Market Overview: FTSE 100 Futures

The FTSE futures market moved lower with a big bear surprise last week as the Always-In bulls gave up and the bears started to short back to the moving average. The bulls see a pullback to move higher, and the bears want a failed breakout above the high of a trading range. The trend has been very strong, so more likely to continue after some movement sideways to down next week.

FTSE 100 Futures

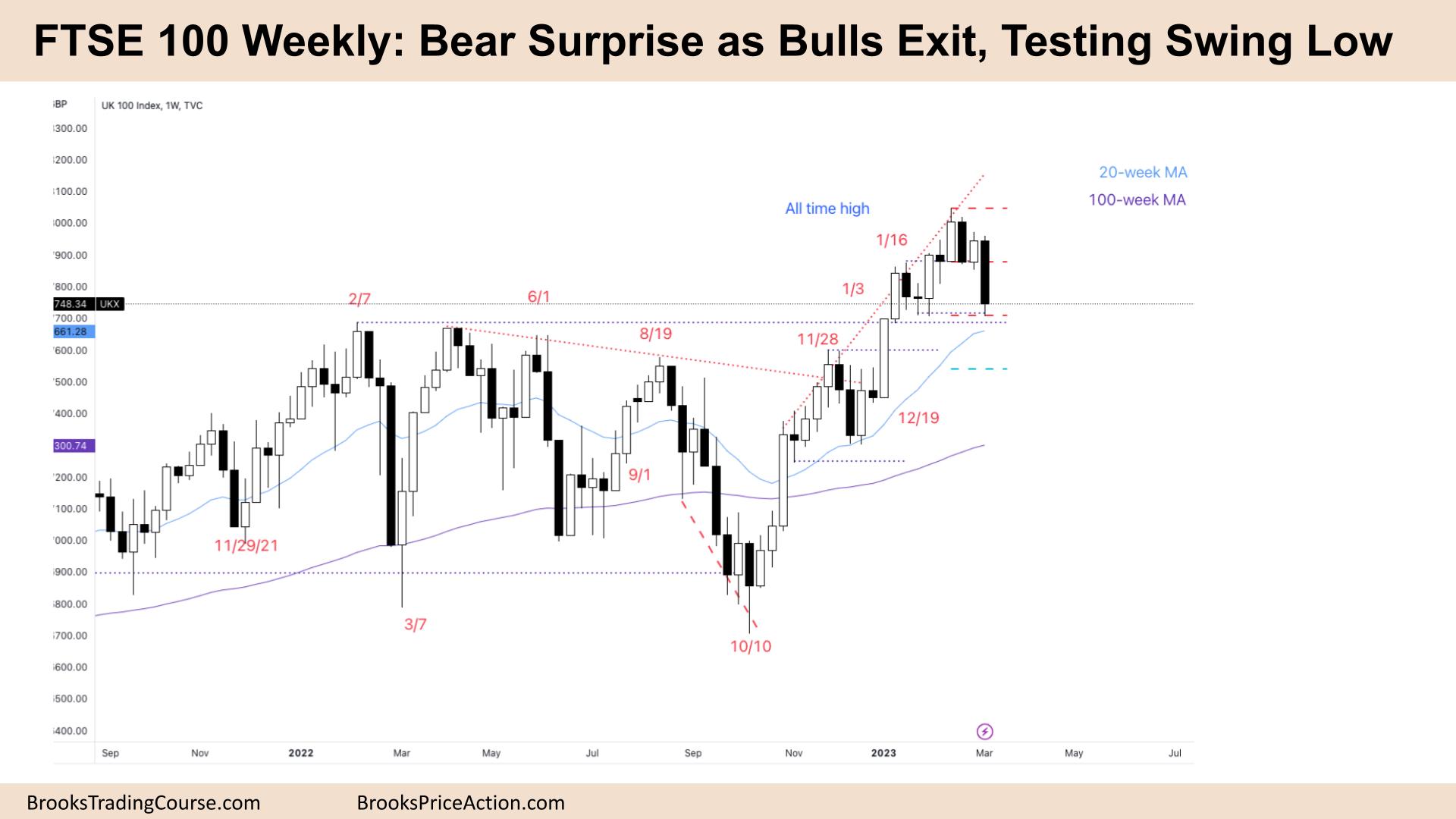

The Weekly FTSE chart

- The FTSE 100 futures was a bear surprise bar closing near its low, so we might gap down on Monday.

- It is a 4-bar bear micro channel, so some traders might expect the first reversal to be minor.

- The bulls see a tight bull channel breaking above the all-time high (ATH).

- It has been nearly 20 bars since there was a bar closing below the 20-bar moving average, so the bulls will likely buy here.

- Either the first touch, the first close below or the first bar completely below the average are good candidates for a buy signal in a bull channel.

- The bears see 3 pushes up – so it’s a wedge top, and they were looking for a reversal below a good bear bar. It’s a kind of micro head and shoulders top.

- But a small bull bar was a bad sell signal last week. So we might need to come up and test the low of last week again.

- The bears want a continuation to sell down below the moving average. It’s a small gap above the prior high, and we did not close it. So it is not as bearish as it could be.

- Buying on Friday at the lows was strong, so we can expect more buying as we dip below. The bulls want to get a reasonable buy signal, a High 1 or a 2nd entry High 2 buy around the prior high.

- This would create a breakout, follow through, and test to go higher.

- The bears are going to expect a 2nd leg sideways to down after such a large bear surprise, and they might get it.

- Always in bulls exited below last week, which created this week’s bar.

- Expect sideways to down next week.

The Daily FTSE chart

- The FTSE 100 futures was a big bear surprise bar closing near its low so we might gap down on Monday.

- It is the largest bear bar we have seen in months.

- The move ended at a measured move from the pullback two weeks ago.

- Last week was the first time limit bears have made money in nearly 6 weeks.

- Last week was the first time stop-entry bears made money – so what kind of trend is it? A weak one.

- The bulls see gaps all the way up, and until they are closed, the bull trend is still intact. We stopped at a swing low, and the always-in bulls have stops below there, so they will likely defend it next week.

- The trend is transitioning into a broad bull channel, a kind of slanted trading range.

- The bulls see a pullback and breakout test of the prior ATH and a trading range breakout. Most trends do not reverse from bull to bear or bear to bull without going sideways.

- We might have started it already.

- The bears see a possible head and shoulders top and are looking for a further move down.

- It is also a 20-bar MA Gap Bar buy setup – the first time in over 20 bars to be completely below the moving average.

- But it’s a bear bar closing on its low, so some traders will wait for a better buy signal, like a bull bar closing above its midpoint before entering.

- Some limit bulls will enter, taking a chance that stop bears will not sell below the bar. They see it as a bear climax and a possible double-bottom buy setup.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.