down from a wedge top. In addition, it is at the resistance of the 1.2000 Big Round Number, and the bottom of a trading range on the monthly chart. Furthermore, it is at a measured move up on the daily chart. The selloff over the past week is a sign that the wedge top is likely to achieve its minimum goal of 2 legs down. Because the 1st leg down is unfolding, the odds are that traders will sell any 2 – 5 day rally.

This is because they expect the 1st reversal back up to fail and lead to a 2nd leg down. A reasonable target for the bears is the bottom of the wedge, which is the August 17 low. If it gets there, the bulls will try to rally from a double bottom with that low. However, the bears will continue to sell rallies, hoping for a strong break below the wedge bottom. They would then look for a measured move down to the next support. That is at the top of the 2 year trading range. This is around 1.1600. In addition, it is about a 50% pullback from this year’s rally.

Because the bull channel on the daily chart is tight, the odds are that even a 400 pip selloff to 1.1600 will simply be a bear leg in what will probably be a big trading range. However, after several months in a range, the bears will have a chance to create a credible major top. Consequently, the downside risk over the next several months is a big trading range, and not a bear trend.

Overnight EURUSD Forex trading

The EURUSD 5 minute chart sold off over the past 30 minutes, but bounced 30 pips. It is testing the support of the August 31 low, which is the bottom of a 3 week trading range. Furthermore, the 1st leg down has lasted 5 bars on the daily chart. That is enough bars in a wedge this size to be at or near the end of the 1st leg down. Consequently, traders will look for the market to stabilize for a few days, and then rally for a few days. Therefore, the bulls will start to buy selloffs, expecting a 100 – 150 pip rally at some point over the next week.

Traders might wait for next week’s FOMC report to get the rally. In any case, because the bears have a reasonable 1st leg down and the selloff is at support, they will take profits and look to sell a 100 – 150 pip rally. This is because they expect a lower high and then a 2nd leg down.

Since both the bears and the bulls expect the selloff to evolve into a trading range and then a 150 pip rally, both will buy selloffs and sell rallies for a few days. The bears will buy back shorts below lows and the buys will sell out of longs above highs. The result will probably be a trading range for a few days.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

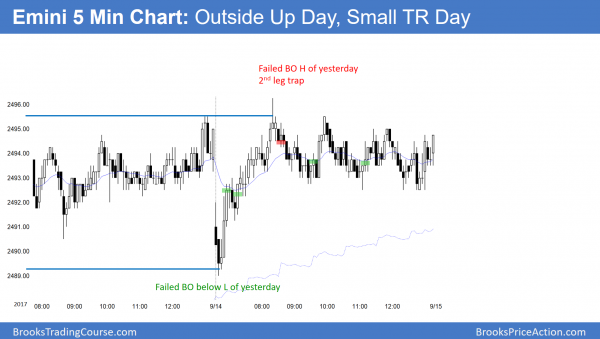

The Emini formed a small outside up day today, but spent most of the time in a tight range.

The Emini formed its 3rd consecutive small tight trading range day. While it made another all-time high, there was no follow-through buying. It is probably waiting for next week’s FOMC interest rate announcement before it breaks out up or down.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.