Market Overview: European Market Analysis

This week saw a FTSE 100 bull surprise reversal up from 100-week MA not far from the start of the large pullback. Two of the largest bars in the trend have occurred in the past 3 weeks which means there is a reasonable chance we’re in a developing trading range.

The bulls want to get a follow-through bar back up to the tight trading range above, where they have been for the past 3 months, hoping to convince traders the trend is still in effect. The bears see it as the end of the first bear leg in the trading range and the start of a possible bear spike and channel. Look for a pause next week as trapped traders decide whether we get a second leg down or not.

FTSE 100 Futures

The Weekly FTSE chart

- This week’s FTSE candlestick was a large bull surprise bar closing on its high so Monday next week might gap up.

- The bulls see last week as a H1 buy triggered when we traded above last week. A reasonable target for them to exit would be a measured move which interestingly is back at the start of the bear breakout.

- It was weak, follow-through selling by the bears after the first pullback in a 16-month broad, bull channel. But the bears see it as a pause before a second leg down to the February low.

- We said last week we might need to go sideways to up first before it starts.

- The two largest bars in the trend have formed in the past 3 weeks – big up, big down, big confusion. Traders will likely BLSHS (buy low sell high and scalp.)

- Big bars mean big risk. Big bars also often trap traders in and out: Weak bears who shorted too low and weak bulls who bought too high.

- Best case for the bulls is we get a pause bar next week with some prominent tails.

- Short of the Ukraine war ending over the weekend, any news is likely to be negative, and hence scare bulls back to buying lower.

- The bulls want this to be a resumption of the 2-year bull channel from support at the 50-week and 100-week MA. The channel lows formed with the Mar 2020 and Oct 2020 lows.

- The bears see we are at the top of the pre-COVID trading range and a reasonable place to swing short. Even though they have struggled to get follow-through selling, 80% of breakouts fail so the math is good for them to scale back in higher.

- We said last week was also the first moving average gap bar in over 3 months which was a reasonable buy setup in a trend. Once again they bought it suggesting it is not as bearish as it could be.

- If you’re a bull buying the H1 where do you take profits? The measured move would be exactly at the high of the bull surprise bar from 2 weeks ago. The bears know this.

- If you’re a bear, where do you sell? Bears have been selling above bars for many weeks and next week should be no different. Use wide stops and scale in.

- The bears want next week to stall at the top of this trading range and they might get it. Between 7500 and 7700 we have had 10 weeks of tails on top of bars in this area. Bulls will likely take profits into next Friday again.

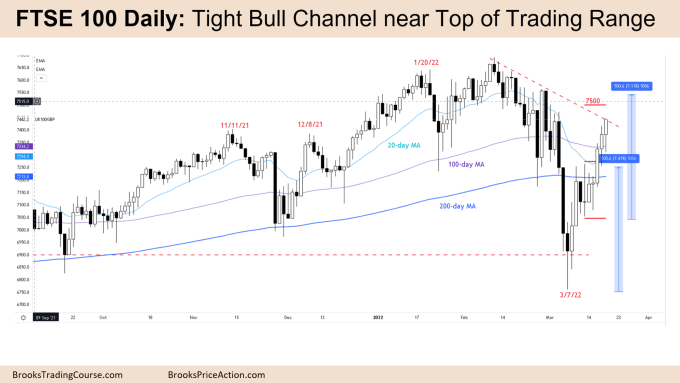

The Daily FTSE chart

- Friday’s candlestick on the daily FTSE chart was a bull bar closing on its high so we might gap up Monday.

- After Monday’s inside bar, Bulls see the 2nd push up in a tight bull channel and know bears might not sell 3 big bull bars. Bears might wait to scale in at the 7500 big figure, measured move target above.

- Bulls see the February low as a sell climax in a broad bull channel, or the bottom of a trading range so are reasonable buys.

- Bulls will expect the first reversal to be minor and we haven’t had a bar go below the low of a prior yet since Tuesday, so we might go up and sideways at the start of the week.

- If instead we do pullback Mon/Tue, the bulls will see the pullback as a MA test and look for a High 1 buy for that 3rd push up.

- Al says that strong reversals have TB2L – 10 bars, 2 legs. The start of the week Monday would be the 10th.

- So the bears might see the pullback as a low 1 sell at the top of a trading range and the end of the 2 legs sideways to up after a bear spike.

- If bears are waiting to sell it could be a vacuum test of the highs where bears believe we are in a trading range and happy to wait to sell higher.

- We are sitting at a previous tight trading range which is a magnet and may also attract profit taking from the bulls.

- Are we in a trend or a trading range? Whenever traders are unsure they will trade it like a trading range and BLSHS (buy low, sell high and scalp.). If it is a trading range, there can be reasonable buys and sells – so we might go sideways first while traders decide.

- Can the bulls convince us we can break out of this range? Most of the largest bars in the past few months have been bear bars. Even if the bulls get a big breakout next week it may be traded as a bull trap / buy climax and likely to reverse. So if we race up Mon / Tue, look for Wednesday to start dipping lower into the weekend.

- Bulls might need to breakout and test the edge of an expanding triangle to convince traders we are going higher.

Weekly Reports Archive

You can access all market reports on the Market Analysis page.