Market Overview: DAX 40 Futures

DAX futures continued down this month with consecutive bear bars closing on lows. The bulls see a bull flag in a longer-term bull trend and expected the second leg to get back to near the breakout of the trading range. The bears see a tight bear channel, but with overlap so can reverse soon. Expect bears to sell above this month and bulls to buy below this month again.

DAX 40 Futures

The Monthly DAX chart

- The DAX 40 futures was a big bear bar closing on its low last month so we might gap down on Monday.

- It is the second consecutive big bear bar closing on its low so we are always in short.

- We are pausing at the 100-month moving average (MA) which has been an area of interest for 7 years so we might go sideways here while traders decide.

- The bulls see a breakout and retest of a trading range and a possible parabolic wedge bottom with March and July. July was a reasonable buy signal so we might get back up to it at some point.

- Because July was a reasonable buy signal, we might also bounce at the 50% point as trapped bulls will sell out of longs there, at breakeven.

- The bulls know that after the COVID lows it was an incredibly strong bounce and the lows of a 2-year bull trend so limit bulls will start to scale in soon.

- The bears see consecutive bear bars, a possible break below a wedge and want a measured move down. They are nearly at the measured move from the double top’s lower high and will look to get the measured move from the higher high.

- It is a big bear bar, late in a bear trend so that could be a sell climax and attract profit taking. Bears are mindful of a wedge overshoot and strong reversal out.

- It’s always in short so better to be flat or short.

- Bulls want a reversal bar, not too big to buy above, a second entry buy is a higher probability setup.

- The bears want a follow-through bar to set up another leg down to the larger harmonic move target below.

- With consecutive bear bars, expect sideways to down trading next month as traders decide.

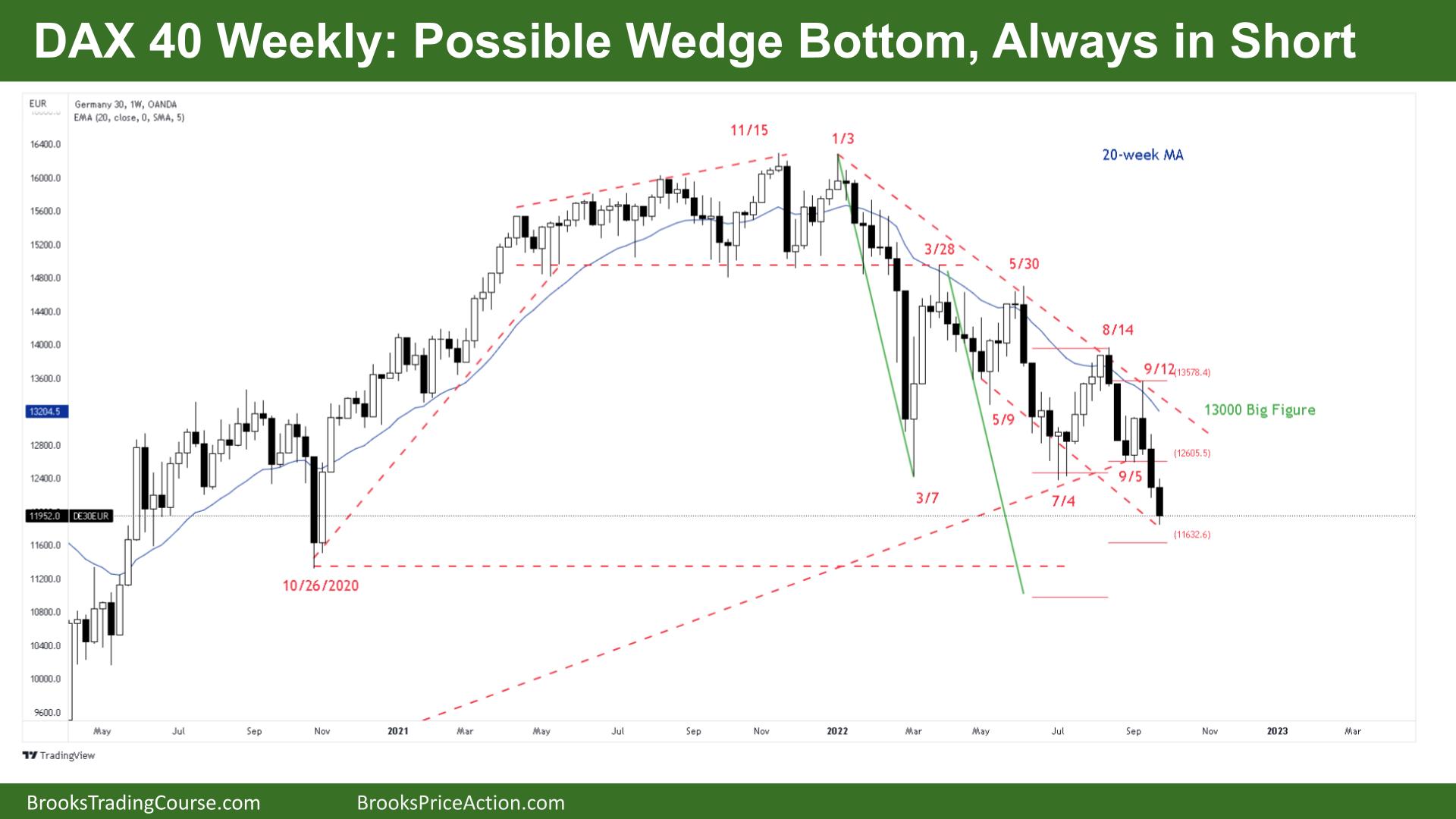

The Weekly DAX chart

- The DAX 40 futures was a bear bar closing near its low last month so we might gap down on Monday.

- It is the third consecutive bear bar closing near its low so we are always in short.

- Consecutive bear bars are a sell signal and a bad buy signal so better to be short or flat, but it might also attract profit taking next week.

- For the bulls, it’s 2 legs sideways to down after a 4-bar tight bull channel. It’s a lower low and a possible wedge bottom. Traders see Sept 5 as the first buy setup and the next buy setup on the weekly will be a reasonable swing buy.

- The bulls also see we are at trendline so a possible overshoot buy is a reasonable entry as well.

- The bulls need a High 2 or consecutive bull bars to attract buyers. Currently, we are still always in short and might need to go sideways before the price can move up again.

- The bears see a bear stairs pattern with no gaps, so it is more likely a bear leg in a trading range for the next year or so.

- They see a breakout below the July 4 low and want a measured move down. But the trend has retraced the COVID bull trend which might be the low for some time.

- The bears want a pause here so sell above again, a sell climax would attract profit taking and a reasonable buy setup. 3 consecutive bear bars are strong enough to attract another leg down.

- Expect sideways to down trading next week. The Sept 5 bull bar’s low is a magnet and an open gap, so any reversal will likely stall around there.

Market analysis reports archive

You can access all weekend reports on the Market Analysis page.