Market Overview: Weekend Market Analysis

The SP500 Emini futures market is at the top of a 2-month trading range. A bull breakout is slightly more likely. The bears want a reversal down from a double top.

The EURUSD Forex is near the top of an 11-month trading range nested within a 7-year trading range. The odds slightly favor an eventual bull breakout. In the meantime, traders are looking for reversals every few days.

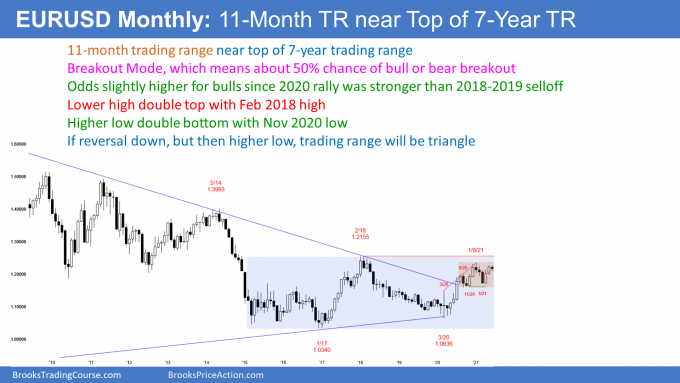

EURUSD Forex market

The EURUSD monthly chart

- 11-month trading range at top of 7-year trading range. Most attempts to break out of a trading range fail, adding more bars to the trading range.

- Trading ranges always have both reasonable buy and sell signals.

- They frequently contain both a double top and a double bottom. The pattern often evolves into a triangle before there is a breakout.

- June so far is bear inside bar. Bears are hoping it is the start of a selloff to the bottom of the 7-year range. More likely, it is not (see below).

11-month trading range

- Higher low double bottom (November 2020 and March 2021) and lower high double top (January and May, 2021).

- Bears want strong break below March low, which is neckline of January 2021/May 2021 double top.

- They then want measured move down from below the November 2020 low (bottom of 10-month range) to bottom of 7-year trading range

- Bears also want 2nd leg down from last year’s wedge top.

- Bulls want any selloff in June or July to be a pullback from the April/May strong rally.

- Bulls want the the November 2020/March 2021 double bottom to lead to a break above the February 2018 top of the trading range.

- The April/May rally was strong enough, so that the June selloff is more likely a pullback from that rally, than the start of a bear trend.

- Therefore, a selloff in June and July will probably stay above the March low, and the 10-month trading will have evolved into a triangle.

7-year trading range

- Higher low double bottom (January 2017 and March 2020), and a lower high double top (February 2018 and January 2021).

- If there is a big reversal down from here, it will probably not break below the 2017 bottom of the 7-year range, because last year’s rally was strong, and it came from a higher low.

- Furthermore, any selloff will probably turn up from above the March 2020 higher low.

- Therefore, if there is a big selloff from here, the trading range will more likely evolve into a triangle.

S&P500 Emini futures

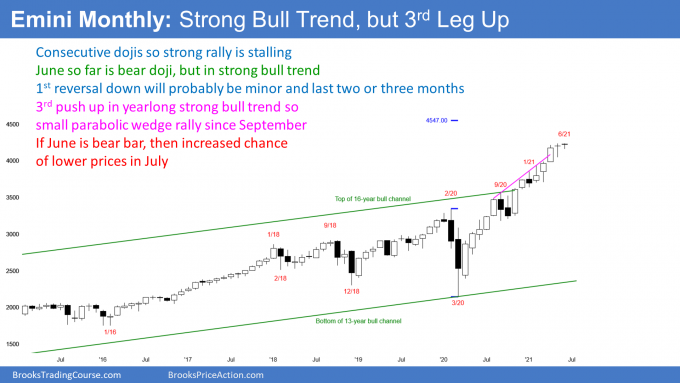

The Monthly Emini chart

- Strong rally from last year’s pandemic low, but rally has had 3 pushes up. It is therefore a parabolic wedge, which often attracts profit takers.

- Buy climaxes can last much longer than what seems reasonable.

- Parabolic wedge does not guarantee profit taking. The Small Pullback Bull Trend could continue for many more months, without a 2- to 3-month pullback, but that is unlikely.

- So far, June is a small bear inside bar.

- If it remains a bear bar, many traders will see that as a sign of profit taking in a parabolic wedge buy climax. That would increase the chance of lower prices for at least a couple months.

- Bulls want June to be a 5th consecutive bull bar. That would be unusual this late in a buy climax.

- Therefore, June will probably close below the open of the month, even if June goes above the May high before the end of the month.

- Because the bull trend is so strong, if the Emini sells off for a few months, the reversal will probably be minor.

- A minor reversal only has a 30% chance of growing into a bear trend (major reversal) without first transitioning into at least a small trading range.

- While the 1st pullback will probably be only a few months, it is important to note that it could lead to a trading range that could last a year or more. The January 2018 buy climax led to a trading range that lasted 2 years. The trading range that began in 2014 lasted more than a year, despite a very strong bull trend.

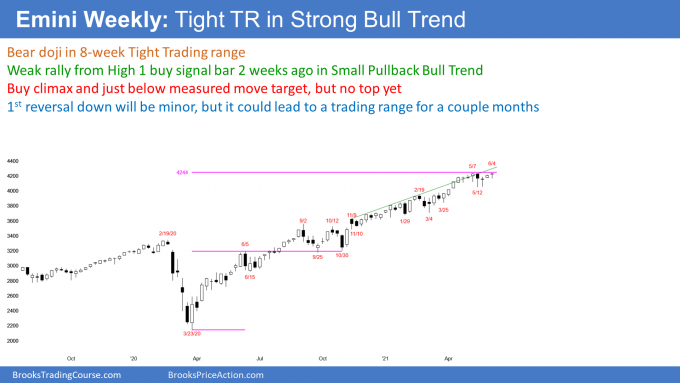

The Weekly S&P500 Emini futures chart

- Outside down week that reversed up, and ended as outside up week.

- Closed above last week’s high, but not above May 7 all-time high.

- Since closed just below all-time high, might gap up to new high next week.

- Bears want reversal down from small double top with May 7 high. Since strong bull trend, minor reversal is more likely than bear trend. A minor reversal is usually only a few weeks, like all of the other minor reversals since the March 2020 low.

- Small Pullback Bull Trend since March 2020.

- A Small Pullback Bull Trend typically evolves into a trading range once it has lasted 60 bars or so. Therefore, a trading range is likely soon.

- Weekly chart has been in a trading range for 8 weeks, but that is probably not enough to end the Small Pullback Bull Trend. Odds continue to favor higher prices.

- When a strong trend ends, it usually will have a correction that is deeper, and lasts longer than all of the prior corrections in the trend.

- This trend had a 10% correction that lasted 2 months (last September and October).

- Once there is a correction, it should be more than 10%, and last more than 2 months.

- If there is more than a 10% correction, traders begin to look for a 20% correction. This is because Institutions say that a correction has converted into a bear trend once it reaches 20%. Traders see it as a psychological support level, and therefore a magnet.

- Any reversal can be major (become a bear trend). The 1st reversal down in a Small Pullback Bull Trend only has 30% chance of growing into a bear trend without first evolving into a trading range.

- Therefore, even if there is a 20% correction that lasts several months, traders will expect a test of the high, before there would be a 40% chance of a bear trend.

- Until there is a clear, strong reversal down, the odds are that every selloff will just be another small pullback that will lead to a new high.

- A correction (10% or more) is typically not clearly underway until it is about half over.

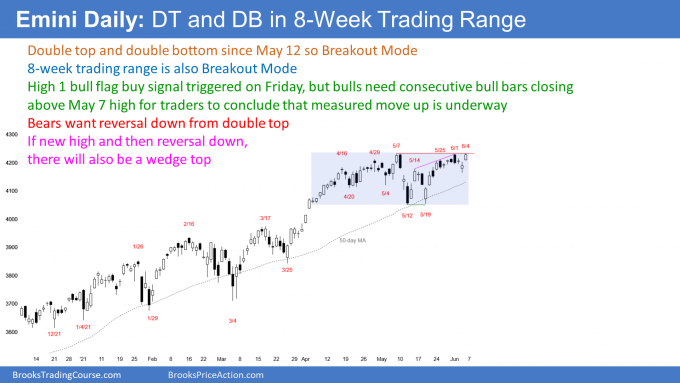

The Daily S&P500 Emini futures chart

- Friday triggered High 1 bull flag buy signal.

- Friday closed near its high, so might gap up to new all-time high next week.

- Even though trading range for 2 months, traders continue to expect higher prices. There is currently 60% chance of bull breakout, and 40% chance of bear breakout.

- Bears want reversal down from around May all-time high. Emini has stalled just above 4,200 for 2 months. It is therefore important resistance in an overbought market.

- If there is new high next week, and then a reversal down, there will be a wedge rally to a higher high double top. The 1st 2 legs of the wedge are the May 14 and June 1 highs.

- Wedge rally to a double top is a common topping pattern.

- Stock market tends to rally around June 26 through the 6th of July. That means it tends to not rally in mid-June, which increases the chance of sideways to down for a couple weeks.

- Most tops fail. Traders will continue to buy every reversal down until one is exceptionally strong. They will then conclude that the market is correcting.

- A correction is usually half over by the time traders decide it is underway.

- Once traders believe the market is in a correction, they like to wait for a 2nd leg down before buying again. That process could take several weeks and possible a few months. It can begin at any time.

Trading Room

Traders can see the end of the day bar-by-bar price action report by signing up for free at BrooksPriceAction.com. I talk about the detailed Emini price action real-time throughout the day in the BrooksPriceAction.com trading room. We offer a 2 day free trial.

Charts use Pacific Time

When I mention time, it is USA Pacific Time (the Emini day session opens at 6:30 am PT, and closes at 1:15 pm PT). You can read background information on the intraday market reports on the Market Update page.