Market Overview: Weekend Market Analysis

The SP500 Emini futures market had consecutive closes above the May 7 breakout point this week on the daily chart. Emini consecutive closes increase the chance of a successful breakout. The bulls will need bigger bull bars, and more bull bars if the breakout is to reach a 200-point measured move up from the 2-month trading range.

The EURUSD Forex weekly chart is turning down from a lower high double top with the January high. However, the reversal will probably only last a couple weeks before the EURUSD goes sideways again.

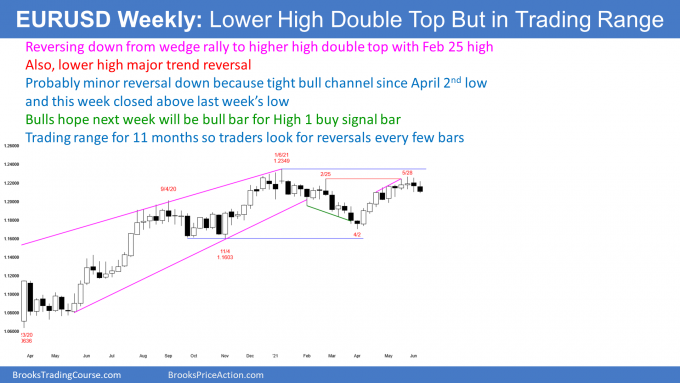

EURUSD Forex market

The EURUSD weekly chart

- Nested trading ranges. There is a 4-week tight trading range (200 pips tall) near the top of an 11-month trading range (700 pips tall). That range is near the top of a 7-year trading range (2,200 pips tall).

- Each of the 3 trading ranges is a Breakout Mode pattern. That means there is about a 50% chance of a bull or bear breakout, and a measured move up or down.

- As uniformly bullish as all of the TV experts are, there is no breakout until there is a clear breakout.

- Markets have inertia and resist change. Continued sideways is more likely than the start of a strong trend. Therefore this reversal down will probably only last a week or so, before the EURUSD goes sideways again.

- While the bulls might have a slight advantage, because of last year’s strong rally from a higher low (above the 2017 low), the EURUSD could not be going sideways if the bulls had a big advantage.

- It is almost as likely that the 200- or 700-pip breakout will be down, as it is that it will be up.

- To conclude that a breakout is likely to be successful, traders want consecutive closes above or below the range.

- The bigger the breakout bars, the more likely the breakout will succeed.

- The bulls want the 2-month rally to break strongly above the February 2018 high, which is the top of the 7-year range.

- The bears want a reversal down. This past week was a bear bar that closed near its low, so it might be the start of a reversal down. Traders expect at least slightly lower prices next week.

- This week closed just above last week’s low, and did not have a big bear body. It therefore is not yet a strong reversal down.

- If down, how far down? The 1st target is the bottom of the 10-month trading range at around 1.16, and the March 31 or November 4 lows.

- If the EURUSD were to break strongly below that, traders would then look for a test of the bottom of the 7-year trading range, which is last year’s low below 1.07.

- It is more likely that it will bounce for at least a couple weeks, if it falls to the bottom of the 11-month range this summer.

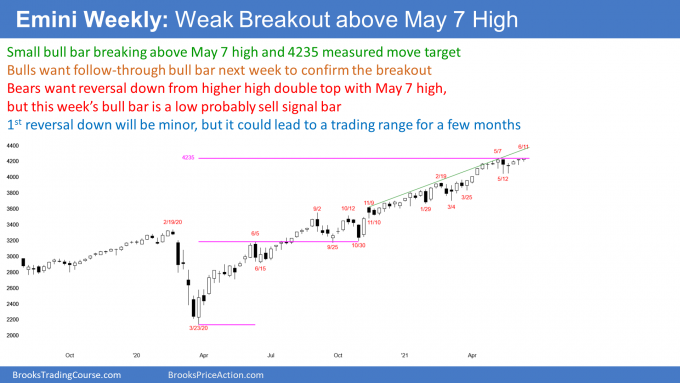

S&P500 Emini futures

The Weekly S&P500 Emini futures chart

- Small breakout above the measured move target from the March 23, 2020 low to the June 5, 2020 high.

- This week broke above, and closed above the May 7 top of the 2-month trading range, but the breakout so far has been small.

- This rally has lasted more than 60 weeks, and a Small Pullback Bull Trend usually begins to evolve into a trading range after about 60 weeks.

- This increases the chance of a reversal within the next month or two.

- A Small Pullback Bull Trend ends with a big pullback. The pullback will be bigger, and last longer than any prior pullback in the trend.

- The biggest pullback was the September/October pullback, which fell 10%.

- Therefore, when the trend ends, the pullback should be more than 10%, and last longer than 2 months.

- While the Emini has been in a tight trading range for April and May, the pullback has only been about 4%. Therefore, the Small Pullback Bull Trend is still intact.

- Traders continue to expect higher prices, but know that a reversal down is likely to come soon.

The Daily S&P500 Emini futures chart

- Thursday was a bull bar that closed above the May 7 high. It was therefore a breakout above the range.

- Friday was the 2nd consecutive bull bar that closed above the May 7 high. Traders see it as confirmation of the breakout, and it increases the chance of higher prices.

- The breakout at this point is weak, because both bars were small, and barely closed above the May 7 breakout point. The bulls need bigger bars or several more small bars, to convince traders that the trading range is ending, and the yearlong bull trend is resuming.

- The bigger the bull bars, and the more they close on their highs, the more likely the rally will reach a 200-point measured move above the May 7 high.

- Friday was a bull inside bar in a bull trend. It is therefore a High 1 bull flag buy signal bar.

- The odds favor at least slightly higher prices, but unless there is a Bull Surprise breakout, the rally will probably not reach a 200-point measured move target.

- The rally is in a wedge bull channel. A reversal down would be from a wedge rally to a higher high double top with the May 7 high.

- That is a common reversal pattern, but the wedge is not clear, and there is no sell signal bar. The odds are against a major reversal without a good sell signal bar, or a big Bear Surprise Bar.

- A reversal would also be a higher high major trend reversal, and an expanding triangle top, which began with the April 16 or April 29 highs.

- Even a strong sell setup (this one is weak) in a bull trend, only has a 40% chance of leading to a trend reversal (into bear trend).

- Most of the time, a selloff from a top will be only a minor reversal. That means that it will be a pullback in the bull trend (bull flag), or lead to a trading range, just like every other reversal since March 2020.

- Until there is a strong reversal down, traders will continue to expect higher prices. They will bet that every reversal down will fail within a few bars.

- Once a correction is clearly underway, it is usually about half over.

- Traders will continue to expect higher prices until there is a strong reversal down.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time (the Emini day session opens at 6:30 am PT, and closes at 1:15 pm PT). You can read background information on the intraday market reports on the Market Update page.