Market Overview: FTSE 100 Futures

FTSE 100 futures moved a lot higher last week with a huge bull surprise breakout. We have been in breakout mode for many months, really, but finally, it broke to the upside strongly. It looks like the bull channel will resume here. Bears want this to be a large double top and a longer trading range. Currently, there are no sell signals, so it’s better to be long or flat.

FTSE 100 Futures

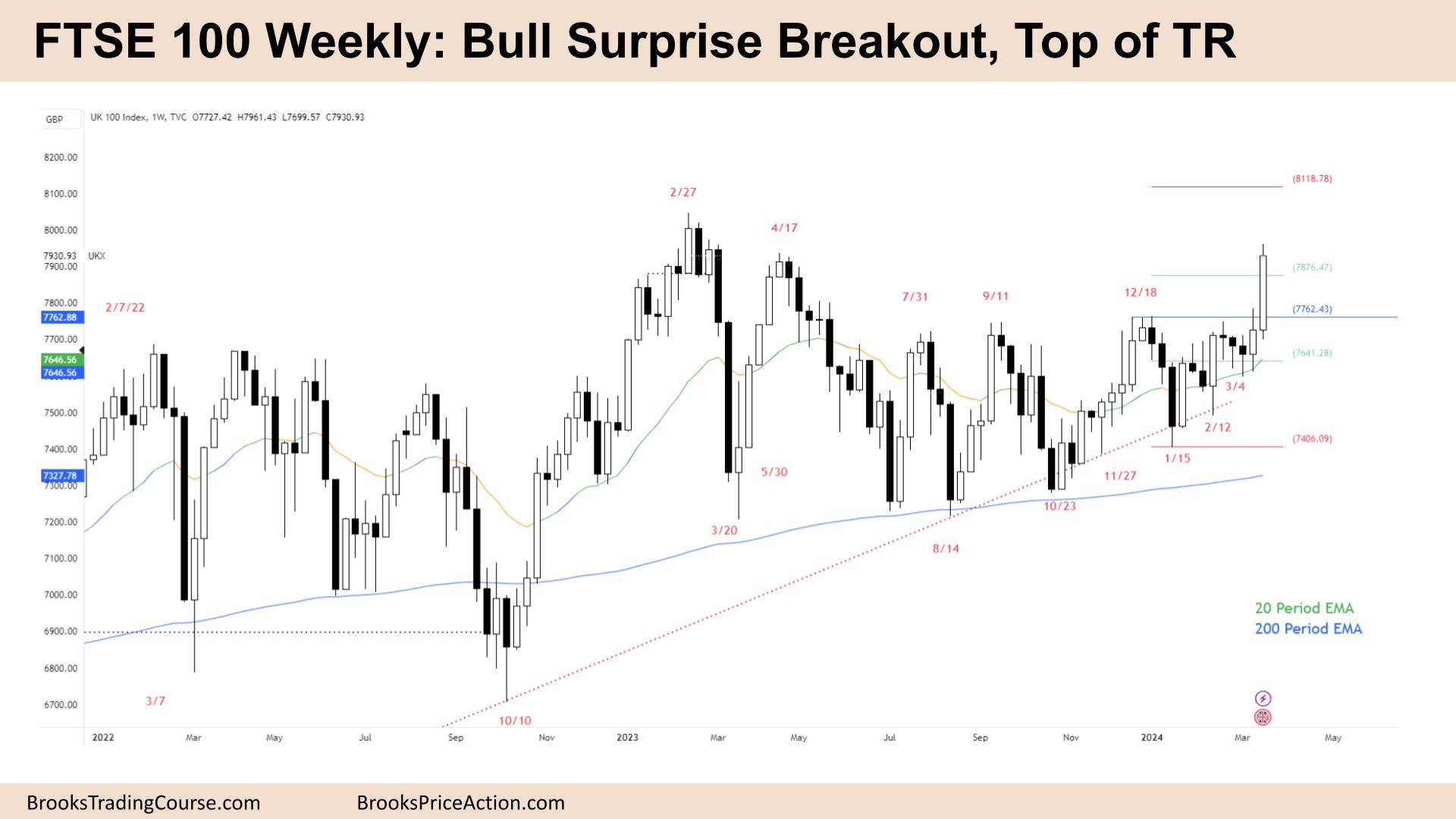

The Weekly FTSE chart

- The FTSE 100 futures moved higher last week, with a bullish surprise breakout that took them to the top of the year-long trading range.

- The bulls see a strong breakout, two consecutive bars above the moving average. So we are always in long and buy the close.

- Bulls who bought last week’s bar made 2:1 in one week – not bad bulls!

- We have been in breakout mode for months and bought the moving average 6 months ago.

- The triangle at the MA broke to the upside. 50% of breakouts from triangles fail, but now, with such a large open breakout gap, it is more likely bulls will be buying the pullback here.

- The risk for the bulls is very large now, so more bulls might wait for a follow-through bar or a pullback to swing more.

- The bears see a buy climax high in a trading range. After 12 months in a trading range, what are the chances a trend will suddenly kick-off? Low.

- Although the bulls broke out of one range the bears see two other breakout point magnets they are near to.

- Nothing for the bears to short here.

- There is a strong buy signal, so buyers are likely at the bar’s midpoint and low.

- The bears could argue that we are testing the last bull close that they could have been trapped in from April 2023.

- February bulls could buy lower and get out in April. But those April bulls got stuck.

- But I think traders should be long or flat. Expect sideways to up while we see what kind of follow-through happens.

The Daily FTSE chart

- The FTSE 100 futures moved much higher with a breakout and follow-through on Thursday and Friday.

- Friday was a big bull bar with a small tail above reaching the measured move target from the trading range.

- It is a breakout and follow-through for the bulls so always in long and buy the close. The issue is the stop is far away now.

- But most bulls would buy and scale in lower betting they will make money on at least their second position.

- Bears knew breakout mode was ending, and they tried 4 or 5 times to stop the bull breakout.

- The bears scaled in two or three times in the wedge bear flag, a wedge top. But the wedge top failed, and they all lost a lot. When they bought back their shorts, we raced higher.

- Most traders should avoid reversals against the trend when the moving averages are lined up like that.

- We broke above a large double top, so there is now a larger trading range target above where we are. I haven’t drawn it in yet. I will at the end of the month.

- Bulls went 2:1 of the trading range they just broke out of, so I expect the price to go sideways here; perhaps bears will start to scale in.

- Not recommending it, however!

- Always in long, so traders should be long or flat.

- Bears will expect a deep pullback as traders take profit. They want a good reversal bar. But most traders will expect one or more legs, a spike, and a wedge bull channel.

- In a trading range, both of these will occur which can be confusing.

- Trading range price action so a deep pullback is possible. Better to buy a pullback or wait for another follow-through bar.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.