Attempted big round number Dow 20,000 yearly close

Updated 6:55 a.m.

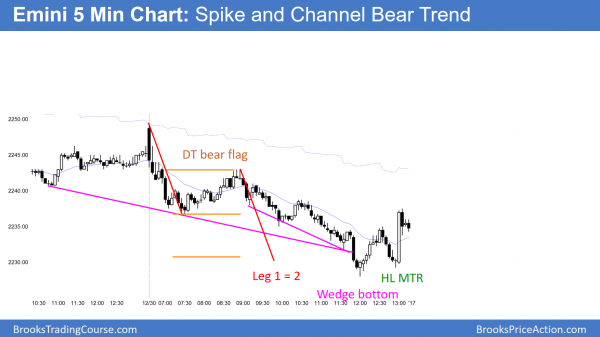

The Emini reversed down strongly from the 60 minute moving average and yesterday’s high on the open. Hence, Dow 20,000 is unlikely today. Yet, the Emini is still above the bottom of the 3 week trading range and above the daily moving average. In addition, today will probably enter a tight trading range buy the end of the 2nd hour. Therefore, despite this strongly bearish open, the odds of a strong bear trend day are lower than they would otherwise be.

Because the selloff was so strong, a bull trend day is unlikely. Yet, the day could rally in a weak bull channel for the rest of the day. Since a strong breakout above the high and the 60 minute moving average is now unlikely, that rally would be a leg within a trading range day.

Limit order bulls made money at the low. Furthermore, the Emini has not yet broken below the 3 week range. Hence, the bears need to do more to convince traders that today will be a strong bear trend day. Yet, if they get a strong breakout below the range, today could be a big bear day. At the moment, the Emini is Always In Short, but at support. Traders are deciding between a bear day and a trading range day. The bears need a strong breakout below the 3 week range.

Pre-Open Market Analysis

The Emini formed a trading range day yesterday. Especially relevant was that it closed above 2244.50. That was the price needed to lift the daily moving average to above the low of the day. As a result, yesterday triggered a 20 gap bar buy setup on the daily chart. Yet, the price never fell to the daily moving average! Remember, the moving average is an average of closes. Hence, it has nothing to do with all of the other trades during the day. Yesterday’s close was high enough to pull the moving average above the low of the day.

Dow 20,000 on the last day of the year?

The Dow 20,000 Big Round Number is a psychological magnet. Yet, it is more symbolic than predictive. Because the bulls have been strong this year, they want other traders to become eager to buy at the high. They therefore want as many signs of strength as possible. A close above 20,000 will create headlines and make traders more confident. It would be a close of the day, week, month, and year above a psychologically important number.

Institutional traders, like everyone else, have egos. Hence, they enjoy overcoming barriers and media attention. Dow 20,000 will make them feel powerful among their friends. In addition, they will enjoy their 15 minutes of media fame.

What happens if they fail to get a yearly close above Dow 20,000? Nothing. Since the bulls are strong, the odds still favor a move above Dow 20,000 soon. Furthermore, yesterday was the 1st pullback to the daily moving average in more than 20 bars. Hence, bulls who have been willing to buy above the average price now can buy at the average price. Many therefore will. As a result, the daily moving average is support.

Overnight Emini Globex trading

The Emini is up 6 points in Globex trading. Because Dow 20,000 is 80 points above yesterday’s close, the bulls will try to get the year to close above that big round number today.

New Year’s Eve Black Swan?

Rare events are more likely during certain times, like the last trading day of the year. In 2009, the Emini was in a 1 point range for 4 hours, and then had a big Sell The Close finish. In addition, the volume was big.

Today is New Year’s Eve for traders. The odds are that today will spend a lot of time in a tight trading range. Yet, the computers do not sleep. Look at the chart above from New Year’s Eve in 2009. Many bars were only 1 tick tall, and the 4 hour tight trading range was barely more than 1 point tall. However, there was a strong Sell The Close trend at the end of the day, and the final sell climax bar had 77,000 contracts. This is a reminder that no matter how quiet the market is, the computers are still looking for opportunities. Because the Dow is so close to such an important number, if it can stay within reach, the bulls might get a strong rally at the end of the day.

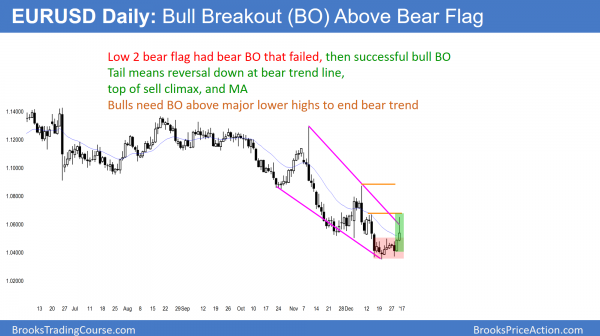

EURUSD Forex Market Trading Strategies

The EURUSD daily Forex chart had a breakout below a Low 2 bear flag (small double top). Yet the breakout failed. Furthermore, the bulls then created a bull breakout above the bear flag. The bar has a big tail on top. Hence, the breakout is stalling at resistance. It is the bear trend line, the moving average, and the top of the most recent sell climax.

Wednesday created a strong bear breakout below a small double top bear flag. Yet, the breakout failed. In addition, the bulls last night got a breakout above the bear flag last night. The rally stalled around a measured move up. In addition, the stall was at other resistance as well. This includes the bear trend line, the moving average, and the top of the most recent sell climax.

The bulls need to get above at least one major lower high in the bear channel. Hence, they need a strong breakout above the December 8 sell climax high. Since a bear trend needs lower highs, if the bulls move above a major lower high, traders will conclude that the bear trend has evolved into a trading range or even a bull trend.

While the wedge bottom has a at least a 50% chance of at least a 2nd leg up, the bulls need consecutive big bull trend bars. That would create a reversal into a bull trend. At the moment, the rally is simply a leg in a trading range in a bear trend.

Most trend reversals begin in trading ranges

All major trend reversal patterns are trading ranges or mostly trading ranges. As a result, most have both reasonable buy and sell candlestick patterns. Hence, the EURUSD is in breakout mode. While there is a 50-50 chance of a successful bull or bear breakout, there is only a 40% chance that the current double top or head and shoulders bottom will lead to a swing trade.

Markets have inertia. Hence, most top and bottom patterns fail to create breakouts, and the trading range continues. As it progresses, it creates new buy and sell setups. Ultimately, one will lead to a successful breakout.

Overnight EURUSD Forex trading

After a 1 hour strong breakout above the 10 day trading range, the EURUSD market entered a trading range for the past 12 hours. Furthermore, the range has been tight for the past 3 hours. In addition, the bond market closes early today and all financial markets will probably be quiet. Hence, the odds are that the tight trading range will continue today.

Because the odds of a currency reversal in January are about 3 times greater than during any other month, traders will be looking for signs of an early bull trend on the daily chart over the next few weeks. Without those signs, the odds are that the bear trend will continue down to par.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

After a Spike and Channel bear trend, the Emini formed a wedge bottom. It reversed up at a Leg 1 = Leg 2 measured move, and at a measured move down from a double top bear flag.

Yesterday’s rally reversed Wednesday’s selloff. Hence, it triggered a higher low major trend reversal on the 240 minute chart. In addition, it was also a head and shoulders bottom. Yet, the EURUSD failed to break strongly above the neck line. The bears therefore see yesterday as a test of the December 22 top of the trading range. Hence, there is a double top sell setup in addition to the head and shoulders bottom buy setup.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.