Market Overview: FTSE 100 Futures

FTSE 100 futures went sideways to down last week after a bull BO. The bulls hit their swing target, took their 2:1, and ran! Big breakout gap below, so a better place to get long is down there – if it sets up. Bears who were fading the breakout got a relief bar. Expect a second leg sideways to down and High 2 next week.

FTSE 100 Futures

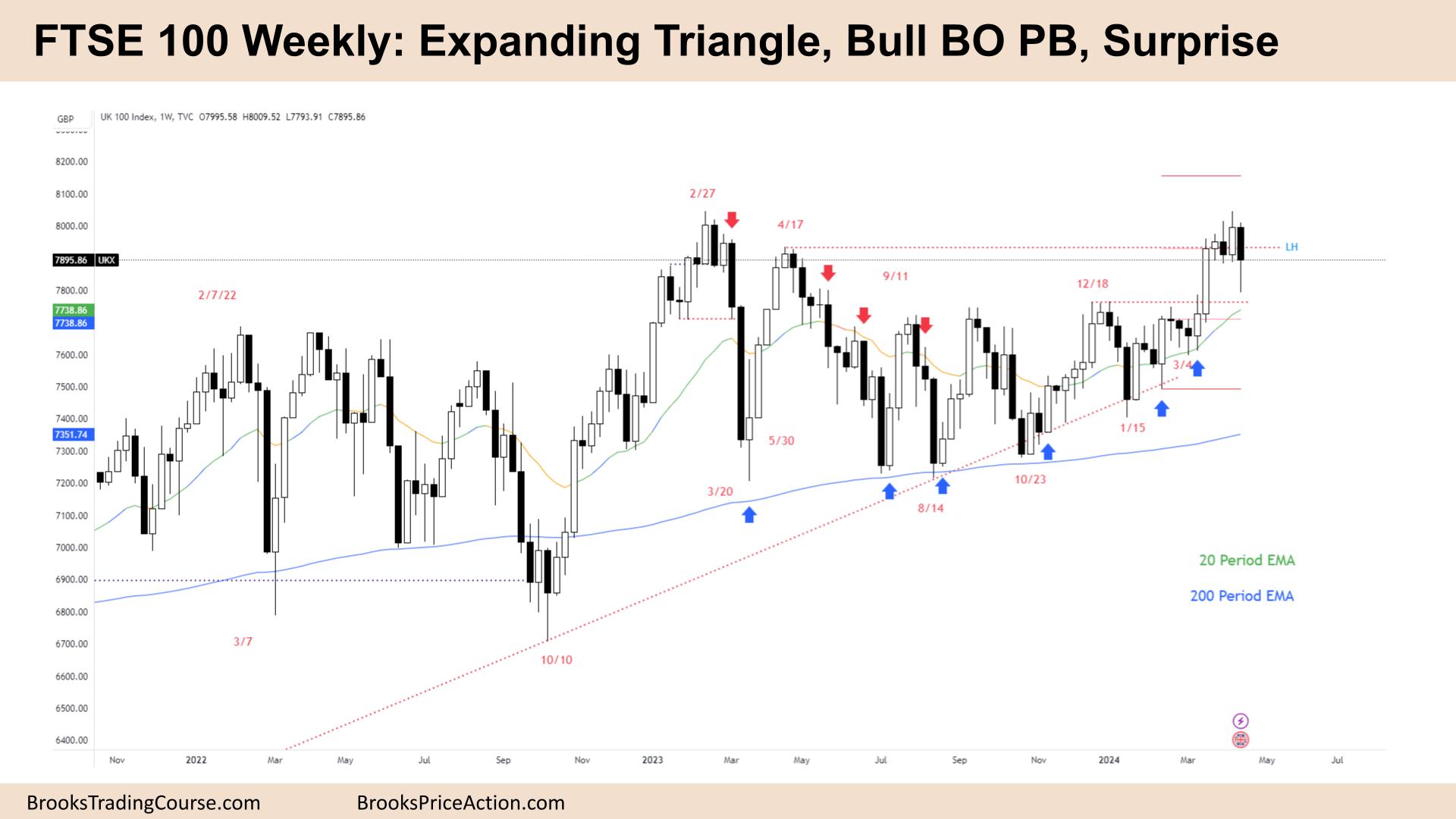

The Weekly FTSE chart

- The FTSE 100 futures went lower last week in an expanding triangle, a bear surprise bar after a bull BO and a pullback.

- The bulls see BOM, a bull breakout and a pullback to the moving average.

- We said last week there were likely buyers at the midpoint of that bull breakout bar, and there was.

- There was a quasi-ledge from December, but we did not go all the way to touch it.

- The bulls now have a breakout gap, which, if it stays open, is likely to lead to a strong second leg up.

- The bears see sideways high in a trading range and a bear surprise bar. The bar is big enough down to disappoint bulls who bought late.

- But it’s a big bar with a large tail below, so there’s not a great sell signal below. We will likely test above it next week.

- Do the bulls get out? In a channel, a good strategy is to scale in and take some off at new highs. The April high was a good reason to take some off.

- Last week was a good place to enter again for a test of the highs. So, I think most bulls would be happy to scale in here, and if they don’t reach the top of this TTR, then they can exit.

- The tail might have been scale-in bears, now surprised with the big bull breakout exit when they got a chance to break-even.

- The trouble with fading a bull breakout like this is that each bar makes a new high. So that is bull channelling behaviour. They want a bear bar to sell above, but the simpler trade is to wait to try to get long.

- Bulls can wait for a 2 legged pullback to the MA, although limit bulls will probably buy below last week and the MA.

- Always in long so better to be long or flat.

- Expect sideways to up next week.

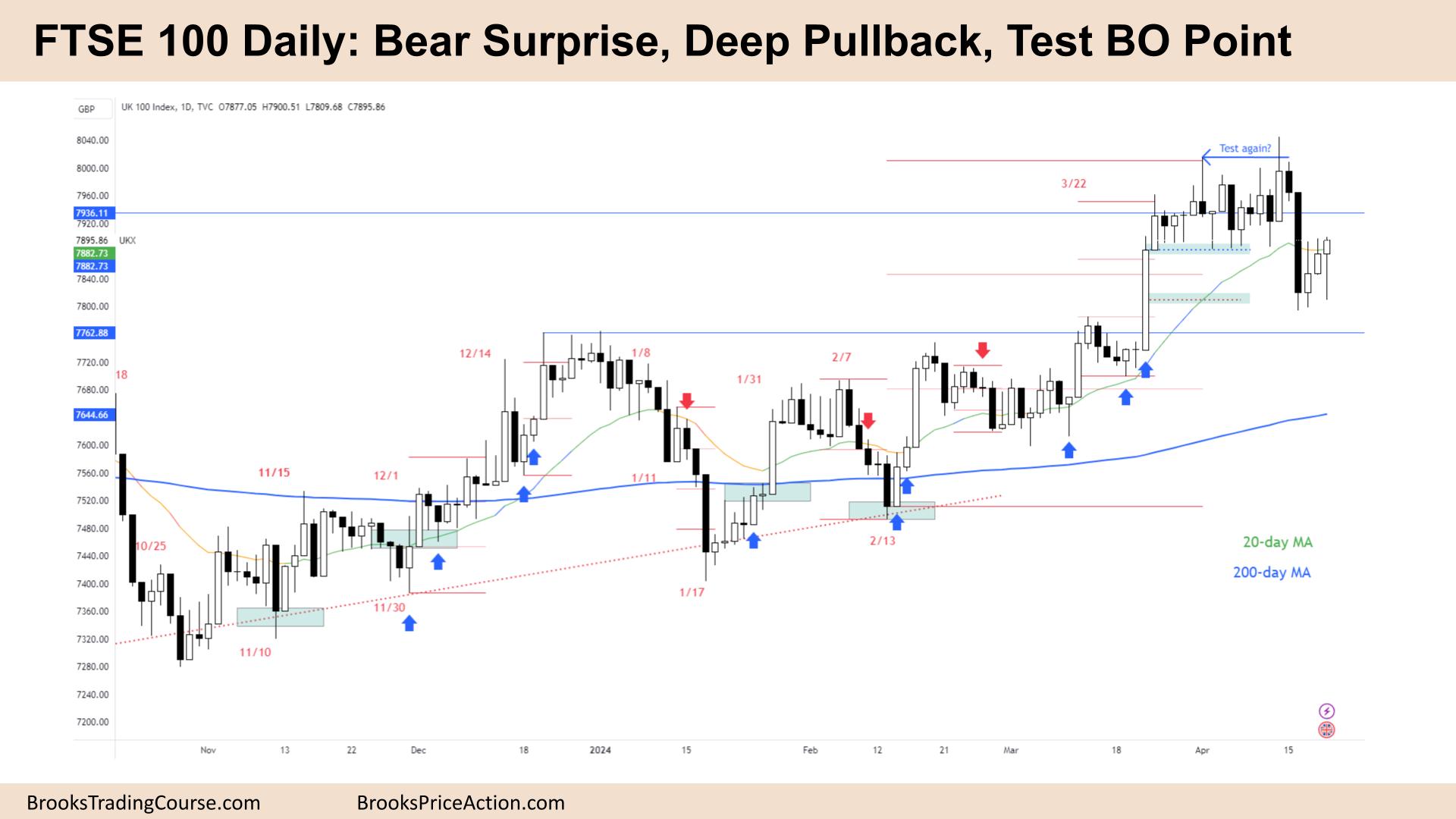

The Daily FTSE chart

- The FTSE 100 futures finished the week with 3 bull bars after a big bear surprise bar after the bull BO.

- We said last week that the bulls hit their target but would likely come back and give them another chance to exit. They did last week, and it sold off quickly.

- The bulls got a swing target of 2:1, so the pullback was expected. We are in a bull channel and might need to test the breakout point below.

- The bears see a strong counter-trend leg and will probably get one more push down before the Bulls buy again.

- The first bear bar is under the MA in 20 bars, so an MA gap bar is a buy set-up for a scalp.

- But I don’t think it is a strong buy here yet. We didn’t close above Thursday.

- If you bought the pullback buy at the midpoint of the big bull bar last week, I would exit here and wait. High chance of another leg down.

- No signal to short yet.

- Bears want a lower high to sell and a good signal. Its likely they get that or straight down to find buyers.

- Friday is an outside up bar, but it let out any bears who were short at the close of the bear surprise. A lucky exit, I suspect!

- Above, there is a tight trading range, so it will act like a magnet. Could you buy for a scalp up? I think the RR is weak for your side of the trade.

- The only short I can see is selling where the MA’s bulls got stuck. But you might need to day trade that one on the 5 min chart! See if anyone agrees with you.

- Trading range or weak bull channel, so better to wait for a second entry long low.

- Expect sideways to up next week.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.