Market Overview: EURUSD Forex

The EURUSD bulls need follow-through buying to increase the odds of a retest and breakout attempt above the trading range high. The bears hope that the current move is simply a deep pullback and want a reversal from a wedge bear flag or a lower high major trend reversal.

EURUSD Forex market

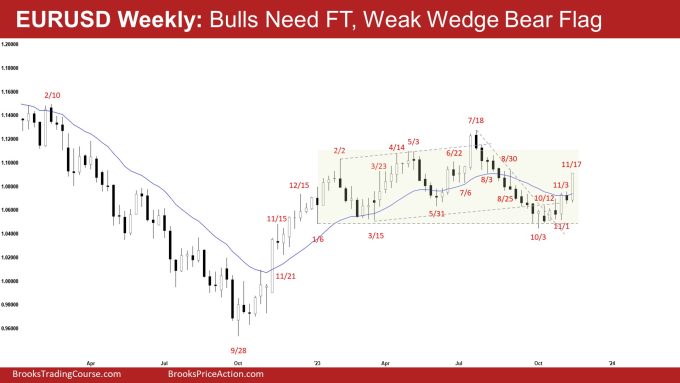

The Weekly EURUSD chart

- This week’s candlestick on the weekly EURUSD Forex chart was a big bull bar closing near its high.

- Previously, we said that the odds slightly favor the market to trade at least a little higher. If the bulls can get a couple of consecutive bull bars closing near their high, it will increase the odds of the bull leg beginning.

- This week traded higher and closed far above the 20-week EMA.

- The bulls got a reversal up from a double bottom bull flag (Oct 3 and Jan 6) and a parabolic wedge (Aug 3, Aug 25, and Oct 3).

- This week closed far above the 20-week EMA and is trading above the middle of the trading range.

- They see the current move as the bull leg to retest the trading range high.

- If the market trades lower, the bulls want a reversal up from a higher low major trend reversal.

- Previously, the bears got a tight bear channel testing the trading range low (Jan 6).

- They see the current move simply as a deep pullback and want the market to retest the October low.

- They want a reversal from a wedge bear flag (Oct 12, Nov 3, and Nov 17) and a lower high major trend reversal.

- The problem with the bear’s case is that they have not been able to create follow-through selling (since the Oct low) and this week’s big bull bar is not a strong sell signal bar.

- Since this week’s candlestick is a big bull bar closing near its high, it is a buy signal bar for next week.

- For now, odds continue to slightly favor the market to still be in the sideways to up phase.

- Traders will see if the bulls can get more follow-through buying or will next week trade slightly higher but close with a long tail or a bear body.

- If the bulls can get a couple of consecutive bull bars closing near their high, it will increase the odds of a retest and subsequent breakout attempt above the trading range high.

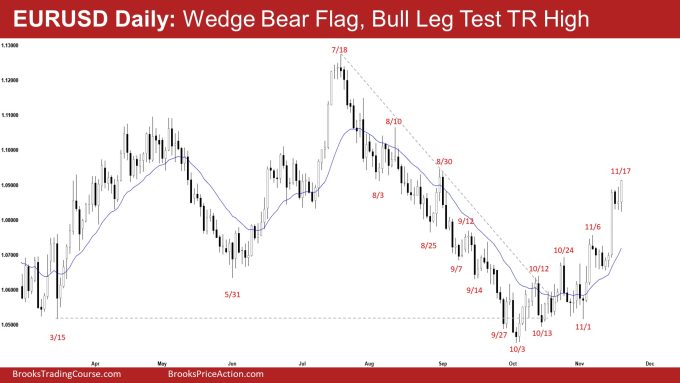

The Daily EURUSD chart

- The EURUSD spiked up on Tuesday followed by sideways trading. Friday was an outside bull bar closing near its high, breaking above the oo (outside-outside) pattern.

- Previously, we said that odds slightly favor at least a small retest of the October 3 low after the pullback. If the retest of the October 3 low is brief and reverses up immediately, odds will swing in favor of the pullback (bounce) resuming for at least a couple more weeks.

- The bears attempted to retest the October 3 low (on Oct 26 and Nov 1) briefly but could not create follow-through selling and the market reversed up instead.

- Previously, the bears got a tight bear channel testing the trading range low (Jan 6).

- They see the current move simply as a deep pullback of the whole selloff from the July 18 high.

- They want a reversal down from a wedge bear flag (Oct 24, Nov 6, and Nov 17), a lower high major trend reversal and a double top bear flag (Aug 30 and Nov 17).

- If the market trades higher, they want the EURUSD to stall around the trading range high area (April/May highs)

- They hope to get a retest of the October low and a breakout below the trading range low.

- The bulls hope that the strong move down (Jul 18 to Oct 3) was simply a sell vacuum test of the 50-week trading range low.

- They got a larger pullback (bounce) from a parabolic wedge (Aug 25, Sept 14, and Oct 3) and a large double bottom with the January low.

- They hope that the bull leg to retest the trading high (April/May highs) is now underway.

- If the market trades lower, they want a reversal up from a higher low major trend reversal.

- They want the 20-day EMA to act as support.

- So far, the bears have not been able to create sustained follow-through selling.

- The buying pressure since the October low looks stronger with larger bull bars with stronger follow-through buying.

- For now, odds slightly favor the market to still be in the sideways to up phase even if there is a small pullback first.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.