Market Overview: EURUSD Forex

EURUSD consecutive bear bar on the weekly chart. It is the start of the pullback. The first targets for the bears are the 20-week exponential moving average and the January 6 low. The bulls want any pullback to be sideways and not deep. They want weak bear bars with long tails below and dojis within the pullback phase.

EURUSD Forex market

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a bear bar closing near its low.

- Last week, we said that the pullback phase may have begun and the bears will need to create strong follow-through selling to increase the odds of lower prices.

- This week was a follow-through bear bar. It was the first pair of consecutive bear bars since September 2022.

- The bears want a 2-legged sideways-to-down pullback lasting at least a few weeks.

- They got a reversal lower from a lower high and a wedge top (Nov 15, Dec 5 and Feb 2).

- The wedge pattern and loss of momentum (smaller bull bodies) increase the odds that we will see at least a small pullback which has begun last week.

- The first targets for the bears are the 20-week exponential moving average and the January 6 low.

- The bulls got a strong spike and channel up from September 2022 and the market may have flipped into Always In Long.

- The strong move up increases the odds of at least a small second leg sideways to up after a deeper pullback.

- The bulls want any pullback to be sideways and not deep. If the pullback is weak and sideways, the odds of another strong leg-up increase.

- They want weak bear bars with long tails below and dojis within the pullback phase.

- Since this week was a bear bar closing near the low, it is a weak buy signal bar for next week. It is a good sell signal bar.

- The odds slightly favor the EURUSD to trade at least a little lower.

- Traders will see if the bears can get strong follow-through selling reaching the 20-week exponential moving average, or if the candlesticks for the next couple of weeks are overlapping and weak bear bars.

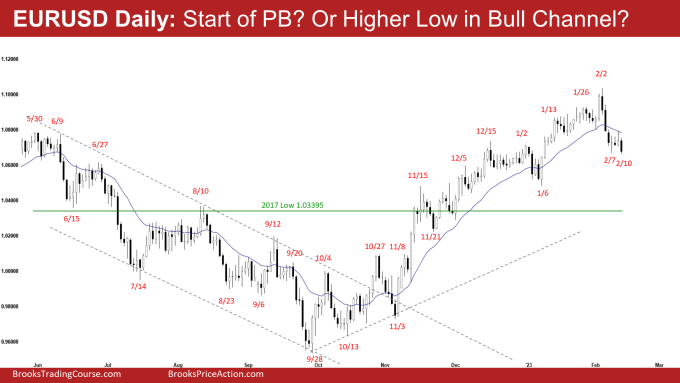

The Daily EURUSD chart

- The EURUSD traded sideways to down for the week, with a small pullback on Thursday and Friday closing near the low of the week.

- Previously, we said that the rally was climactic and lasted a long time. The wedge pattern, micro wedge and micro double top increase the odds of at least a small pullback which can begin at any moment.

- The pullback phase has begun.

- The bears see the move up since September as a 50% pullback of the selloff which started in May 2021.

- They got a reversal lower from a wedge top (Nov 15, Dec 15, and Feb 2) and a micro wedge (Jan 13, Jan 26 and Feb 2).

- They see Thursday as a small pullback and want at least another leg down.

- The next target for the bears is the January 6 low.

- The bears need to create strong consecutive bear bars closing near their lows to increase the odds of lower prices.

- The spike & tight channel up since October means strong bulls.

- The odds slightly favor the market has flipped into Always In Long.

- The bulls want any pullback to be sideways and not deep.

- If there is a deep pullback, the bulls want a reversal from a higher low major trend reversal and a larger second leg sideways to up.

- If the EURUSD trades slightly lower, they want a reversal up from a double bottom bull flag with January 6 low.

- Odds slightly favor the EURUSD to still be in the sideways to down pullback phase to work off the overbought condition.

- Traders will see if the bears can create strong consecutive bear bars or if the candlesticks are overlapping with weak bear bars and dojis.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.