Amazon and Google testing 1,000, lifting stock market

Updated 6:54 a.m.

The Emini gapped up to a new all-time high and above 2400 and the 2 month trading range. Yet, the 1st bar was a bear bar and the next was a doji. Furthermore, most days for the past week have had lots of reversals. This generates confusion, and increases the chances for trading range price action again today.

At the moment, the Emini has consecutive big bull bars and is Always In Long. This is a buy the close rally. The odds favor higher prices, but strong rallies on the open usually last about an hour. They then typically evolve into trading ranges.

The bears are still hoping for a buy climax, like a parabolic wedge, and an early high of the day. Yet, they will need several consecutive bear bars before traders believe they have taken control.

Pre-Open market analysis

The Emini spent most of yesterday in a tight range. But, it broke to the upside late in the day. The bears want a double top with that high, which is last week’s high. Yet, the momentum up this week has been good. Therefore, it is more likely that the bulls will get a new high. However, because the weekly chart’s buy climax is extreme, the odds still favor a test of 2300 before reaching 2500.

Amazon and Alphabet almost to 1,000 Big Round Number

While 2 stocks alone are not enough to lift the entire market, they both are within 20 points or so of the 1,000 Big Round Number. In addition, their momentum up is strong. Consequently, they are likely to go higher. Are they lifting the market, or riding the market’s momentum up? More likely the latter. Yet, they are giving a sign that the Emini will probably go at least a little higher.

What will happen once they get very close to 1,000 or slightly above? Since their rallies are extreme, they will both probably enter trading ranges. Their pullbacks will probably correspond to a pullback in the overall market.

Watch for a Black Swan

If the Emini breaks above the 2400 major resistance, it could rally for a measured move up based on the 80 point height of the 2 month trading range. That would then be a test of the 2500 Big Round Number.

Since that is a low probability outcome when the weekly chart is so overbought, it is a Black Swan event. Black Swans can be extreme. Therefore traders need to be ready for a relentless and strong rally over the next 2 months.

While unlikely, price is truth. If the market goes up when the odds are that it is more likely to go down, bulls will be trapped out and bears will be trapped in. This can create a strong buy climax that can go far and fast.

Overnight Emini Globex trading

The Emini is up 3 points in the Globex market. Therefore, if it opens here, it will gap up to a new all-time high. Furthermore, it will break above the 2 month trading range and the 2400 Big Round Number. Since most breakouts fail, the odds are that this one will as well. Yet, it could continue for several more days. Less likely, it could reach a measured move up to around 2500.

The 5 consecutive bull trend days is extreme. It therefore is a buy climax within a buy climax on the weekly chart. While the odds favor a test below the weekly moving average, there is no top yet.

While the Emini has rallied for 5 days, the bodies on the daily chart have been shrinking. This so far is a weak rally. Furthermore, all of the days have been mostly sideways on the 5 minute chart. Consequently, today will probably have a lot of trading range trading as well.

Since the Emini is attempting to break above major resistance, there is an increased chance of a strong trend day up or down, but sideways is still more likely.

EURUSD Forex market trading strategies

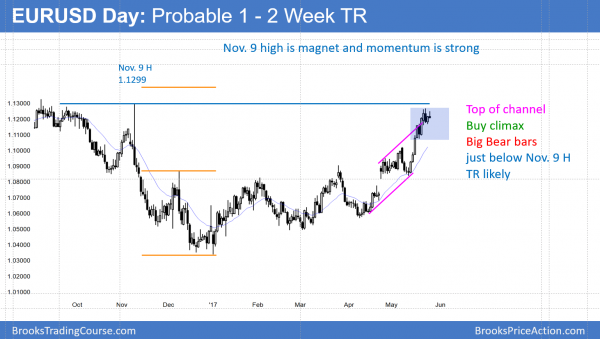

The EURUSD daily Forex chart has 2 big bear bars after a strong breakout. It is therefore likely to form a trading range over the next 2 weeks before breaking above the November 9 major high.

The 7 week rally has been strong. Furthermore, it is now just below the November 9 H, which was the top of a strong selloff. It is therefore a magnet. At the moment, the momentum up is strong enough for the rally to get closer to that resistance. But, the bulls are losing momentum. As a result, it is likely that there will be a trading range before the bulls try again.

The 4 big bull days beginning May 24 were extreme. Hence they formed a buy climax. That rally was strong enough to have at least a small 2nd leg up. The 2 day rally that ended on Tuesday was therefore enough to meet the minimum objective. Consequently, the bulls now have less a sense of urgency. They therefore are now more willing to take profits.

As a result, when last night traded above yesterday’s high, there were more sellers than buyers. This is true even though yesterday was a strong buy signal bar on the daily chart. Therefore this is a sign that the strong trend is transitioning into a trading range. Because the rally was so extreme, the trading range could last a couple of weeks.

The bears know that the trend is extreme and that the bulls will be quicker to take profits. They therefore are beginning to sell rallies for scalps.

Overnight EURUSD Forex trading

The 240 minute EURUSD Forex chart turned down from a lower high last night. Yesterday, I said that this was likely. The chart has been in a trading range for 4 days. While yesterday’s low is the current bottom of the range, the May 18 low is a more likely target. This is because it is the 1st pullback on the daily chart after a strong buy climax. Markets usually test that low and then enter a trading range.

The bulls hope that the current head and shoulders top on the 240 minute chart is a triangle bull flag. They therefore want a bull breakout that goes far above the November 9 1.1299 high. More likely, the pullback will fall to the May 18 1.1075 low first. It is about equidistant from these 2 targets.

The momentum up over the last 2 weeks has been strong. In addition, there is the magnet of the November 9 high just above. Consequently, the odds favor another leg up to that high. But, this trading range on the 240 minute will probably grow into a 2 week trading range on the daily chart first. Hence, day traders have been scalping more for the past 3 days. Furthermore, they will likely continue until the market reverses up from the bottom of the developing range.

Summary of today’s S&P Emini futures price action and what to expect tomorrow

The Emini gapped to a new all-time high. It had brief trend resumption up at the end of the day, but it failed.

GOOGL and AMZN got to within a few dollars of 1000 today. Both with try again tomorrow. That should support the Emini. Yet, the odds favor limited upside in both stock since their rallies are buy vacuums. This will therefore probably limit the upside in the Emini as well. The odds still favor a test of 2300 before 2500.

See the weekly update for a discussion of the price action on the weekly candlestick chart and for what to expect going into next week.

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed S&P Emini futures price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Intraday Market Update page.