Market Overview: Weekend Market Update

I only have time for a brief update this weekend. However, I created a video of what to expect over the coming year and it will be available here soon on my trading course’s website.

The Emini broke above last year’s high, but there was immediate profit-taking on Friday’s Iran news. The bears want a 2 – 3 week reversal down. However, they will need at least one or two bear bars first.

The Bond futures are reversing up from the bottom of a 4 month trading range. Any reversal up will probably be minor and last 2 – 3 week.

The EURUSD Forex market is stalling at the top of a 6 month trading range. Traders are wondering if the 2 year bear trend has ended and a yearlong trading range has begun. It will probably be in a trading range from around 1.08 to 1.18 for the next year.

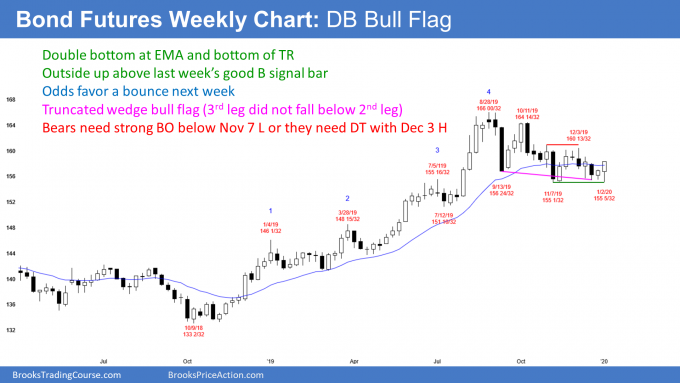

30 year Treasury bond Futures market:

Bounce from double bottom

The 30 year Treasury bond futures formed an outside up bar this week. There is now a double bottom with the November 7 low. In addition, this week’s low is the 3rd leg down in a truncated wedge bull flag. The 1st two lows were September 13 and November 7. Traders should expect higher prices over the next couple of weeks.

The 1st target is the December 3 lower high. If the bulls break above that, then the October 11 and August highs are the next magnets. But, because of the 10 year nested wedge top on the monthly chart, the odds are against a big breakout above the October 11 all-time high. The trend over the next 10 years is down, even if there is one more brief new high 1st.

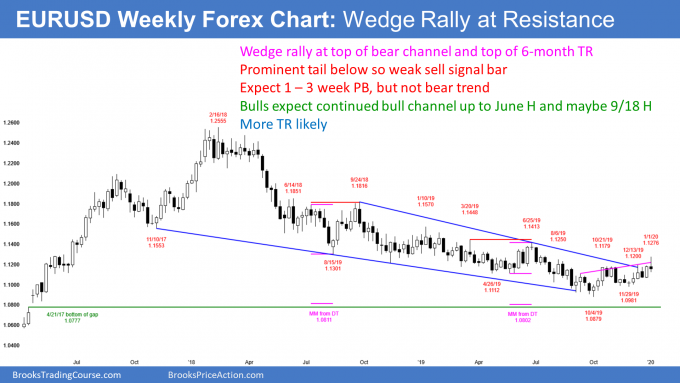

EURUSD weekly Forex chart:

Stalling at top of 6 month trading range

The EURUSD weekly Forex chart reversed down this week after breaking above the October high. That is the top of the 6 month trading range. But, the bears were unable to create a big bear bar closing on its low. Consequently, this week is a weak sell signal bar for next week.

While the 3 month rally has been the strongest rally in 2 years, it still looks like a bull leg in a trading range. It lacks relentless buying. The bulls need more consecutive bull bars, more bull bars closing on their highs, few bear bars, and fewer bars with tails above and below. Without those features of a trend, traders will continue to look for reversals every 2 to 3 weeks.

Because the 18 month tight bear channel on the monthly chart is unusually long, traders should expect an evolution into a trading range this year. The top of the range will probably be around the September 2018 high. That was the start of the bear channel and it is near the 1.18 Big Round Number. The bottom will either be the October low, or just a little lower at the 1.08 Big Round Number.

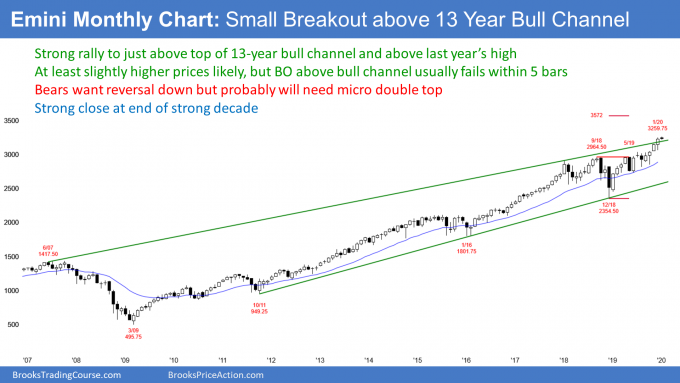

Monthly S&P500 Emini futures chart:

Strong rally, but getting extreme

The monthly S&P500 Emini futures chart had 4 consecutive bull bars prior to this month. The bulls want another one in January. But the Emini is at the top of a 10 year bull channel. That will probably limit the extend of a rally from here. Also, 4 bull bars coming 10 years into a bull trend is fairly extreme. That increases the chance of a pause within a couple months.

But 4 big bull bars closing near their highs is a sign of strong bulls. That limits the downside risk over the next few months. This is true even if the bears were able to create a bear bar in January. The best the bears can probably get over the next few months is a 1 – 2 bar (month) pullback. Traders should continue to expect the Emini to trade sideways to up.

Breakout above last year’s high

I talked last week about the yearly chart. That is a chart where each bar is one year. I said that last year was the biggest bull bar in a 10 year bull trend. It was therefore climactic and unsustainable. This year would likely be less strong. Furthermore, within the next 3 years, the Emini will probably begin to go sideways for the next decade.

However, this year was likely to break above last year’s high. The bulls accomplished that goal on Thursday, the 1st trading day of the new year and new decade. But it pulled back below last year’s high on Friday.

The bears hope that the breakout will fail and that this week will be the high for the year. They want the year to close on its low so that it will be a sell signal bar on the yearly chart.

We are only 2 days into the year. The bears currently have only a small chance of achieving their goal at this point. But if they get 2 – 3 consecutive bear bars on the monthly chart, more traders will suspect that we have seen the high of the year.

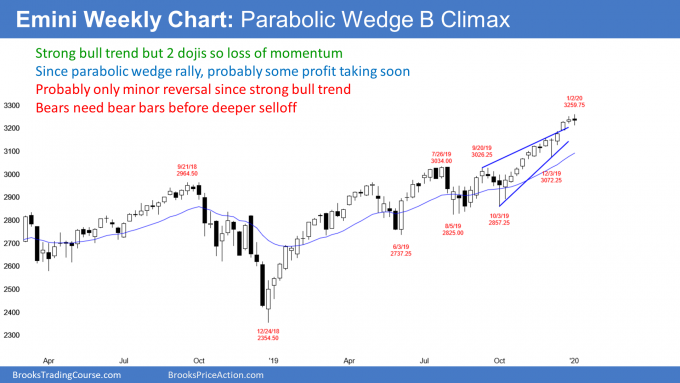

Weekly S&P500 Emini futures chart:

Strong bull trend losing some of its momentum

The weekly S&P500 Emini futures chart traded above and below last week’s range. This week was therefore an outside bar. Its close was near the open and therefore the week was a doji bar, which is neutral. Since last week was small, these 2 weeks are a sign of a loss of momentum.

Since the 3 month bull trend has been strong, traders will buy the 1st 1 – 3 bar pullback. Consequently, the downside risk over the next few weeks is small.

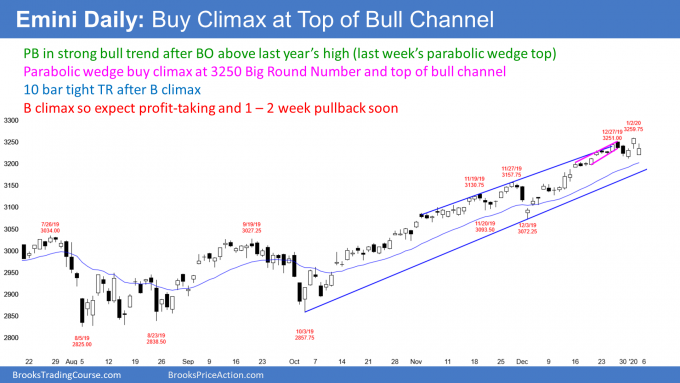

Daily S&P500 Emini futures chart:

Pause in 3 month rally

The daily S&P500 Emini futures chart has been in a Small Pullback Bull Trend for 3 months. However, it has been sideways for 2 weeks. That means that the bulls are not as strong as they have been. This increases the chance of some profit-taking and a 2 – 3 week pullback.

The bears want a bear breakout below the 2 week range and then a measured move down. That would be to around the 3 month bull trend line.

Can the bears retrace the entire 3 month rally? Probably not without a bigger top. Any reversal down at this point will be minor. The bulls will buy it, expecting at least a test back to the high.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Standard Time

When I mention time, it is USA Pacific Standard Time (the Emini day session opens at 6:30 am PST, and closes at 1:15 pm PST). You can read background information on the intraday market reports on the Market Update page.