Christmas week means likely quiet holiday Emini trading

Updated 6:48 a.m.

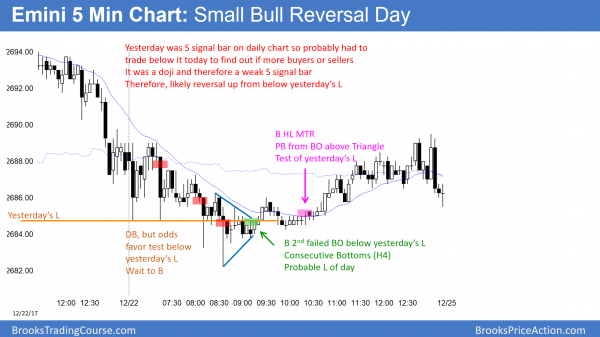

Today opened with a big doji bar in the middle of yesterday’s range. Yesterday was a trading range day. Since a big bar has big risk for stop entry traders and a tight trading range has low probability for stop entry traders, most traders will wait for more information. For example, they will buy after they see a strong bull breakout or sell after a strong bear breakout. In addition, they will take a stop entry sell at the top of the range or a stop entry reversal up from the bottom.

Today opened with several bars with prominent tails, and in the middle of a 6 day tight trading range. This reduces the chances of a trend day today and increases the chances of a trading range day. Furthermore, if there is a trend, this neutral open makes a big trend day less likely.

The Emini is neutral at the moment. Traders want to see strong trend bars up or down before concluding that a swing has begun.

Pre-Open market analysis

The Emini has been in a tight trading range for 5 days. The daily chart is still in a bull trend, despite the 3 week wedge rally. The week between Christmas and New Year’s Day is usually the quietest of the year. Most of the bars will probably be small and most days will spend a lot of time in tight trading ranges. It is an opportunity to work on patience and discipline. Even if a day is small, there will always be some scalps. Traders must be selective and look to buy low and sell high. Unless there is a strong breakout up or down, it is better to scalp.

In general, beginners should not scalp, but they should be able to find at least a couple 1 – 2 point trades every day this week. There might a few swing trades as well. Less likely, there will be a strong trend day up or down.

Overnight Emini Globex trading

The Emini is down 1 point in the Globex session. Today will therefore be the 6th day in a tight trading range on the daily chart. While this is breakout mode, this week is typically the quietest trading week of the year. Volume is less, and the Emini will spend most of the time in tight trading ranges. If a trading range is less than 3 points tall, most day traders will wait for a breakout before trading.

Breakouts can come at any time, and there will be breakouts on the 5 minute chart this week. However, the odds are that they will not be big and not last long. Instead, they probably with quickly evolve into another tight range. Yet, if one has 2 – 3 big bull bars or lasts 5 – 10 bars, traders will swing trade, expecting a 2nd leg in the trend. Moves like this will be much less common this week. Traders will mostly scalp, and most trades will probably have limit order entries.

Friday’s setups

Here are several reasonable stop entry setups from Friday. I sometimes also show limit order entries and entries on the close of bars.

EURUSD Forex market trading strategies

The EURUSD daily Forex chart has been in a weak rally for 3 weeks. It will likely reverse soon and the trading range will continue.

The EURUSD daily Forex chart in is a 5 month trading range that is nested within a 3 year trading range. The 3 week rally has several reversals and bars with prominent tails. It therefore looks like another leg in the 2 month range. It will therefore probably reverse within a week. It would then form either a small double top with either the December 14 or November 27 high. A reversal down from the November 27 high would also be a wedge top.

All trading ranges eventually break out into trends. Yet, my 80% rule says that 80% of breakout attempts, no matter how strong, will fail. Trading ranges have inertia, which means they resist change.

The week between Christmas and New Years is usually the quietest of the year. This means that most days are in tight trading ranges that can last for hours at a time. In addition, breakouts are usually brief. However, Early January always has an increased chance of the start of a swing on the monthly chart. Consequently, traders should watch for a series of strong trend bars up or down beginning in the next few weeks. While this is still unlikely, the odds of it are higher in January.

Overnight EURUSD Forex trading

The 5 minute EURUSD Forex chart has been in a 30 pip range overnight. It is in the middle of a 4 day trading range. Traders are deciding if the 3 rally ended with last week’s high, or if there will be more more leg up to a wedge top. The odds slightly favor one more leg up because of the 3 big bull bodies in last week’s rally.

Day traders expect to scalp all week. Even if there is a 50 pip breakout up or down this week, traders know that it is unlikely to go much beyond that. Therefore, unless there is a very fast 50 pip rally with follow-through, traders will expect reversals instead of a trend.

The week will probably spend most of the time within tight trading ranges. If a range is less than 30 pips tall, most day traders should wait for the range to get taller before trading.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

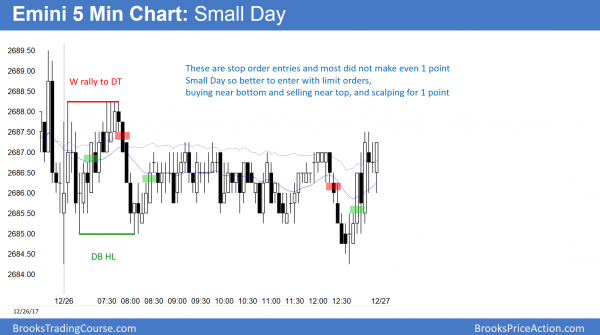

The Emini was a Small Day today. If a day stays small until 10 a.m. or so, it usually remains small. Most traders should not trade. Those who did bought with limit orders near the low, sold near the high, and scalped for 1 point.

The Emini was a small day, and it was the 6th day in a tight trading range. Since the daily chart is in a bull trend, the odds favor slightly higher prices. However, the buy climaxes are historic. Consequently, the Emini ill probably have to pull back about 5% before it will go much higher.

This week usually is the quietest trading week of the year. Yet, there are usually at least a couple breakouts at some point.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.