Weekend report co-author Andrew A.

Market Overview: Weekend Market Analysis

SP500 Emini sell signal bar on weekly chart. If July has a bear body on the monthly chart, then a 15 – 20% correction will likely be underway for the next 2 – 3 months. Without that, traders will bet that this reversal will be like all of the others for the past year and lead to a new high soon.

The EURUSD Forex weekly chart is near the bottom of a yearlong trading range. Since most attempts to break out fail, there should be a reversal up soon. However, it might come after a brief break below the trading range.

EURUSD Forex market

The EURUSD weekly chart

- The EURUSD traded below last week’s low and closed as a bear bar at the lower half of the range.

- The small tail below indicates that the bears are not as strong as they could be.

- EURUSD is in a 2-month selloff from the lower high major trend reversal and head and shoulders top.

- The January 6 high is also a wedge top and therefore traders expect 2 legs sideways to down. The current selloff is a 2nd sideways leg. Traders are wondering if it will continue down.

- Bears have only a 40% chance of a successful breakout below the trading range.

- There is a wedge bull flag drawn using the May 5th, June 18th and July 16th lows.

- The recent tight trading range is also a 4-week micro wedge bottom and higher low double bottom with March 31st low.

- However, there is a 8-bar bear microchannel (no pullback in 8 weeks). This is therefore a weak bull setup.

- If EURUSD trades higher next week, a minor reversal is more likely than a bull trend unless the bull breakout bar is strong, reversing many prior bars and closes near the highs.

- The yearlong trading range will likely continue. EURUSD is near the bottom of the yearlong trading range and most breakout attempts fail.

- Should the EURUSD break below the Mar 2021 and Nov 2020 lows, odds are it will reverse back into the trading range again.

- The bears want a break below the neckline of the Head & Shoulders top. The bigger the breakout bar, the more it closes on its low, and the more bear follow-through bars, the more likely the breakout will lead to a measured move down to the March 2020 low.

- Until there is a strong and credible breakout from this yearlong trading range, traders will bet on reversals.

S&P500 Emini futures

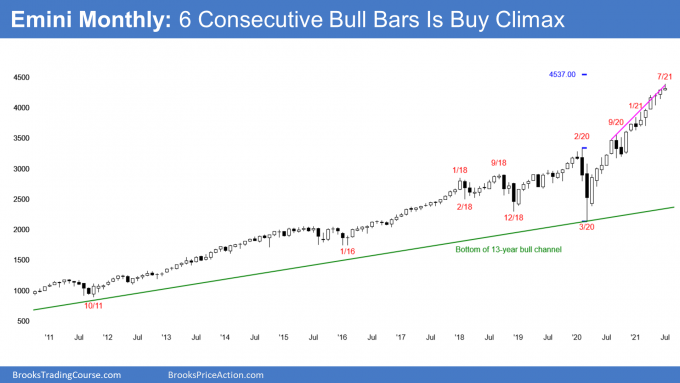

The Monthly Emini chart

- July currently is a doji with a small bull body and long tail above.

- The past 6 months are a 3rd push up in a tight bull channel since the pandemic lows. The rally, therefore, is a parabolic wedge buy climax, which often attracts profit takers.

- July is the 6th consecutive bull bar, which is extreme. The last time we had 6 consecutive bull bars was in 2011. This increases the chance that July will close below the open of the month.

- If July has a bear body on the monthly chart, then a 15 – 20% correction will likely be underway for the next 2 – 3 months.

- Without that, traders will bet on higher prices in August.

- Because the rally has been in a tight bull channel, bulls will buy the pullback, even if it is 20%.

- There are 2 more trading weeks to go and the monthly bar can look very different at the end of the month.

The Weekly S&P500 Emini futures chart

- The weekly bar broke to a new high but closed near the low.

- The Small Pullback Bull Trend has lasted more than 60 bars, which is unusual and therefore unsustainable and climactic. It should end soon, and it would end with a pullback bigger than prior pullbacks.

- Since this week closed as a bear bar, the bears need to close next week on another bear follow-through bar to make traders believe that a deeper pullback is beginning.

- The bears need to break strongly below the trend line around 4260, which is also a test of the May 7 breakout point.

- If the bears fail to break the trendline with 2 or more bear bars closing near their lows, the selloff will probably be a breakout test of the May 7 high. Traders will expect a new high.

- Traders know that in a strong bull trend, reversals are more likely to fail and turn into bull flags.

- The Emini has been in a small pullback trend since the pandemic low. This is a very strong bull trend.

- A Small Pullback Trend ends when there is a bigger pullback. The largest pullback since the trend started was in September, which was 10% and lasted 2 months.

- So, the strong trend eventually will end with a pullback that is 10 – 20% and lasts at least 2 – 3 months. A Small Pullback Bull Trend usually evolves into a trading range and not a bear trend so bulls will buy the pullback.

- After a trading range, a resumption of the bull trend is more likely than a reversal into a bear trend.

The Daily S&P500 Emini futures chart

- The Emini tested the top of the expanding triangle and Friday closed as a big outside down bar after a small wedge top.

- Friday broke below a minor trendline drawn from the June 18th with the July 8th lows.

- The next target for the bears is around the 4240-4260 area where the lower expanding triangle trendline, the major trend line and 50EMA are located.

- There is often a 5- to 10-bar trading range after a buy climax like the recent 11-bar bull microchannel. Look at the April bull microchannel as an example.

- Since this week broke below a minor trend line, the Emini could also be setting up a Major Trend Reversal should price retest the recent highs.

- The retest can be a Lower High, Double Top, or Higher High. The weaker the bars in the retest, the better for the bears.

- However, traders also know that most reversal attempts in a strong trend fail 80% of the time and reversal attempts eventually turn into bull flags.

- Bulls have bought every 1 – 3 day selloff for a year so odds still favor another minor reversal.

- There is a measured move target at 4404 above.

- All reversal attempts fail until the last one so picking tops is a low probability bet.

- Traders are better off waiting for signs of strong reversal setup such as:

1) A big bear bar or series of bear bars that breaks a major trend line and reverses below the lows of many prior bars or swing lows;

2) A weak retest of the highs that fails with a 2nd reversal down. - If bears get 2 – 3 big bear bars closing near their lows next week, odds will start favoring 15 – 20% correction.

- Most reversals down will continue to be minor, but a 15 – 20% correction is likely this year.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Weekly Reports Archive

You can access all weekly reports on the Market Analysis page.